OKAY this is an easy one! Get paid to take out a loan on aave.com -

This is a decent strategy if your stuck between two different assets, or simply want to compound gains let me explain;

This is a decent strategy if your stuck between two different assets, or simply want to compound gains let me explain;

for this example we will be using AAVE on the Avalanche Network! Simply plug in the Avalanche info found here -> support.avax.network/en/articles/46…

Step #1: Deposit your asset on $AAVE -

Make sure to check the list of assets available to deposit. You're going to want to chose an asset that has a high enough market cap like $ETH, to keep the volatility to a minimum.

Make sure to check the list of assets available to deposit. You're going to want to chose an asset that has a high enough market cap like $ETH, to keep the volatility to a minimum.

Step #2: Take out a loan against your asset -

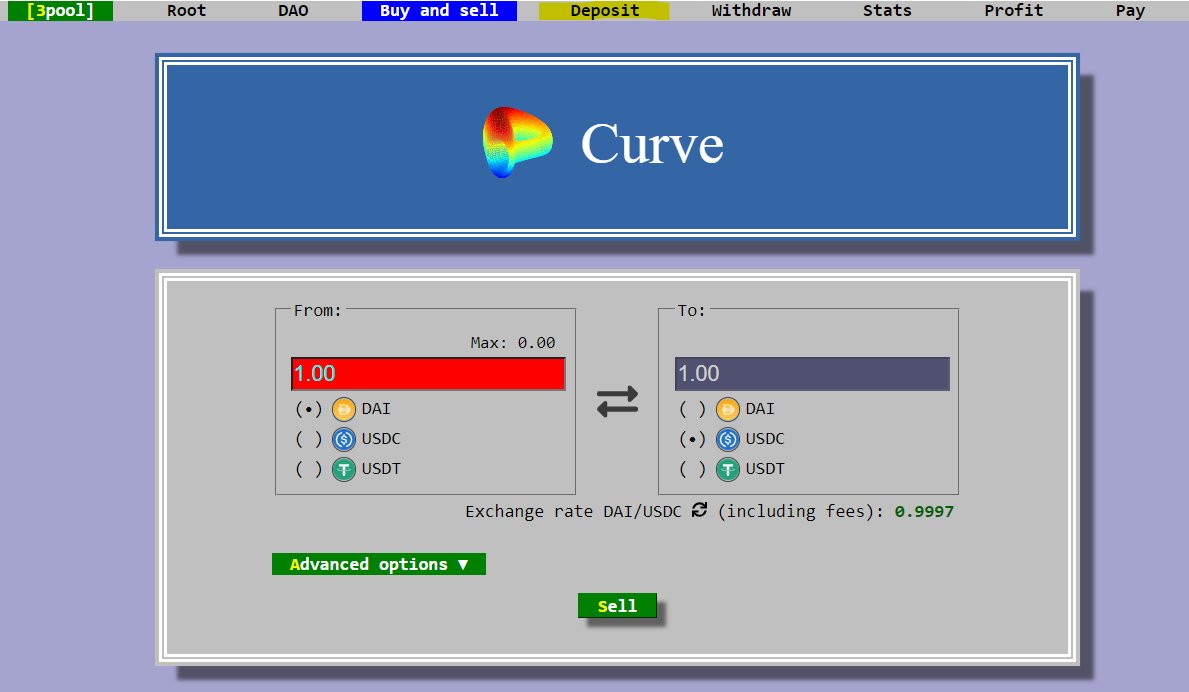

Chose your stablecoin of choice, $DAI $USDT or $USDC.

Chose your stablecoin of choice, $DAI $USDT or $USDC.

Step #3: Your Health Factor -

This is the important part! As you do not want to get liquidated. ( AAVE sells your asset) You're going to want to keep a HIGH health factor. I shoot for 2.5 ( for the riskier degens you play around with it)

This is the important part! As you do not want to get liquidated. ( AAVE sells your asset) You're going to want to keep a HIGH health factor. I shoot for 2.5 ( for the riskier degens you play around with it)

Step #4: A couple different things I like to do here -

If I'm expecting more bullish price action, I'll buy another altcoin and either deposit on aave.com OR

If I'm expecting more bullish price action, I'll buy another altcoin and either deposit on aave.com OR

Step #4.5: This is where your giga-brain comes in -

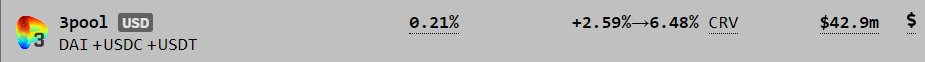

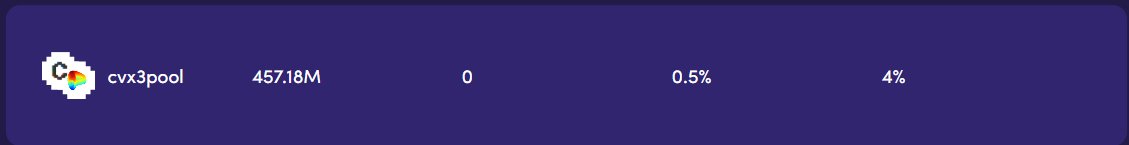

Instead of buying an altcoin w your debt, you could bridge your stables back to the $ETH network (right here: bridge.avax.network ) and get paid twice by depositing into convex.( remember convex?)->

Instead of buying an altcoin w your debt, you could bridge your stables back to the $ETH network (right here: bridge.avax.network ) and get paid twice by depositing into convex.( remember convex?)->

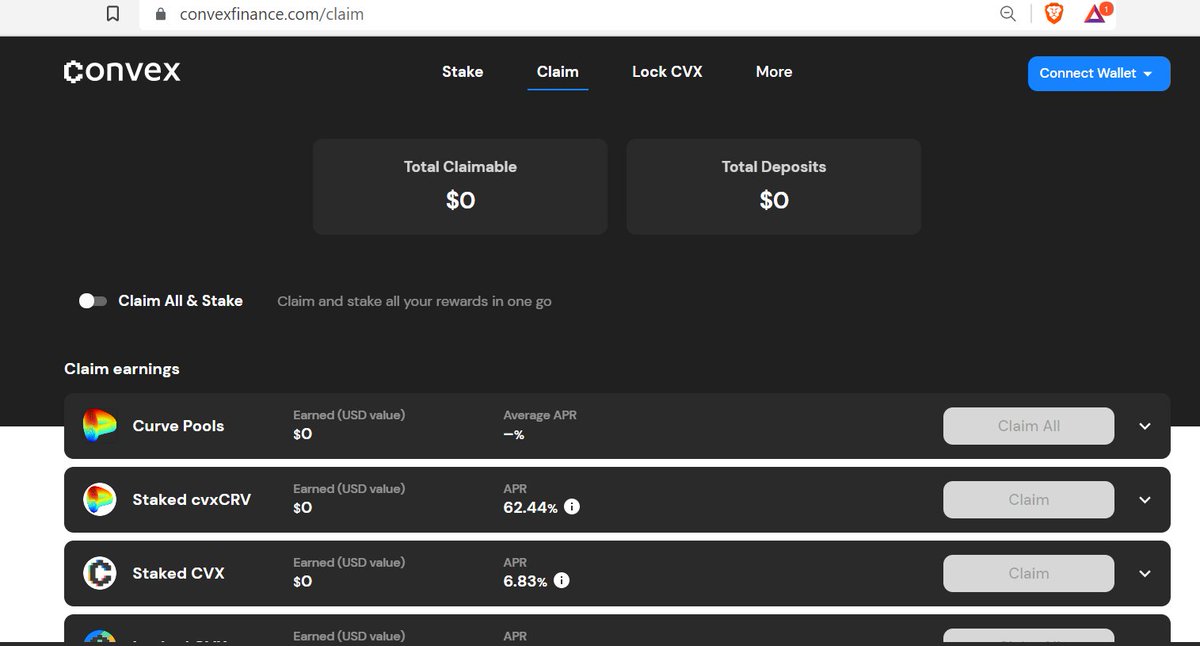

Step #5: The Flywheel Effect -

Once you deposit your stables onto convexfinance.com, you'll be getting paid in $CRV and $CVX which you could then use to compound your convex flywheel which will intern bring you oh so closer to #FinancialFreedom.

Once you deposit your stables onto convexfinance.com, you'll be getting paid in $CRV and $CVX which you could then use to compound your convex flywheel which will intern bring you oh so closer to #FinancialFreedom.

The crucial thing here is to keep your eye on your Health Factor. This strategy is a little more active than our convex play but as long as we #PlaySafe #wagmi.

• • •

Missing some Tweet in this thread? You can try to

force a refresh