Fortunate to have spent the better part of the week with 22 of the most thoughtful and talented investors around. They are even better people. We break down several companies, eat and drink too well, and simply enjoy each other's company. This was our 9th annual gathering. 1/

Would have been ten save cancelling 2020 for Covid. Went ahead and called it the 10th anniversary anyway, in the spirit of Chamath math. Discreet group, so without naming those on hand or the ideas discussed, some general observations and the results of a fun survey follow. 2/

Three of the ideas were energy specific. You can take that as a contrary indicator, as with mistimed magazine covers, or that some sharp folks see value. My bet, having presented one of the energy ideas, is on the latter. All ideas dissected were investments, not speculations. 3/

Quality of management, durability of economics and quality of accounting are common yardsticks of measuring value. Price matters to these folks, who universally understand the price paid for an asset correlates to subsequent return. Risks and downside pervades the discussion. 4/

Between formal discussion, had time for some very informal surveying. Recognize bias results likely created by surrounding oneself with like-minded people, but also recognizing the utility of surrounding oneself with folks smarter than you. Take the results for what they are. 5/

At a sample of 22, the data lacks statistical significance. On bias, as I do the inviting, the goal is not to surround myself with lunatics. To the extent any of these folks are on social media (most aren't), you won't find EVs, battery and rocket emojis in their bios. 6/

In any event, thought sharing the survey results might be fun. Some predictable, but some surprises as well:

1. Do you own shares of Tesla? 0/22 (Lots of laughs)

2. Do you own/drive a Tesla? 2/22

3. In the next 5 years, do you intend to purchase/drive an electric vehicle? 8/22

1. Do you own shares of Tesla? 0/22 (Lots of laughs)

2. Do you own/drive a Tesla? 2/22

3. In the next 5 years, do you intend to purchase/drive an electric vehicle? 8/22

4. Of those intending to purchase/drive an EV in the next 5 years, will you buy a Tesla? 3/8 (Two of the three being the cats already owning one)

5. Do you own Bitcoin? 1/22 (Explained as done out of curiosity on how to do it, not of a belief in crypto as an investment)

5. Do you own Bitcoin? 1/22 (Explained as done out of curiosity on how to do it, not of a belief in crypto as an investment)

6. Do you own any non-Bitcoin cryptos or exchanges? 0/22 (Lots of laughs here about Doge and seeming consensus about fraud in places like Tether)

7. Do you own shares in Berkshire Hathaway? 18/22 (Surprised the number wasn't higher, more like 100%)

7. Do you own shares in Berkshire Hathaway? 18/22 (Surprised the number wasn't higher, more like 100%)

8. Do you own fixed-income securities (not as cash reserves but as a long or mid-duration asset class)? 4/22 (As to why, the explanation in each case was security specific and equity-like in nature)

9. Do you own any NFTs? 0/22 (Lots of laughs)

9. Do you own any NFTs? 0/22 (Lots of laughs)

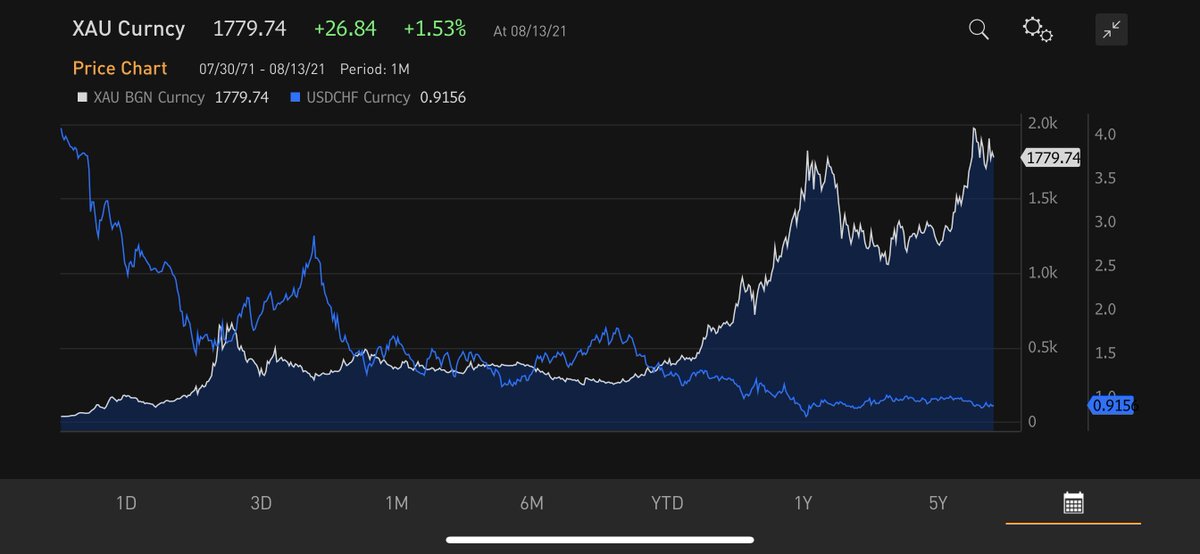

10. Do you own physical gold as an investment? 2/22

11. Do you own shares of gold miners? 4/22

12. Do you own shares of Apple? 3/22

13. Do you own shares of Microsoft? 6/22

14. Do you own shares of Alphabet/Google? 9/22

15. Do you own shares of Amazon? 4/22

11. Do you own shares of gold miners? 4/22

12. Do you own shares of Apple? 3/22

13. Do you own shares of Microsoft? 6/22

14. Do you own shares of Alphabet/Google? 9/22

15. Do you own shares of Amazon? 4/22

16. Do you own shares of Facebook? 6/22

17. Do you own shares in uranium companies? 2/22

18. Will inflation (CPI-U) be north 3.5% a year from now? 9/22 yes

19. Do you own Chinese ADRs/listed companies? 1/22 (Led to a great discussion of whether China was investable at all)

17. Do you own shares in uranium companies? 2/22

18. Will inflation (CPI-U) be north 3.5% a year from now? 9/22 yes

19. Do you own Chinese ADRs/listed companies? 1/22 (Led to a great discussion of whether China was investable at all)

20. Do you own any Chamath SPACs or vehicles? 1/22 (Laughs) (Explained as an unmitigated horrible investment in Clover not made directly but outsourced - Even more laughs)

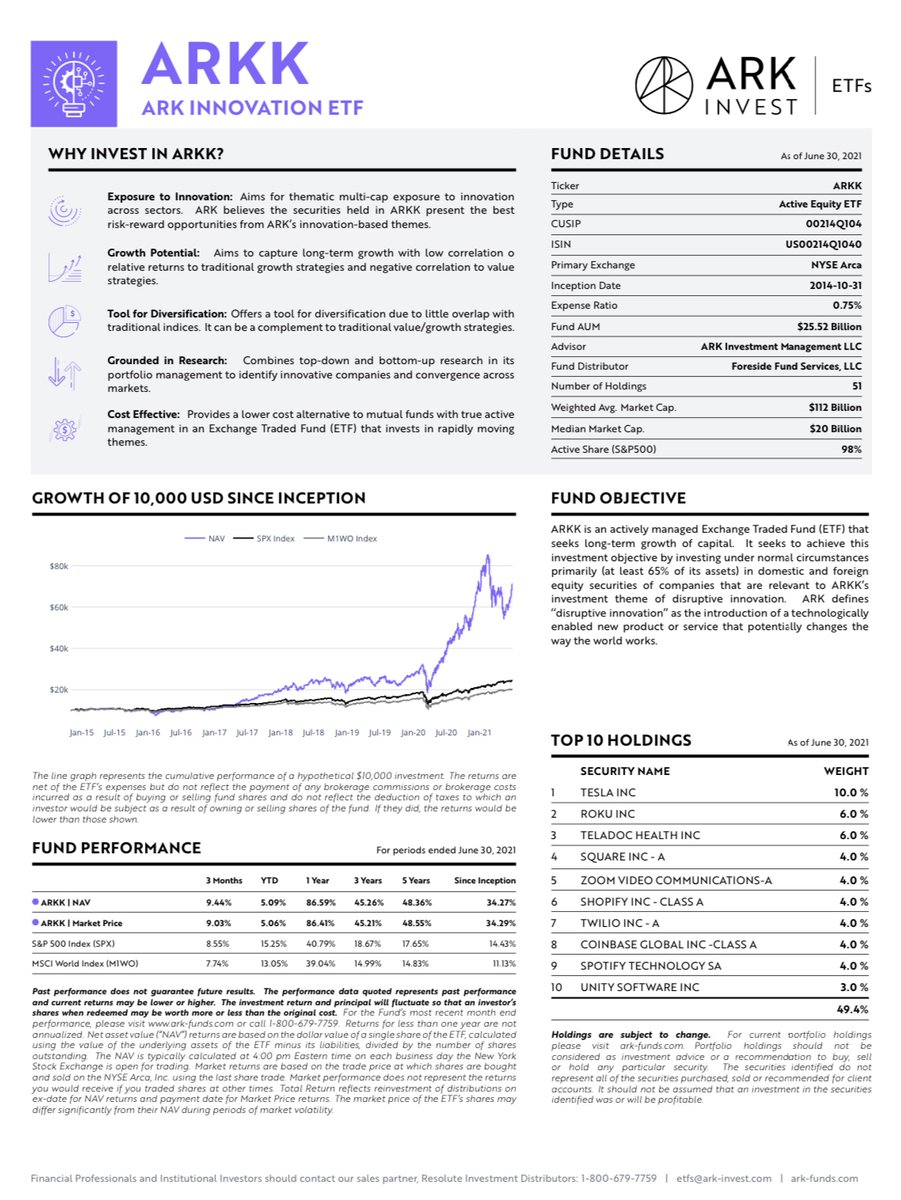

21. Do you own any ARK ETF's? 0/22 (Lots of laughs)

21. Do you own any ARK ETF's? 0/22 (Lots of laughs)

That's it. I find myself at a point each year with the group reflecting if Mary and I were hit by the proverbial bus, every individual in the room would be a terrific guardian to our kids, steward of capital, and would do it if asked. Blessed for great friends and camaraderie.

• • •

Missing some Tweet in this thread? You can try to

force a refresh