If the inflation surge persists, it could cause a further reset for nominal rates, which remain well below where they should be based on their correlation to inflation expectations. But the Fed’s gigantic balance sheet plays a role in keeping rates below normal. (THREAD)

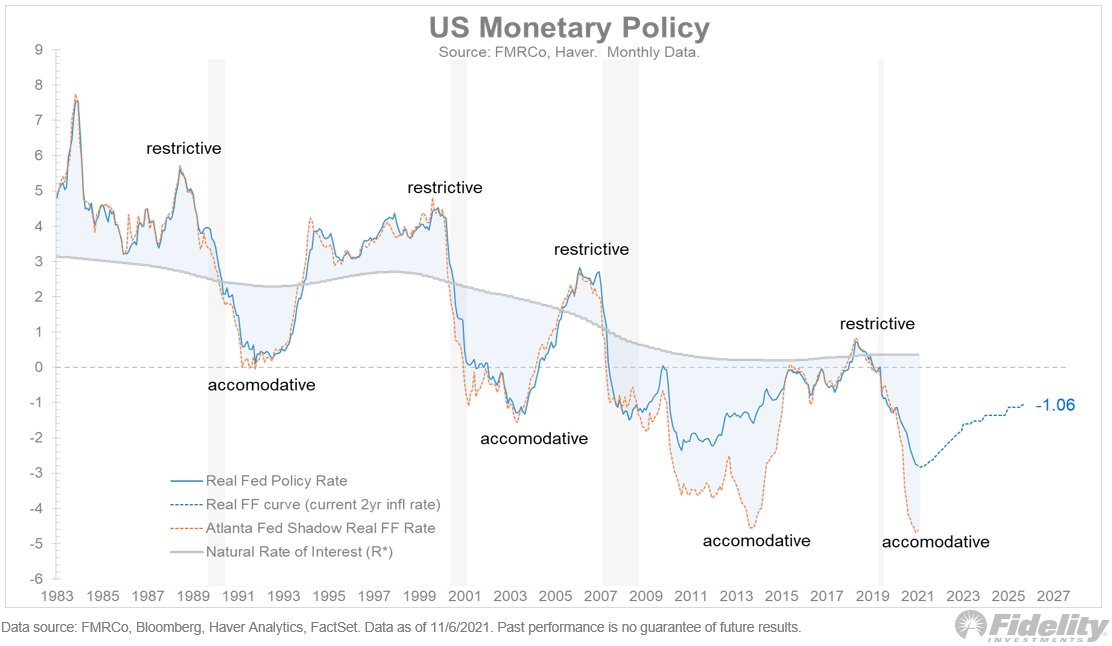

If there is an inflation scare, the Fed could be forced to overshoot the neutral rate (R*) by tightening faster/harder, and in the process forcing rates to rise beyond what the economy can withstand. That would be your classic late-cycle policy error (three steps & a stumble). /2

The alternative scenario is that the Fed understands that today’s over-indebted economy is highly levered to low rates, and that it will just have to accept higher structural inflation and keep policy on the looser side of neutral. /3

In that scenario, real rates could remain negative for a long time, in a repeat of the 1940s (which continues to be a compelling analog for today). /4

If that scenario happens (and I think it’s more likely than the first scenario), inflation expectations via the TIPS market are likely mispriced. That should be an opportunity for gold & Bitcoin. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh