More Money Than God by @scmallaby is the best book to understand history of hedge funds - and therefore a lot of the participants and styles in public markets today.

The footnotes alone are worth the price.

The footnotes alone are worth the price.

“Rarely do portfolio managers articulate why they are successful. Sometimes they try to do so but are wrong. I have worked with hundreds of PMs and found that articulating why they are successful is quite difficult for them—although often they are not aware that it is.”

“Trading can be intuitive. We are looking at so many factors in the markets [that] a lot of our analysis operates on a subconscious level. All of a sudden you just know this is the right trade. If somebody really quizzed you, you probably couldn’t clearly articulate your views...

and would just say, no no no, I know this is the right trade. It’s because all these things have been taken in—the market action, the technicals, the things that you read and the conversations you have with other traders, analysts and policy makers. It just comes together.”

"the paradox that money is at once an abstraction and a medium for emotional expression."

“The market is like a beautiful woman—endlessly fascinating, endlessly complex, always changing, always mystifying. I know this is no science. It is an art. . . . It is personal intuition.”

“The market is like a beautiful woman—endlessly fascinating, endlessly complex, always changing, always mystifying. I know this is no science. It is an art. . . . It is personal intuition.”

Long-short funds getting beat up in the go-go 60s

"All this attempt to be scientifically precise makes you feel good, but at the end of the day you made money if your selections were good or not You’d hate to be short much of anything in the 1960s."

"All this attempt to be scientifically precise makes you feel good, but at the end of the day you made money if your selections were good or not You’d hate to be short much of anything in the 1960s."

“When the 1960s came and markets were going straight up, the [volatility] numbers were useless. Let’s take Texas Instruments: It didn’t fluctuate, it was going straight up. Telephones proved to be more volatile than Texas Instruments, which was doubling and tripling every year."

“To make money on the short side you have to be a scrapper. The government is against you. The media was against you; it was un-American to be short. Advances tend to be long and gentle, falls are sharp and short. So most days, the short seller is taking it in the nose."

Steinhardt:“I used to generate vast amounts of commissions, I did all sorts of things that generated huge commissions for my own purposes that I felt had some circular benefit: You generate commissions, you get good ideas, you have the ability to be more liquid than the next guy"

"we asked and we found out who the seller was, and it was clear to us that the seller knew something... It was an insider thing. Who am I to stop payment on that trade? I’m not supposed to know the seller ... I’m not supposed to have proof that he knew anything. But I did.”

“Valuable as market analysis and data generation may be, money management discipline is even more important to successful speculation ... Most successful speculative derivatives traders generate more losing trades than profitable trades.

... They are successful only because their gains on positive trades are substantially larger than their tightly controlled losses on negative trades.”

“When we incubated young traders, when they came close to kickouts he [Paul Jones] would bring them into the office and say, ‘You’ve got to write an analysis on why this happened and how it’s not going to happen again.’ He took that away from Commodities Corporation.”

“Commodities Corporation really learned that trends always go further than you think. ... we found that over the short term trends tended to continue at every level. The theory was that unless you had a really good reason, you want to stay with the trend.”

Kovner: “As a trader of a leveraged fund you had to be centrally concerned with path rather than end points.”

"I thought ‘Oh my god, I was taught in business school that charts don’t work, that markets are efficient.’ But then Bruce told me that charts are just representations of market psychology and therefore extremely valuable, and indeed indispensable, for trading.”

Soros:“The key to reflexivity is a misconception of reality. The theory is that people act in their self-interest, but the fact is that they act in what they perceive to be their self-interest; their best interest is not necessarily what they believe is in their best interest.”🧐

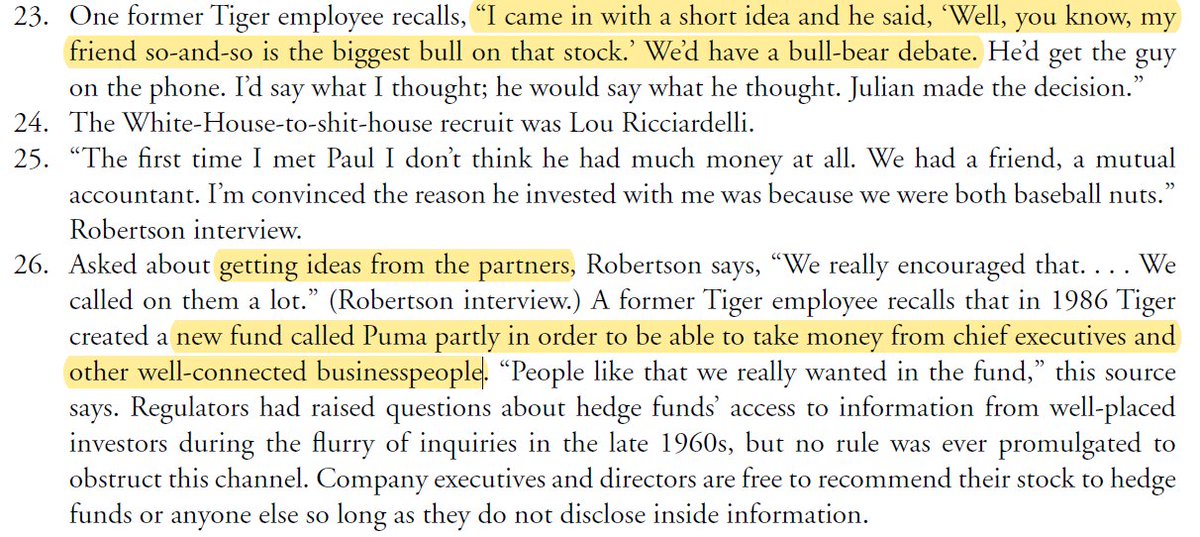

Soros: “If a story is interesting enough, one can probably make money buying it even if further investigation would reveal flaws. Then later, if you discern the flaw, you feel good, because you are ahead of the game. So I used to say, ‘Jump in with both feet; take one out later.”

"Soros’s rule encouraged big risk taking in years when he had performed well, while forcing a cooler approach at times when he was weaker. If the performance of traders exhibits trends, the rule ... [encouraged] risk taking in periods when he was in sync with the markets."

"Soros suggests that his political antennae were an important part of his edge. “It’s easier, in a way, to understand the mentality of the authorities than it is to understand the market, because the market is more anonymous. . . .

So I would say, perhaps, that my application of boom-bust thinking has been in understanding how the authorities are acting more than the market itself.”

Paul Tudor Jones: “George Soros is one of the most profound thinkers in the markets. The book was a highly intricate piece of analytics. Looking at the interlocking relationships. He knitted things together; it was an education.”

.@WallStCynic on Soros: “It was the quietest place you’ve ever heard. The most raucous you heard was during lunch, when people yelled at the cook ... Steinhardt was much different. People screaming. Michael firing people. It was truly a different atmosphere.”

@WallStCynic Working with Robertson at Tiger:

“Julian sat in the center of the L. It was just a blast. We all overheard each other’s conversations. It was just a constant flow of information and ideas. And you had one of the greatest investors ever right there. It was just fun every day.”

“Julian sat in the center of the L. It was just a blast. We all overheard each other’s conversations. It was just a constant flow of information and ideas. And you had one of the greatest investors ever right there. It was just fun every day.”

@WallStCynic Analyst bull-bear debates.

“I came in with a short idea and he said, ‘Well, you know, my friend so-and-so is the biggest bull on that stock.’ He’d get the guy on the phone."

“I came in with a short idea and he said, ‘Well, you know, my friend so-and-so is the biggest bull on that stock.’ He’d get the guy on the phone."

@WallStCynic Paul Tudor Jones.

“What Paul will tell you is that he makes his money, for thirty years without a losing year, assessing human reaction. There’s a body of information and he assesses human reaction with respect to this information. Fear and hope . . . that’s the whole business.”

“What Paul will tell you is that he makes his money, for thirty years without a losing year, assessing human reaction. There’s a body of information and he assesses human reaction with respect to this information. Fear and hope . . . that’s the whole business.”

“There’s a skill set which he has in abundance, which is to have a feel for the market... he would know how prices would behave, how many people are in the same position... if a lot of people own the same position, if things reverse they could suddenly get very ugly very quickly”

Script for the market.

“I put myself in the mental position of being short, and think how I would react emotionally to different events and see what it would take to get me to take my position off. That will be the high for the day, the point at which the shorts capitulate."

“I put myself in the mental position of being short, and think how I would react emotionally to different events and see what it would take to get me to take my position off. That will be the high for the day, the point at which the shorts capitulate."

"I close my eyes and imagine myself long. I say, ‘Okay, where is the point I get nervous? Where would I say, “Oh my God, I have to get out?” ’ And that would be my projected low for the day."

"You know every single high and low is going to be made in the context of these emotional extremes being hit. Execution is fifty percent of the game."

“The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge."

“I think there are certain situations where you can absolutely understand what motivates every buyer and seller and have a pretty good picture of what’s going to happen. It just requires an enormous amount of grunt work and dedication to finding all possible bits of information.”

Druckenmiller: “I never learned enough about fundamental analysis, not having been to business school, not having a CFA. By necessity and also because my first boss, my mentor, used technical analysis, I had to rely quite heavily on charts.”

Druckenmiller: “The way I figure out the economy is from the bottom up, from company anecdotal information, knowing that housing leads retail and retail leads capital spending. When you talk to companies and guys who run companies, you get a whole additional perspective."

"I learned a lot at Soros, but not what I thought I would learn. ... Soros’s great gift was how to use leverage, and how much money to have down based on the risk/reward and your sense of conviction. His view on the yen or the euro was better than random, but not much."

"And yet he was still one of the great money managers ever because he knew how to bet his convictions."

• • •

Missing some Tweet in this thread? You can try to

force a refresh