Sharing my two thoughts on @10kdiver's thoughtful post on CAGR/IRR as I went through the calculations 👇🏻

https://twitter.com/10kdiver/status/1457115966651830272

@10kdiver Question ❓

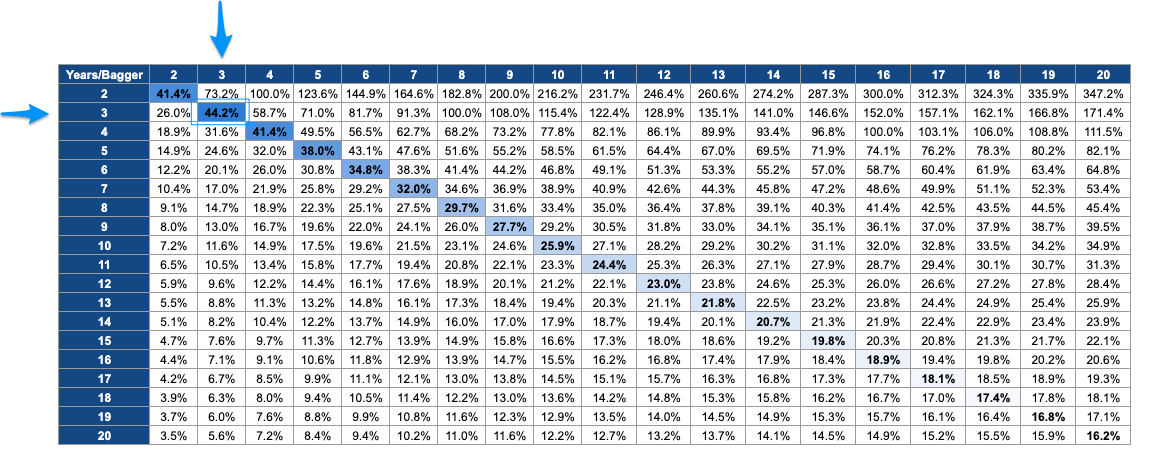

➡️ What’s the maximum CAGR for a stock that multiplies by a factor N and taking N years to do so?

My Naive Answer ❌

➡️ Without realising that it was a loaded question, like many ~44%, I chose “No Limit to Max CAGR”

➡️ What’s the maximum CAGR for a stock that multiplies by a factor N and taking N years to do so?

My Naive Answer ❌

➡️ Without realising that it was a loaded question, like many ~44%, I chose “No Limit to Max CAGR”

More importantly, it reminded me why when I am seeking a minimum portfolio CAGR return of at least 25%, I always think about every investment if it can:

1) 3-5X in 3-5 years' time

2) 5-7X in 5-7 years' time

1) 3-5X in 3-5 years' time

2) 5-7X in 5-7 years' time

• • •

Missing some Tweet in this thread? You can try to

force a refresh