Coupang $CPNG 3Q21 Earnings 💪🏻

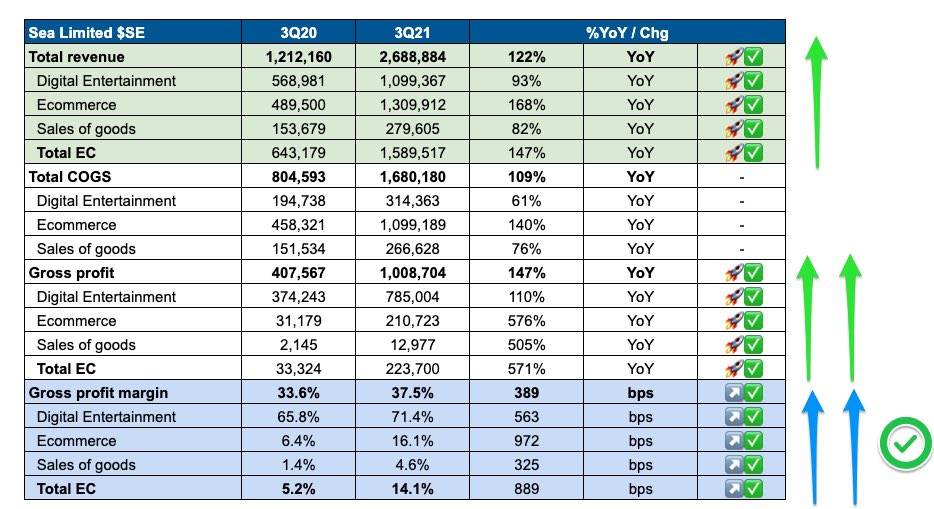

- Rev $4.6b +48% ↗️

- Gross Profit $754m +62% ↗️ margin 16% +136bps ✅

- Adj EBITDA -$207m ↘️ margin -4% +117bps ✅

- NG Net Income -$324m ↘️ margin -7% -146bps ↘️

- 9M OCF -$208m ↘️ (vs +$285m)

- Rev $4.6b +48% ↗️

- Gross Profit $754m +62% ↗️ margin 16% +136bps ✅

- Adj EBITDA -$207m ↘️ margin -4% +117bps ✅

- NG Net Income -$324m ↘️ margin -7% -146bps ↘️

- 9M OCF -$208m ↘️ (vs +$285m)

$CPNG Business Metrics

- Active Customers 16.8m +20% ↗️ -2%QoQ ↘️

- Active Customers >+20% for 15th quarter ✅

- Net Rev per Active Customer $276 +23% ↗️

- Spend +25% for every customer cohort ✅

- Purchasing categories >6 doubled vs 2y ago ✅

- Active Customers 16.8m +20% ↗️ -2%QoQ ↘️

- Active Customers >+20% for 15th quarter ✅

- Net Rev per Active Customer $276 +23% ↗️

- Spend +25% for every customer cohort ✅

- Purchasing categories >6 doubled vs 2y ago ✅

1 | Attractive Korean Market Opportunity

- Users: 37m active internet shoppers vs 16.8m active customers (~2X from here)

- Market: Korea 3rd largest e-commerce ($200bn by 2024) in the world after US and China. growing twice as fast (+20%YoY) as total retail (+10%YoY)

- Users: 37m active internet shoppers vs 16.8m active customers (~2X from here)

- Market: Korea 3rd largest e-commerce ($200bn by 2024) in the world after US and China. growing twice as fast (+20%YoY) as total retail (+10%YoY)

2 | $CPNG Gaining Market Share

- Coupang: Growing >2X as fast as the respective segments.

➡️ Tailwinds + Top Dog:

$CPNG growing at least ~4X faster than the retail market

- Coupang: Growing >2X as fast as the respective segments.

➡️ Tailwinds + Top Dog:

$CPNG growing at least ~4X faster than the retail market

3 | Supported by strong customer retention and engagement

- Net Rev per Active $276 +23% ✅

- Actives buying >6 categories >2X vs 2019 ✅

- >25% growth across all cohorts ✅

- Net Rev per Active $276 +23% ✅

- Actives buying >6 categories >2X vs 2019 ✅

- >25% growth across all cohorts ✅

4 | QoQ Active Customer Decline (ST not LT)

- 16.8m +20% ↗️ -2%QoQ vs 17.0m ↘️

- Not to maximise QoQ growth.

- Reduced efforts to acquire new customers, sacrificed ~500bps growth to protect customer experience, not taking orders when reached daily capacity.

- 16.8m +20% ↗️ -2%QoQ vs 17.0m ↘️

- Not to maximise QoQ growth.

- Reduced efforts to acquire new customers, sacrificed ~500bps growth to protect customer experience, not taking orders when reached daily capacity.

5 | Capacity Constraint, not Demand Constraint 💪🏻

- Demand was not constrained, capacity was (physical & labor)

- Doubled physical capacity of closest competitors combined, still not enough to keep up with full demand.

- Demand was not constrained, capacity was (physical & labor)

- Doubled physical capacity of closest competitors combined, still not enough to keep up with full demand.

6 | Timing of Investments (ST Noise) 📈

- Record level of capacity building out.

- Higher taste of underutilized capacity in near-term. E.g. Fresh, nearly half under construction/open, no revenue.

- LT positive strength, ST noise due to improvement rollouts.

- Record level of capacity building out.

- Higher taste of underutilized capacity in near-term. E.g. Fresh, nearly half under construction/open, no revenue.

- LT positive strength, ST noise due to improvement rollouts.

7 | Profit Drivers ST Mixed ⤴️

- Still far from margin and mix

- See long runway for continued improvement, past ST headwinds, will unlock meaningful margin expansion/

- Expect cost per order and operating leverage against fixed costs to only continue to grow with scale

- Still far from margin and mix

- See long runway for continued improvement, past ST headwinds, will unlock meaningful margin expansion/

- Expect cost per order and operating leverage against fixed costs to only continue to grow with scale

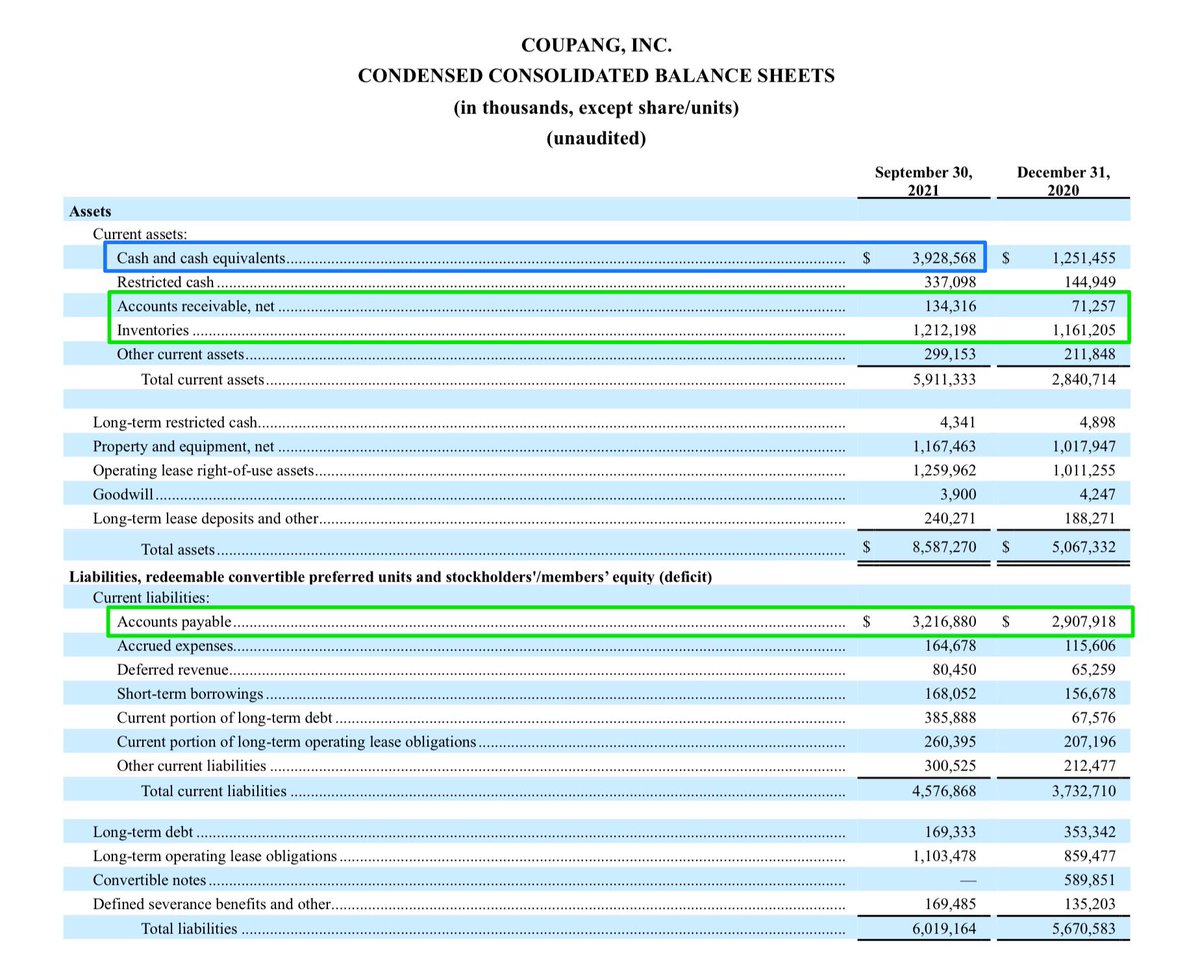

8 | CCC unchanged, Favorable WC Dynamics 💪🏻

“Our cash conversion cycle (i.e. negative) is unchanged and we expect the combination of the favorable working capital dynamics in our business and improving profitability to drive healthy cash flows over time.”

“Our cash conversion cycle (i.e. negative) is unchanged and we expect the combination of the favorable working capital dynamics in our business and improving profitability to drive healthy cash flows over time.”

9 | No Competition ✅

- Saw virtually no impact from competitive factors.

- Business drivers more so than any point in the company’s history, unaffected by competition.

- Saw virtually no impact from competitive factors.

- Business drivers more so than any point in the company’s history, unaffected by competition.

10 | Scaling Eats

- Largest logistic food delivery in market.

- App most downloaded on iOS, 2nd in Android

- Fastest scaling major ➡️ strong customer adoption & retention

- Increasingly confident in LT profitability, giving conviction to continue to invest in ST to scale Eats.

- Largest logistic food delivery in market.

- App most downloaded on iOS, 2nd in Android

- Fastest scaling major ➡️ strong customer adoption & retention

- Increasingly confident in LT profitability, giving conviction to continue to invest in ST to scale Eats.

11| Advertising

“Advertising revenue nearly tripled year-on-year in Q3.

We're still in the early innings and expect advertising to contribute significantly to margins in the future.”

“Advertising revenue nearly tripled year-on-year in Q3.

We're still in the early innings and expect advertising to contribute significantly to margins in the future.”

12 | Investments

- Added 8mil sqft of infrastructure YTD 2021

- Fulfilment for Rocket Fresh +90% YTD

- Announced plans to open new fulfillment centers > USD 1.3bn create over 13,000 new jobs.

- Added 8mil sqft of infrastructure YTD 2021

- Fulfilment for Rocket Fresh +90% YTD

- Announced plans to open new fulfillment centers > USD 1.3bn create over 13,000 new jobs.

13 | 3P Fulfilment by Logistics - 2H22

- Just out of beta testing, high conviction, seen significant sales lift for SMES, encouraged, clear customer value proposition.

- 3PL meaningful contributor from 2H22.

- Over LT, expect meaningful contributor to top-line & bottom-line.

- Just out of beta testing, high conviction, seen significant sales lift for SMES, encouraged, clear customer value proposition.

- 3PL meaningful contributor from 2H22.

- Over LT, expect meaningful contributor to top-line & bottom-line.

14 | International Expansion (Japan, SEA) 👍🏻

- Still fairly nascent, still early, still building out, testing.

- Continue to be encouraged by what they see.

- Disciplined approach to start small investments and grow as they learn more and build more confidence.

- Still fairly nascent, still early, still building out, testing.

- Continue to be encouraged by what they see.

- Disciplined approach to start small investments and grow as they learn more and build more confidence.

Final Takeaways on Coupang $CPNG:

➡️ Near-term headwinds that is more capacity-constrained led not demand-led. Coupled with the buildout of various offering at differing life-stages, clouding the near-term profit margin mix.

➡️ Near-term headwinds that is more capacity-constrained led not demand-led. Coupled with the buildout of various offering at differing life-stages, clouding the near-term profit margin mix.

cont’d…

➡️ Scale & operating leverage is still evident, and time is all that is needed for $CPNG to reach maturity to get the operating leverage they need.

With -45% price decline ($46b mkt cap $18b ann sales), 2022 could look vastly differently from 2021.

➡️ Scale & operating leverage is still evident, and time is all that is needed for $CPNG to reach maturity to get the operating leverage they need.

With -45% price decline ($46b mkt cap $18b ann sales), 2022 could look vastly differently from 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh