It’s tempting to analyse the Budget as a one-off. But as I argue in my column today, last week was part of an inexorable process - the transformation of Britain into an elderly care system with a state attached. (1/) thetimes.co.uk/article/the-bu…

Part of the story here is obviously about Covid. Like all the rest of us, the state put on weight during the pandemic - and like all the rest of us, it’s finding it hard to lose.

A big part of the jump in spending in the new figures is the Treasury admitting that the pandemic is not a meteor but an asteroid. Under the original plan, departmental spending was meant to drop back to pre-pandemic levels. But (Adam Curtis voice) that was always a fantasy.

Instead, as happened after WW1 or WW2, there will be a step change in state spending. Total expenditure has now blazed past a trillion a year. By 2025/6, we’ll be hitting that in terms of day-to-day spending alone.

But the crucial point (now as then) is that this is driven not just by the costs of the crisis, but a long-term expansion of the state.

On Budget day, @duncanweldon flagged up this @OBR_UK data, showing the shape of spending over the last half-century. As I say in the col, if you showed this to someone in 1979, they would conclude that Benn or Foot, not Thatcher, had won the next few elections

In other words, even Thatcher couldn’t fight demographics. Britain is transforming inexorably into an old-age state - look at the rises in pensioner and NHS spending. Just look at how much of Sunak's spare cash is going into health. (Same for Brown, Osborne, Hammond, Javid…)

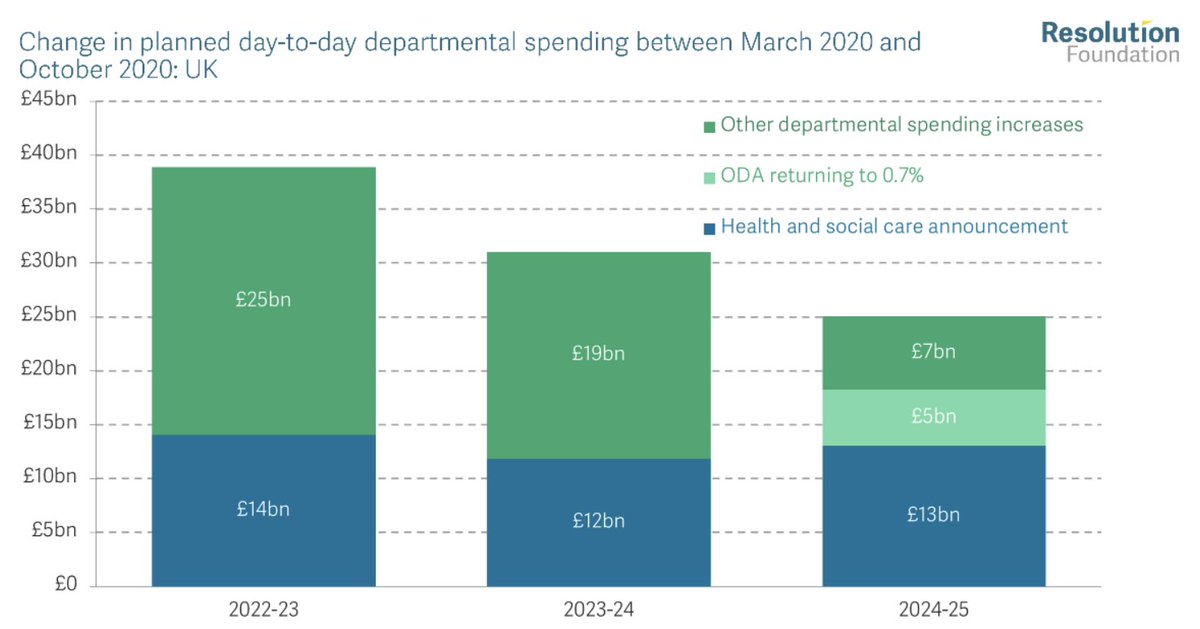

Here’s another take on it, from @torstenbell at @resfoundation. The dotted green line is the proportion of day-to-day spending that goes towards the NHS (most of which goes on the elderly). I’m willing to bet that in a decade or two, that will be north of 50%.

We talk about the ‘great offices of state’. But in terms of how the state is actually organised, the order is pretty clearly PM, Chancellor, Health Secretary - or even PM, Health Secretary, Chancellor. Boris is essentially now First Lord of the NHS.

And as I say in my column, the political dynamics reinforce this. Eg the triple lock may have been waived for this year due to statistical distortions from Covid. But generally speaking it is utterly gold plated, because pensioners decide elections. (Just ask Theresa May…)

And as if all this wasn’t enough, there’s an obvious growth impact. As I say in the column, it’s striking in that OBR chart that in 1979 we paid twice as much for debt servicing, even though debt was actually half the size of today - ultra-low interest rates for the win...

But the bigger story on debt is a fall from 259% of GDP in 1946 to just 23% in 1990. That’s not just because we prioritised debt servicing for years (though we did), but because we grew. Not as fast as others (sick man of Europe etc), but we still grew.

Today, debt is back at 100%+ of GDP. But we’ve got mediocre growth and productivity. The workforce is shrinking (comparatively) as the population ages. And to pay for all those old people we’re loading the taxes on to workers and businesses. Not good!

Meanwhile, NHS costs continue to rise, comfortably outpacing GDP. And politicians post-Lansley are hideously reluctant to do any kind of reform that might upset people. (This is also the central reason why all the ‘Tory privatisation’ stuff is the purest bollocks.)

This doesn’t ~necessarily~ mean higher taxes. You could lump it on borrowing (not ideal). You could squeeze everything else and protect the NHS, which is kind of what we’ve done over the last half-century and definitely what we did over the last 10 years.

But as I say in the column, demographic pressures are pushing costs up and up - and for most politicians, a choice between headlines about a collapsing NHS or picking the voters’ pockets is, ultimately, no choice at all. Please give it a read. thetimes.co.uk/article/the-bu…

PS I should stress - this isn't just happening in Britain! Populations are ageing, growth is low, health and care costs are rising pretty much everywhere. Striking that Trump's most successful change to the Republican formula was promising to keep all the elderly benefits...

• • •

Missing some Tweet in this thread? You can try to

force a refresh