Fascinating new @CPSThinkTank report out today on the value of university. Worth reading the whole thing but quick thread to summarise (1/?) cps.org.uk/research/the-v…

The university system is a priceless national asset. But there is a significant long tail of courses that aren't delivering for their students - because universities are incentivised to maximise quantity of recruits rather than quality of outcomes for them.

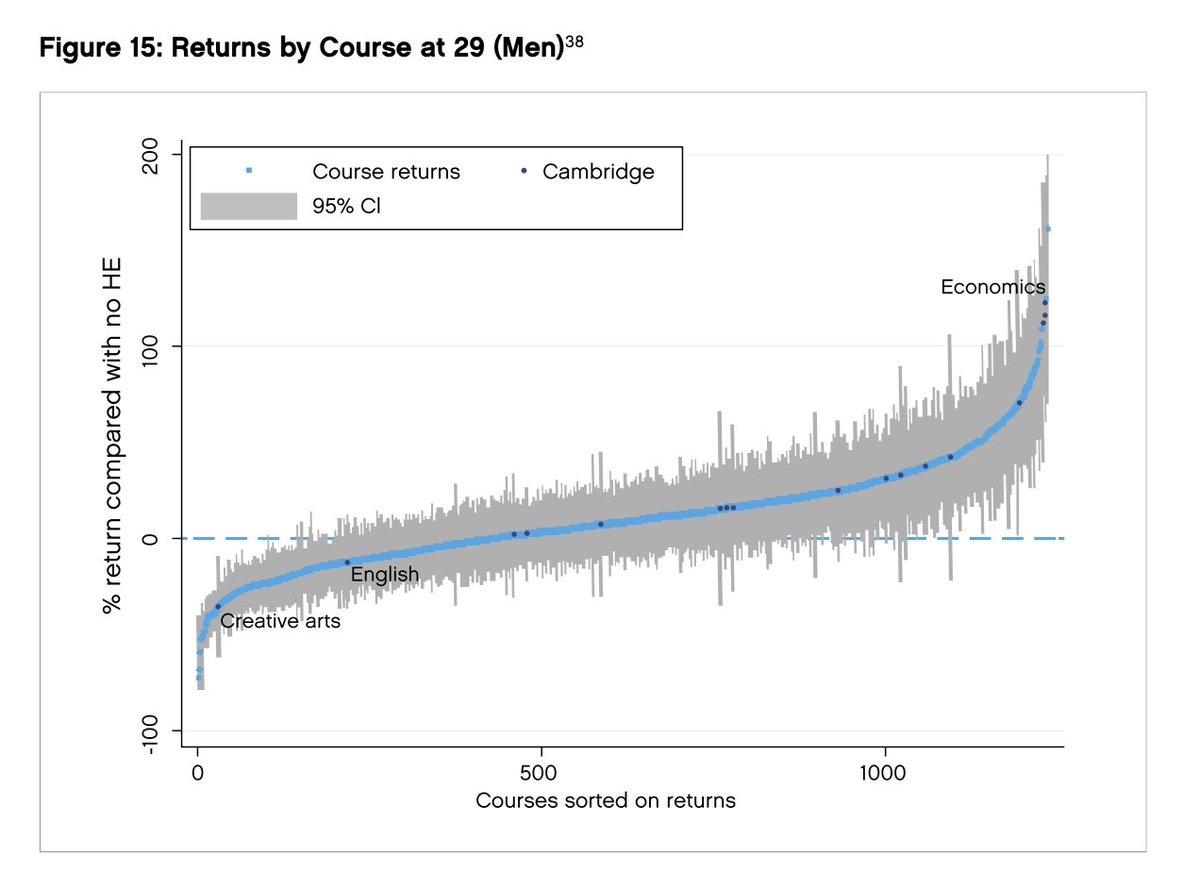

.@TheIFS (who have done a lot of the work on this) estimate that 20% of students are actively worse off financially for going to university. This is obviously concentrated among particular courses/institutions. Here's lifetime return by course

My favourite example of this is Creative Arts. It's grown and grown as a subject, but on average leaves male graduates significantly poorer for having taken it (and female graduates no better than they would have been).

In fact, so few students taking the subject earn enough to repay their student loans that the average individual subsidy is some £37k per pupil - vs £11k for engineering. That doesn't seem like a good deal!

Now, before Tristram Hunt gets upset again, I should state clearly that the creative industries are great! We need lots of people to work in them. And people should be free to follow their hearts and pursue their dreams - university is not just about improving earnings prospects.

Look at the data for PhDs - they're actively hammering earnings potential, but people still want to do them...

But but but, I strongly suspect that if you told people, when they were considering doing a degree, that it would actively leave them poorer (by almost £100k in some cases), they would think again.

The same with the courses listed here. The 'Proceed rate' measures how many are graduating and going on into employment (or other stable outcome). These are awful, indefensible results. And note how many are in business.

Our report argues that sky-high student debt (now comfortably more than the US!) and low-returning courses are two sides of the same coin. Because their salaries never get high enough, people end up paying and paying but never clearing debt - or just have it hanging over them.

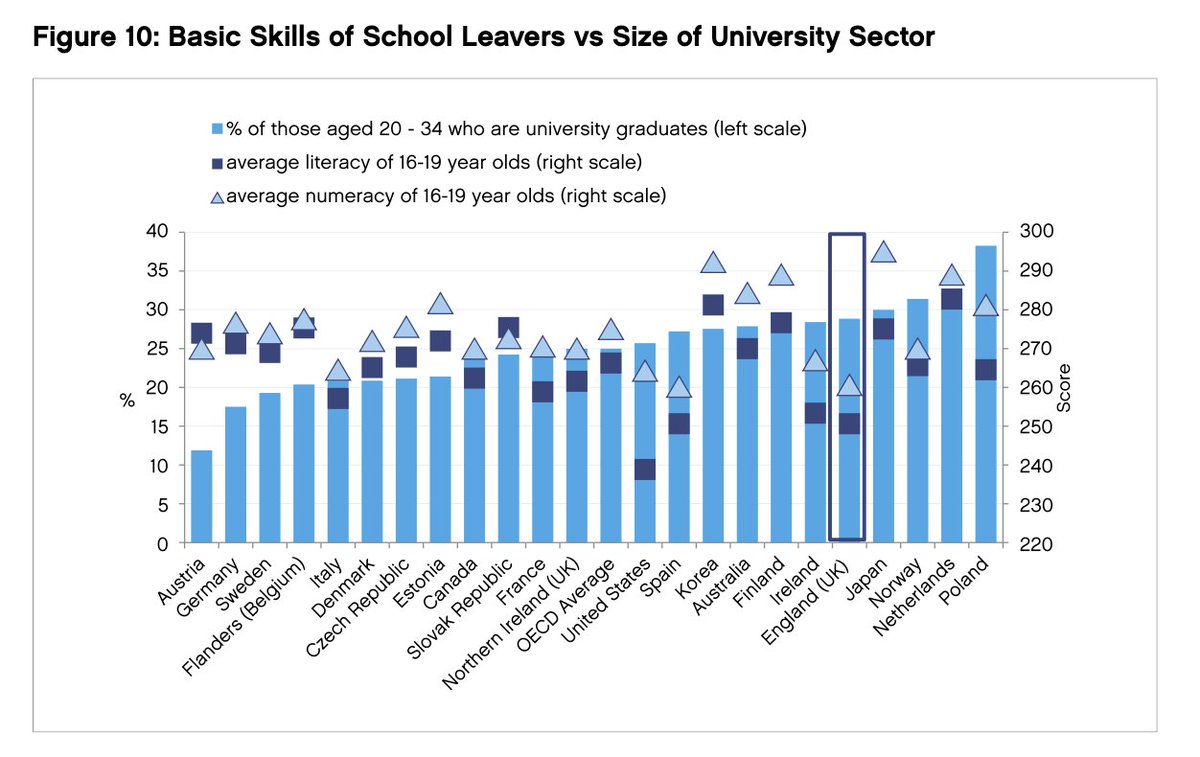

Indeed, one of the striking elements here is the mismatch between university numbers and literacy/numeracy skills - we argue that essentially, Mr Tony expanded the universities before making sure pupils had the core skills to benefit.

At the same time, we neglected further education, apprenticeships etc which evidence shows do offer a really significant return on investment.

Our proposal for fixing this is that universities take on more of the burden for the loans they are offering. Rather than passing on the burden of default to the govt, they should assume it themselves. You would still allow default, and cross-subsidy, but ultimately...

...if universities offered too many courses that don't leave their students better off in the long term, they would be the ones to pay the price of that.

Already, this is producing howls of outrage from the university establishment, who accuse us of all manner of evils while utterly failing to address our central point about too many people being lured on to courses that don't do anything for their career prospects/earnings.

One common criticism is that this would reduce access - if universities prioritise return, they would only recruit rich kids who are going to become richer anyway. But this is misguided.

For one thing, we now have data which tells us how much a course affects earnings given the socioeconomic background of those taking it - which we argue should be much more widely shared whatever the funding structure.

For another, under the current system it is kids from disadvantaged backgrounds and ethnic minorities who disproportionately end up on the low-returning courses. The light bar here is the % going to uni - the dark bar is the percentage going to Russell Group or similar.

As I said at the start, our university system is a priceless national asset. But we can make it an even better experience for students, and leave them and the taxpayer substantially better off, by doing more to cut off the long tail of bad courses. Ends.

PS To stress yet again for the people who didn't actually read it, I/we do not think that financial impact is the sole metric of value. People should be free to do courses that uplift/engage them. But there are also some really crap courses out there.

• • •

Missing some Tweet in this thread? You can try to

force a refresh