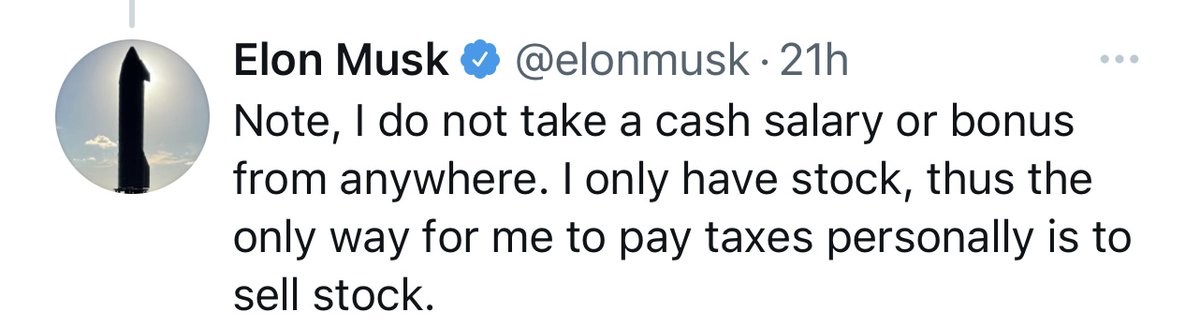

So, @elonmusk, you do know that the proposed tax on UNREALIZED capital gains on billionaires is just that, a proposal, right? Why would you burden yourself with an enormous tax until the proposal becomes tax law, which is highly unlikely? A couple questions for you. 1/

You note that as you earn no salary or bonus the only way to personally pay taxes is to sell stock. What became of the $22 million you received on the sale of Zip2, which you founded with your brother? After paying taxes on the realized gain, did you invest the net proceeds? 2/

After being fired by the PayPal board and replaced by Peter Thiel, PayPal was sold to eBay. You received over $165 million in eBay shares from the sale. Do you still own them? Did you pay taxes on any realized gain and invest the net proceeds? Surely you have non-Tesla assets? 3/

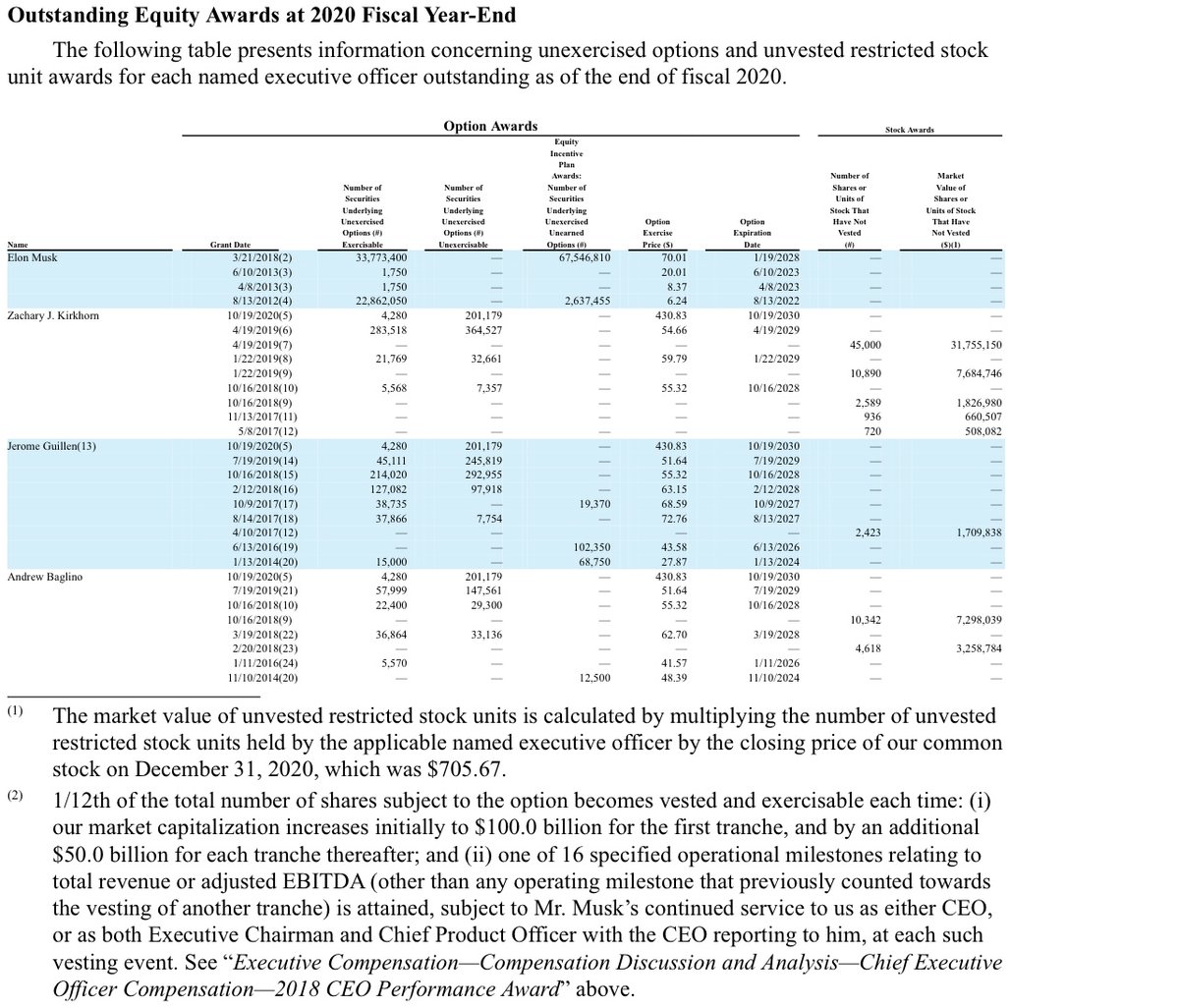

You have committed to owning all of your shares in Tesla for the duration. Why would you break your word simply on a tax proposal until it becomes law? I understand you invested $6.5 million in Tesla when you joined the company in 2004, the year following its founding. 4/

Since joining Tesla, have you made any additional investments in the company or is the majority of ownership derived from share grants? I presume you will ultimately sell shares to finance exercises of expiring stock options instead of continued borrowing and pledging shares? 5/

It looks like the next tranche expiring is not until August of next year? Why couch a sale now based on proposed tax policy? Why not wait? Is your "poll" really a diversion from the belief that shares are overvalued? You don't tend to see insider selling when stocks are cheap. 6/

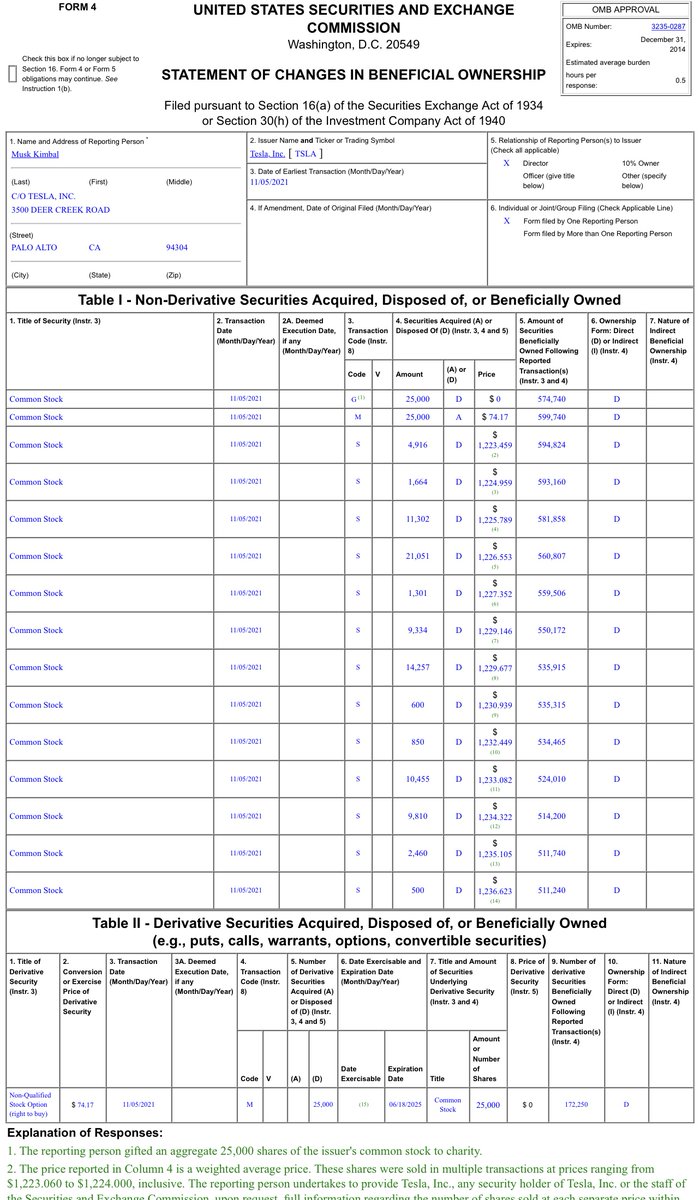

Did your brother/board member, Kimball, know you'd poll to decide a personal sale ONE day after selling over $100m? Ditto other insiders in recent days? Seeing LOTS of SEC Form 4 filings. The timing of Kimball's sale at all time highs a day prior to your tweet is interesting. 7/

Do you know that Warren Buffett, fellow billionaire, has NEVER sold a share of Berkshire since gaining control in 1965? Yet Mr. Buffett's ownership in has been halved because he donates a portion of his shares each year to charity. Why not adopt a like non-taxable approach? 8/

No doubt it's your prerogative as to what you do with your wealth. Except for the plane you appear to live modestly. We've seen photos of your TX house. Mr. Buffett also lives modestly and has a "few million" in invested assets outside of BRK, owned prior to buying Berkshire. 9/

Berkshire & Tesla make an interesting contrast. Mr. Buffett acquired all of his shares with cash. He makes a larger $100k salary than you working gratis. Big difference in that he was NEVER given options & NEVER sold a share, despite the stock at times being very overvalued. 10/

Surely as the now richest in the world you won't leave ALL of your estate to your 6 children? $50 billion a kid seems like more than enough. Saw your proposed sale of $6 billion of $TSLA last week if you could solve world hunger, so you certainly appear charitably inclined. 11/

Couching a sale as tax (proposal) driven and not because of valuation is odd. You presently have no tax liability payable and can continue to pursue strategies, even charitable ones, to keep it that way. Looks like despite your money being first in it won't remain the last out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh