Peloton $PTON 1Q22 Earnings - Down but not out

- Rev $805m +6% ⬆️

- CF Rev $501m -17% ↘️

- Sub Rev $304m +94% 🚀

- Gross Profit $263m -20% ↘️ margin 33% -1074bps ↘️❌

- CF $60m -75% ↘️ margin 12% (vs 39% prev) ↘️❌

- Rev $805m +6% ⬆️

- CF Rev $501m -17% ↘️

- Sub Rev $304m +94% 🚀

- Gross Profit $263m -20% ↘️ margin 33% -1074bps ↘️❌

- CF $60m -75% ↘️ margin 12% (vs 39% prev) ↘️❌

Peloton $PTON 1Q22 Earnings - cont’d

- Sub $203m +121% 🚀 margin 67% ⭐️ +820bps ✅ (fixed cost leverage)

- Adj EBITDA -$234m ↘️ (vs $119m) margin -29% ↘️ (vs +16% prev)

- Net Income -$376m ↘️ (vs +$69m prev)

- OCF -$561m FCF -$648m ↘️ (vs $942m cash)

- Sub $203m +121% 🚀 margin 67% ⭐️ +820bps ✅ (fixed cost leverage)

- Adj EBITDA -$234m ↘️ (vs $119m) margin -29% ↘️ (vs +16% prev)

- Net Income -$376m ↘️ (vs +$69m prev)

- OCF -$561m FCF -$648m ↘️ (vs $942m cash)

Biz Metrics ⤴️

- CF Subs 2.49m +87% ⬆️ +19% QoQ↗️✅

- CF Workouts 120m hrs +55% ⬆️ -20% QoQ ↘️

- Avg 16.6 workouts vs 20.7 vs 19.9 (4Q21) ↘️

- CF Churn 0.82% (vs 0.85% guide) ↗️ (0.70% 4Q21).

~98% monthly plans.

- Digital Subs 887k +74% ⬆️ -1% QoQ↘️

- Stable 12m retention 92%✅

- CF Subs 2.49m +87% ⬆️ +19% QoQ↗️✅

- CF Workouts 120m hrs +55% ⬆️ -20% QoQ ↘️

- Avg 16.6 workouts vs 20.7 vs 19.9 (4Q21) ↘️

- CF Churn 0.82% (vs 0.85% guide) ↗️ (0.70% 4Q21).

~98% monthly plans.

- Digital Subs 887k +74% ⬆️ -1% QoQ↘️

- Stable 12m retention 92%✅

1 - General Comments

1) Lower CF Revenues on fewer Bike deliveries & Bike price reduction.

2) Lower CF margins on bike price reduction, increased supply chain & logistic exp, & Tread recall reserves.

3) Lower Adj EBITDA margins on increased marketing & Precor’s cost structure

1) Lower CF Revenues on fewer Bike deliveries & Bike price reduction.

2) Lower CF margins on bike price reduction, increased supply chain & logistic exp, & Tread recall reserves.

3) Lower Adj EBITDA margins on increased marketing & Precor’s cost structure

2 - Guide

- 2Q22 CF Subs 2.8-2.85m 📶 FY22 3.35-3.45m (lowered from 3.6m prev)

- 2Q22 Rev $1.1-1.2b ⤴️ (from 1Q22 lows)

“I think what you were asking really is the confidence level in the new guide. Yes, we are confident in the ranges that we've provided for both Q2 & FY.”

- 2Q22 CF Subs 2.8-2.85m 📶 FY22 3.35-3.45m (lowered from 3.6m prev)

- 2Q22 Rev $1.1-1.2b ⤴️ (from 1Q22 lows)

“I think what you were asking really is the confidence level in the new guide. Yes, we are confident in the ranges that we've provided for both Q2 & FY.”

3 - Normalization wrt Engagement Expected

“gyms are available, people can get out of their house now…we knew that we weren't going to see those crazy elevated COVID engagement numbers forever.”

“gyms are available, people can get out of their house now…we knew that we weren't going to see those crazy elevated COVID engagement numbers forever.”

4 - Near-Term Challenges

“anticipated fiscal 2022 would be a very challenging year to forecast, given unusual year-ago comparisons, demand uncertainty amidst re-opening economies, and widely-reported supply chain constraints and commodity cost pressures.

“anticipated fiscal 2022 would be a very challenging year to forecast, given unusual year-ago comparisons, demand uncertainty amidst re-opening economies, and widely-reported supply chain constraints and commodity cost pressures.

4 - Near-Term Challenges (cont’d)

…delivered first quarter results that modestly exceeded our guidance, a softer than anticipated start to Q2 and challenged visibility into our near-term operating performance”.

…delivered first quarter results that modestly exceeded our guidance, a softer than anticipated start to Q2 and challenged visibility into our near-term operating performance”.

5 - Younger and less affluent customers

Premium to Mass

“First, on August 26, we lowered the price of our original Bike to $1,495, or $39 per month with 39-month 0% APR financing.

…believe price remains a barrier to purchase…to improve the accessibility of our platform.”

Premium to Mass

“First, on August 26, we lowered the price of our original Bike to $1,495, or $39 per month with 39-month 0% APR financing.

…believe price remains a barrier to purchase…to improve the accessibility of our platform.”

5 - Younger and less affluent customers (cont’d)

“Younger and less affluent consumers continue to represent our fastest growing demographic, yet among non-Members, there remains a lingering perception that Peloton is a luxury item.”

“Younger and less affluent consumers continue to represent our fastest growing demographic, yet among non-Members, there remains a lingering perception that Peloton is a luxury item.”

6 - New Thread Launch

…launched our all-new Tread in the US, re-launched in Canada and the U.K…& expanded distribution to Germany…

…features an industry-first combination of both physical & digital safety keys…

…very encouraging with an initial NPS in the U.S. of 89”.

…launched our all-new Tread in the US, re-launched in Canada and the U.K…& expanded distribution to Germany…

…features an industry-first combination of both physical & digital safety keys…

…very encouraging with an initial NPS in the U.S. of 89”.

7 - Stronger Content Slate

“we added eight instructors across regions and modalities, introduced 60 new scenic rides and runs, recorded our inaugural classes from our new Peloton Studios London.”

“we added eight instructors across regions and modalities, introduced 60 new scenic rides and runs, recorded our inaugural classes from our new Peloton Studios London.”

8 - Adequate Inventory, Expecting recovery

“With the benefit of adequate inventories and order-to delivery windows that are now back to pre-pandemic levels, we expect a healthy holiday selling season.”

“With the benefit of adequate inventories and order-to delivery windows that are now back to pre-pandemic levels, we expect a healthy holiday selling season.”

9 - Rationale of Precor

“on Precor…reminding everyone why we made that acquisition…building the substantially the best Connected Fitness equipment manufacturer in the world…build a structural cost advantage & quality advantage while we build that scale advantage.

“on Precor…reminding everyone why we made that acquisition…building the substantially the best Connected Fitness equipment manufacturer in the world…build a structural cost advantage & quality advantage while we build that scale advantage.

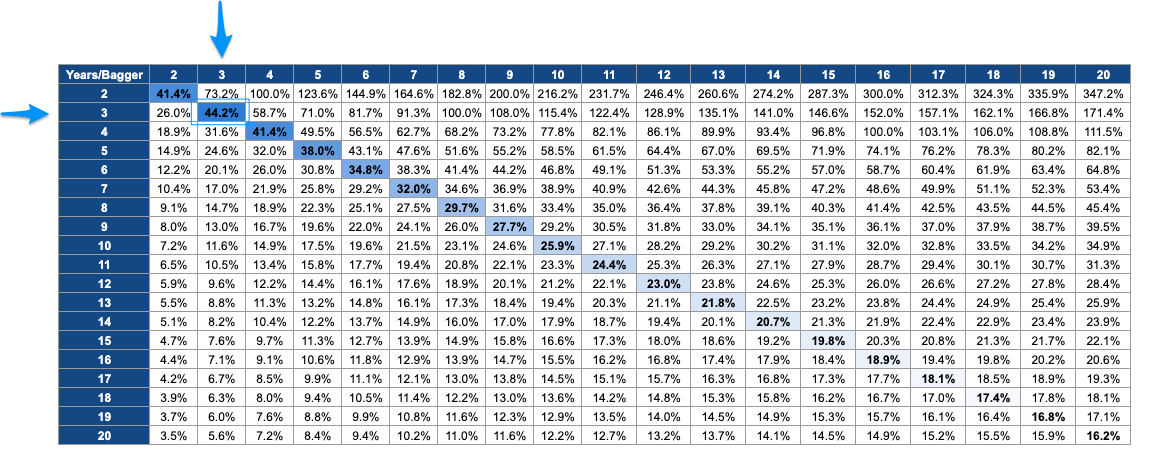

10 - Profit Margins ⤴️

- Sub Gross Margins continue to expand from 69% ⭐️📈 (agst fixed content product cost) ↗️

- CF Gross Margins (guide to recover back to 16% FY22 vs 7% 2Q22) ⤴️

- Total Gross Margins to rebound vs 2Q22 guide 24% to FY22 guide 32% ⤴️

- Sub Gross Margins continue to expand from 69% ⭐️📈 (agst fixed content product cost) ↗️

- CF Gross Margins (guide to recover back to 16% FY22 vs 7% 2Q22) ⤴️

- Total Gross Margins to rebound vs 2Q22 guide 24% to FY22 guide 32% ⤴️

11 - Net CAC Neutrality

“…rightly point out what we've tried to solve for really is a net CAC neutrality, meaning that the gross profit dollars in the units that we sell offset be fully loaded…It's showrooms, merchant fees, acquisition marketing media fully loaded CAC.”

“…rightly point out what we've tried to solve for really is a net CAC neutrality, meaning that the gross profit dollars in the units that we sell offset be fully loaded…It's showrooms, merchant fees, acquisition marketing media fully loaded CAC.”

12 - Not Requiring to Raise Capital

FCF -$650m in 1Q22 vs $924m cash:

“…we don't see the need for any additional capital raise based on our current outlook.

…taking significant steps to adjust our expenses across COGS & OpEx…have a lot of levers to pull.”

FCF -$650m in 1Q22 vs $924m cash:

“…we don't see the need for any additional capital raise based on our current outlook.

…taking significant steps to adjust our expenses across COGS & OpEx…have a lot of levers to pull.”

➡️ Final Takeaways on Peloton $PTON:

Workouts are lesser in return to normalcy. Growth in Connected Subs to continue to rise, revenues to rebound in Q2 with sufficient inventory. Higher margin recurring subscription was always the thesis, not CF, could be a temp setback for now.

Workouts are lesser in return to normalcy. Growth in Connected Subs to continue to rise, revenues to rebound in Q2 with sufficient inventory. Higher margin recurring subscription was always the thesis, not CF, could be a temp setback for now.

Don’t see any reason to exit as fundamental thesis is still valid.

Suspect in the coming quarters in FY22 and in FY23, things would look drastically different and it could rebound quite strongly. Looking forward to see what happens.

Suspect in the coming quarters in FY22 and in FY23, things would look drastically different and it could rebound quite strongly. Looking forward to see what happens.

• • •

Missing some Tweet in this thread? You can try to

force a refresh