Upstart $UPST 3Q21 Earnings 💪🏻

- Rev $228m +250%🚀

- Fee Rev $210m +235%🚀

- Contribution Profit $96m +184%🚀 margin 46% -831bps ↘️

- Adj EBITDA $59m +281%🚀 margin 26% +224bps ✅

- Adj Net Income $57m +367%🚀 margin 25%⭐️ +636bps ✅

- 9M OCF $180m ⤴️ (vs -$52m) margin 35%⭐️

- Rev $228m +250%🚀

- Fee Rev $210m +235%🚀

- Contribution Profit $96m +184%🚀 margin 46% -831bps ↘️

- Adj EBITDA $59m +281%🚀 margin 26% +224bps ✅

- Adj Net Income $57m +367%🚀 margin 25%⭐️ +636bps ✅

- 9M OCF $180m ⤴️ (vs -$52m) margin 35%⭐️

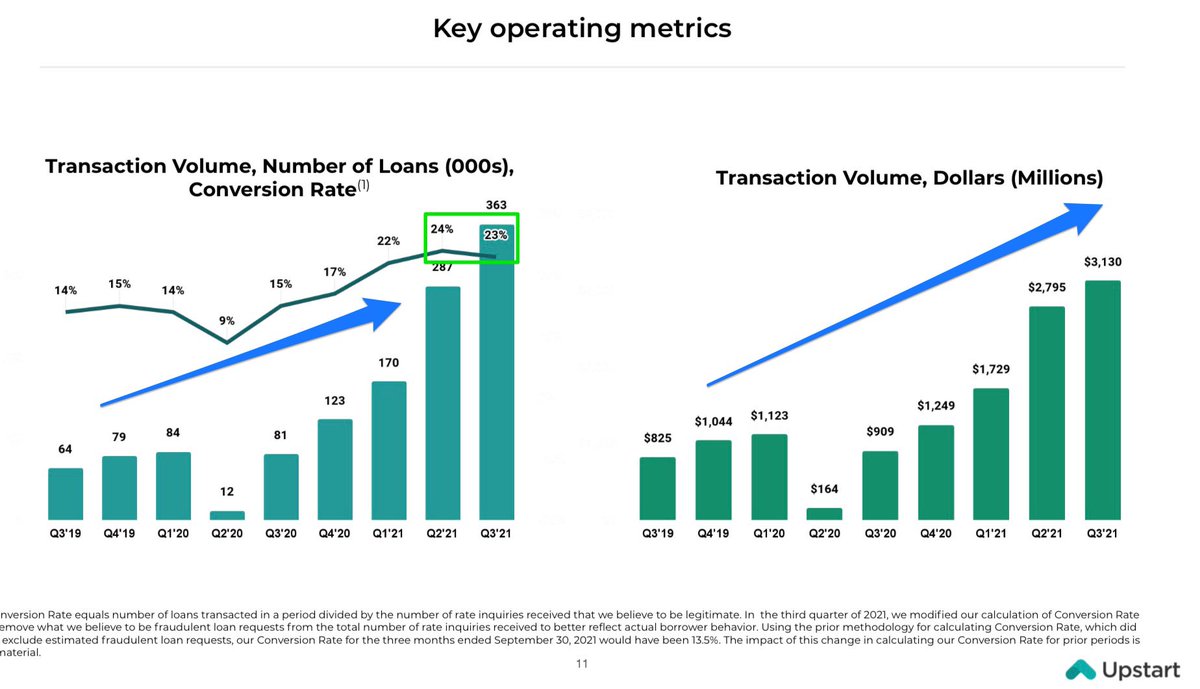

$UPST Biz Metrics 💪🏻

- Loans (count) 363k +348% 🚀

- Loans (value) $3.1b +244% 🚀

- Loan (avg size) $8.6k 📉 (vs $11k 3Q20 $9.7k in 2Q21)

- Conversion rate 23% ↗️ (from 15% in 3Q20) ✅

- Loans instantly approved 67% ↘️ (vs 71% in 2Q21 and 69% in 3Q20)

- 31 partners 📈 (from 10)

- Loans (count) 363k +348% 🚀

- Loans (value) $3.1b +244% 🚀

- Loan (avg size) $8.6k 📉 (vs $11k 3Q20 $9.7k in 2Q21)

- Conversion rate 23% ↗️ (from 15% in 3Q20) ✅

- Loans instantly approved 67% ↘️ (vs 71% in 2Q21 and 69% in 3Q20)

- 31 partners 📈 (from 10)

Auto Update:

- Auto: 291 dealer rooftops and 7 bank partners signed up.

- Today, more than 4,000 Upstart-powered auto loans have been originated in 47 different states.

- Auto: 291 dealer rooftops and 7 bank partners signed up.

- Today, more than 4,000 Upstart-powered auto loans have been originated in 47 different states.

1 | Triple Digit Growth 🚀

“Q3 was another strong quarter of triple-digit growth and profits.”

“…tripled the number of banks and credit unions on our platform, and tripled the number of auto dealerships we serve,”

“Q3 was another strong quarter of triple-digit growth and profits.”

“…tripled the number of banks and credit unions on our platform, and tripled the number of auto dealerships we serve,”

2 | Strength in AI Platform

➡️~2X more in repayment events & training data 💪🏻

“…experienced 9mil repayment events and was trained on 15bn sales of training data as of a year ago.

“Today, …processed 17mil repayment events and is trained on 28bn sales of training data.”

➡️~2X more in repayment events & training data 💪🏻

“…experienced 9mil repayment events and was trained on 15bn sales of training data as of a year ago.

“Today, …processed 17mil repayment events and is trained on 28bn sales of training data.”

3 | Eliminating FICO Requirements becoming a trend 👍🏻

“…first time an Upstart bank partner decided to eliminate any and all FICO requirements…

…of this change, 59% were Black, Hispanic, or low to moderate-income.

…. a canary in the coal mine has now become a trend.”

“…first time an Upstart bank partner decided to eliminate any and all FICO requirements…

…of this change, 59% were Black, Hispanic, or low to moderate-income.

…. a canary in the coal mine has now become a trend.”

4 | Auto Market >6X Larger than Personal Loan

“Our efforts in auto lending continued to make progress as well. As a reminder, the auto lending market is at least six times the size of personal loan market.”

“Our efforts in auto lending continued to make progress as well. As a reminder, the auto lending market is at least six times the size of personal loan market.”

5 | Auto Developments

“…rebranded Prodigy to Upstart Auto Retail.

…triple the number of dealers…added…more than one rooftop a day

…major new milestone… the first Upstart-powered loan was originated to our auto retail software…”

“…rebranded Prodigy to Upstart Auto Retail.

…triple the number of dealers…added…more than one rooftop a day

…major new milestone… the first Upstart-powered loan was originated to our auto retail software…”

6 | Auto Contribution Margin will improve with time…(patience)

“…the contribution margin (for auto) as with personal loan...be something that improves over time…probably be on some journey similar to what we've seen in personal loans, but with obviously a few years behind.”

“…the contribution margin (for auto) as with personal loan...be something that improves over time…probably be on some journey similar to what we've seen in personal loans, but with obviously a few years behind.”

7 | Significance of Auto in 2022

“…we believe auto will be a meaningful contributor to our financials next year, but we don't have specifics on what exactly that means.”

“…we believe auto will be a meaningful contributor to our financials next year, but we don't have specifics on what exactly that means.”

8 | Beyond Personal & Auto - Small Dollar Loans (2022)

“interest in the small-dollar product from our bank and credit union partners is off the charts, and we hope to bring it to market before the end of 2022.”

“interest in the small-dollar product from our bank and credit union partners is off the charts, and we hope to bring it to market before the end of 2022.”

9 | Helping their AI models to learn quicker with benefits

“…much less about direct profits…than it is about the ability to have our models learn much more quickly and to bring people who are at the margins and …could approve them for a much smaller loan…”

“…much less about direct profits…than it is about the ability to have our models learn much more quickly and to bring people who are at the margins and …could approve them for a much smaller loan…”

10 | Beyond Personal & Auto - Biz Loans (2022)

“…unmet need to provide fast easy access to affordable installment loans to business owners...”

“…another product in high demand from more bank and credit union partners and we hope to bring it to market during 2022 as well.”

“…unmet need to provide fast easy access to affordable installment loans to business owners...”

“…another product in high demand from more bank and credit union partners and we hope to bring it to market during 2022 as well.”

11 | Beyond Personal & Auto - Home Mortgage (intent)

“…home mortgage market…the largest consumer lending category

“…opportunity that we're excited…begin to invest in significantly throughout 2022.

…has a longer time horizon…important to share our intention right now.”

“…home mortgage market…the largest consumer lending category

“…opportunity that we're excited…begin to invest in significantly throughout 2022.

…has a longer time horizon…important to share our intention right now.”

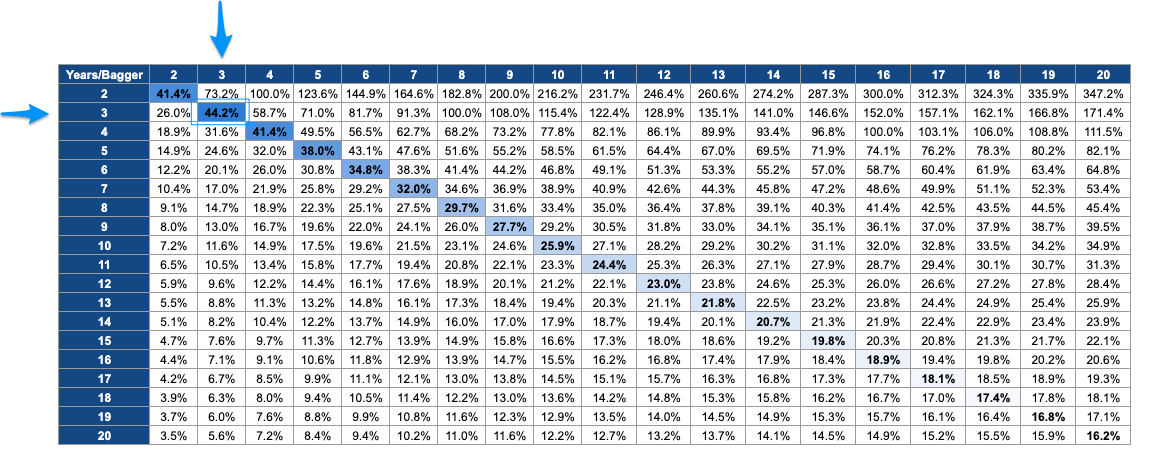

12 | Lower Platform Conversion & Loans Fully Automated

Conversion 23% ↘️ 24.4% QoQ

Automation 67% ↘️ 71% QoQ

➡️ Reason: Borrower segments set a relatively newer to our models, will initially tend to convert at a lower rate than those segments for which we have longer history.

Conversion 23% ↘️ 24.4% QoQ

Automation 67% ↘️ 71% QoQ

➡️ Reason: Borrower segments set a relatively newer to our models, will initially tend to convert at a lower rate than those segments for which we have longer history.

13 | Lower Contribution Margins

“…46% contribution margin, down from 54%…prior…above our guided level of 45%.

…margin was expected to moderate concurrent with the scaling up of our acquisition programs, as well as from the margin impact of our growing auto loan volumes.”

“…46% contribution margin, down from 54%…prior…above our guided level of 45%.

…margin was expected to moderate concurrent with the scaling up of our acquisition programs, as well as from the margin impact of our growing auto loan volumes.”

14 | Strong Q4 Guide

“We also expect these macro-dynamics to ultimately lead to an increase in borrower loan demand.

…Q4 of 2021…expecting revenues of $255 to $265 million, representing a +200%YoY at the midpoint”

Raising FY21 Guide to $803m from prior $750m.

“We also expect these macro-dynamics to ultimately lead to an increase in borrower loan demand.

…Q4 of 2021…expecting revenues of $255 to $265 million, representing a +200%YoY at the midpoint”

Raising FY21 Guide to $803m from prior $750m.

15 | Declining Average Loan Sizes

1) Optical. No FICO guardrails, smaller sizes. ↘️

2) Real. Suppressed loan demand due to stimulus, borrow less. Thinks it will stabilize and gradually return to larger as saving rates decline and credit balances increase. ⤴️

1) Optical. No FICO guardrails, smaller sizes. ↘️

2) Real. Suppressed loan demand due to stimulus, borrow less. Thinks it will stabilize and gradually return to larger as saving rates decline and credit balances increase. ⤴️

16 | Focused on Value

“So you don't likely see Upstart chasing low margin, zero margin, money losing parts of the credit industry, because they're not of interest to us.”

“…we're obviously looking for strong contribution margins and things that can help us to grow.”

“So you don't likely see Upstart chasing low margin, zero margin, money losing parts of the credit industry, because they're not of interest to us.”

“…we're obviously looking for strong contribution margins and things that can help us to grow.”

Final Thoughts on Upstart $UPST:

➡️ AI-driven platform combined with scale, rapid growth, improving profitability, combined with auto loan opportunities (6X, larger), expansion into mortgage (55X larger) and more banking partners. Remains a high conviction position.

➡️ AI-driven platform combined with scale, rapid growth, improving profitability, combined with auto loan opportunities (6X, larger), expansion into mortgage (55X larger) and more banking partners. Remains a high conviction position.

• • •

Missing some Tweet in this thread? You can try to

force a refresh