Sona Comstar

Sona BLW Precision Forgings Ltd

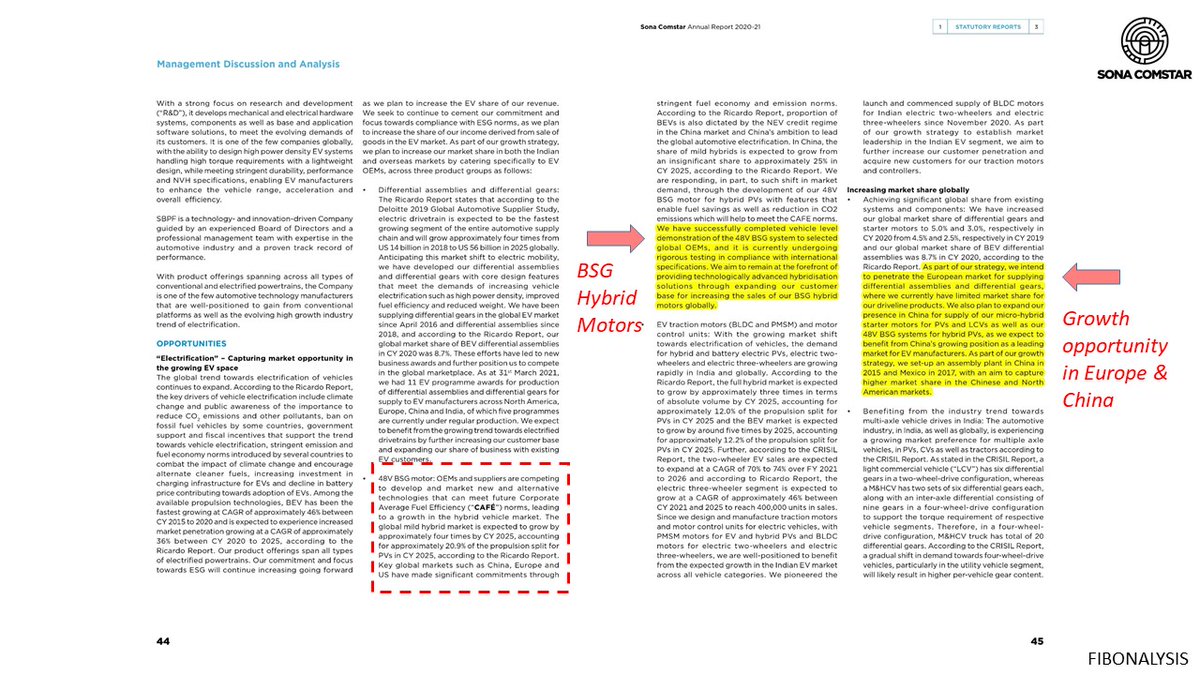

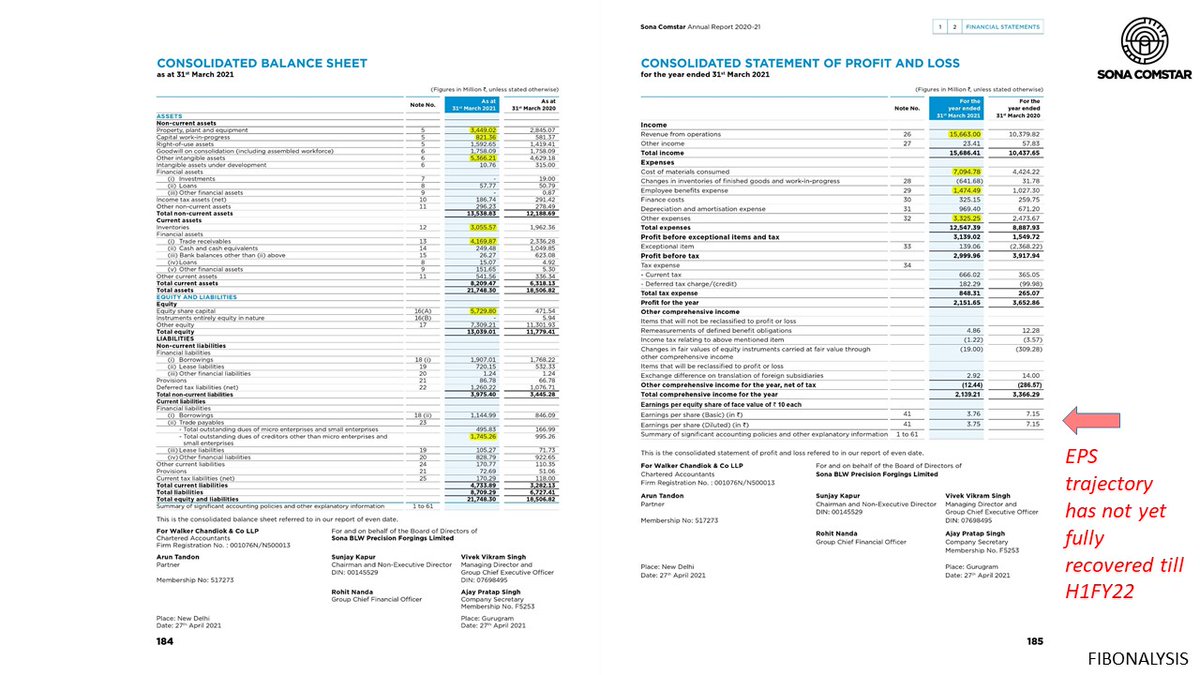

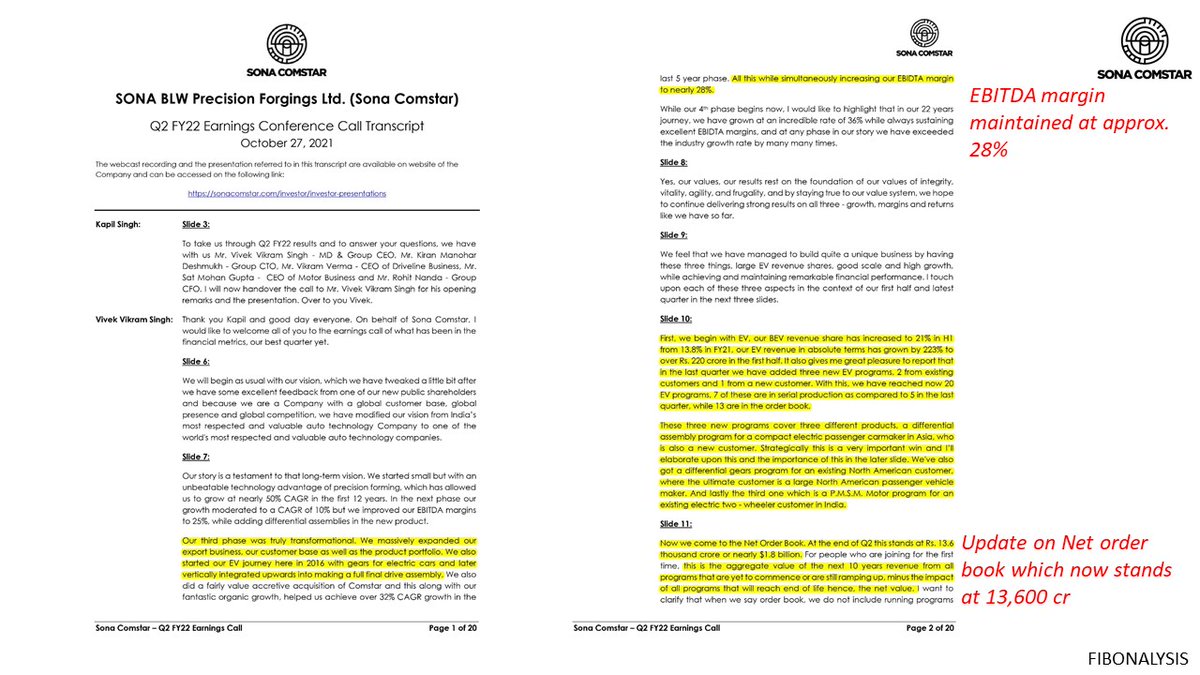

Let us understand the business first and also connect the dots why market is valuing it so richly almost at par with few OEMs.

Have done a detailed presentation on the same. Ready to discuss, exchange data and learnings.

#sonacoms

Sona BLW Precision Forgings Ltd

Let us understand the business first and also connect the dots why market is valuing it so richly almost at par with few OEMs.

Have done a detailed presentation on the same. Ready to discuss, exchange data and learnings.

#sonacoms

21/n

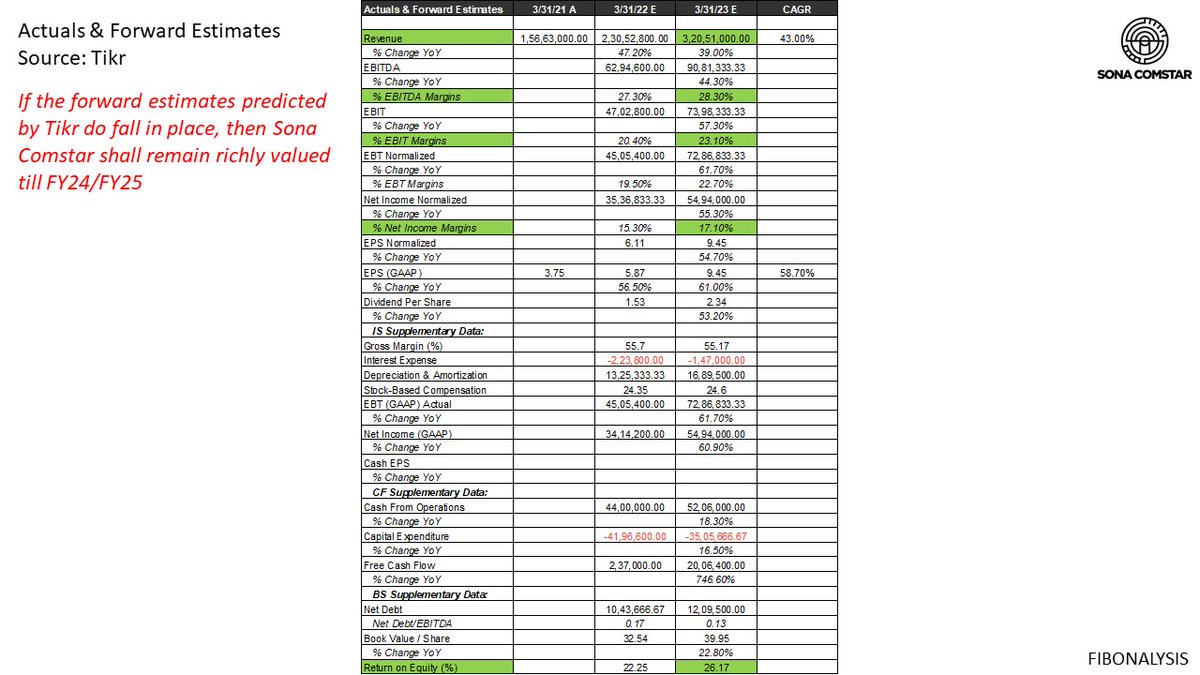

Conclusion & Estimates

Slides 74-75

This concludes an exhaustive presentation on Sona Coms.

Hopefully have been able able to connect some dots and create better understanding of the company.

#investing

#technofunda

#Investment

#StockMarket

#stocks

#Fibonalysis

Conclusion & Estimates

Slides 74-75

This concludes an exhaustive presentation on Sona Coms.

Hopefully have been able able to connect some dots and create better understanding of the company.

#investing

#technofunda

#Investment

#StockMarket

#stocks

#Fibonalysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh