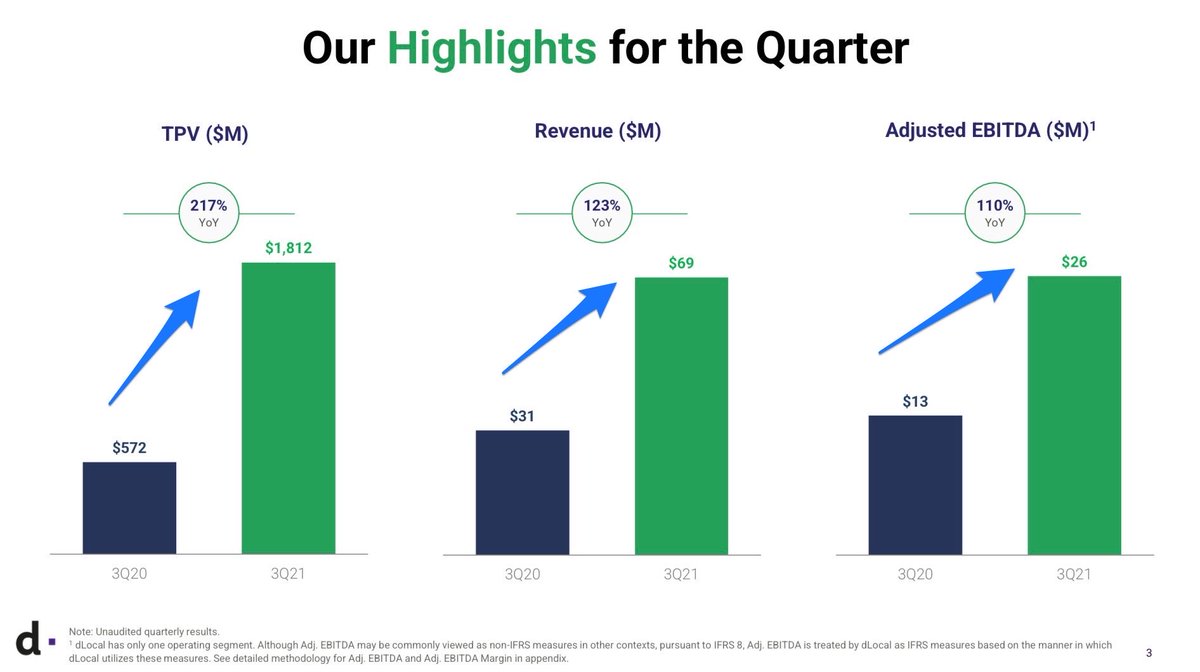

Sea Limited $SE 3Q21 Earnings 🚀

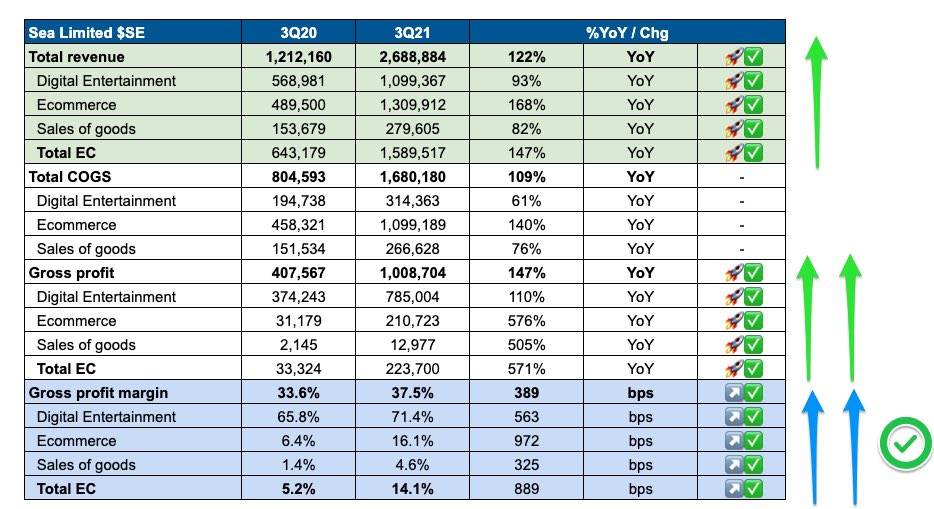

1 | Rapid revenue growth 🚀 and rising Gross Profit Margins ✅, especially in E-commerce

1 | Rapid revenue growth 🚀 and rising Gross Profit Margins ✅, especially in E-commerce

2 | Operating Leverage (declining R&D, S&M & G&A margins) leading to improving profit margins (EBIT & Net Income). ✅

- Note Adj EBITDA & OCF margins were lower this quarter.

- Note Adj EBITDA & OCF margins were lower this quarter.

3 | Segment Level EBIT Margins Analysis:

Ecommerce 🛒 & Digital Financial Services 💵 is rapidly improving their profitability, though off a highly negative base. ↗️✅

Ecommerce 🛒 & Digital Financial Services 💵 is rapidly improving their profitability, though off a highly negative base. ↗️✅

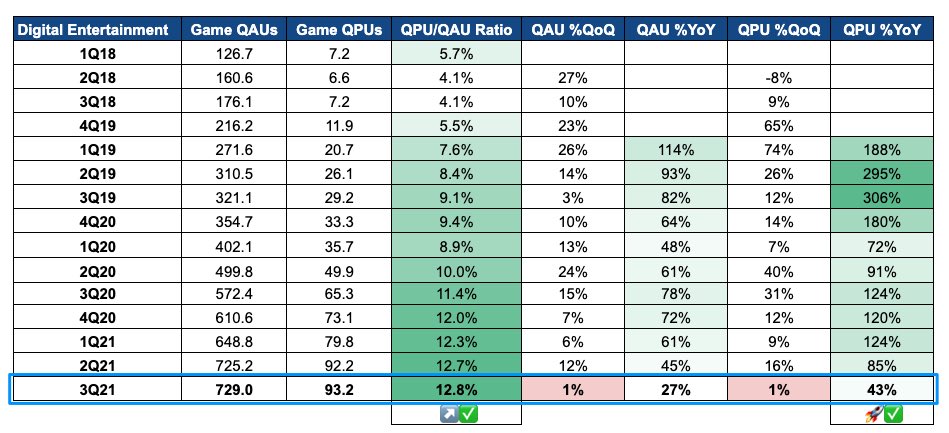

4 | Digital Entertainment continues to grow, especially on paying users vs active users. 📶

- QAU and QPU flat QoQ +1% ➡️, though +27% and 43% YoY ↗️.

- Not cause for immediate concern, but watching this in coming quarters, if it deteriorates further or reaccelerates. 👀

- QAU and QPU flat QoQ +1% ➡️, though +27% and 43% YoY ↗️.

- Not cause for immediate concern, but watching this in coming quarters, if it deteriorates further or reaccelerates. 👀

5 | Solid Quarter 💪🏻

“We are reporting another quarter of strong results across all our businesses in the third quarter.

…we continued to record triple digit growth in GAAP revenue gross profit.

…demonstrate our ability to capture new and attractive opportunities.”

“We are reporting another quarter of strong results across all our businesses in the third quarter.

…we continued to record triple digit growth in GAAP revenue gross profit.

…demonstrate our ability to capture new and attractive opportunities.”

6 | Garena - Fire Fre Max & Craftland

Introduced Fire Fire Max (enhanced Free Fire, higher quality effects, animation, graphics and features) and Craftland (players create custom maps)

Introduced Fire Fire Max (enhanced Free Fire, higher quality effects, animation, graphics and features) and Craftland (players create custom maps)

7 | Garena near-term softness vs tough comps, still positive

“…improved not only YoY but also QoQ versus very tough comps…”

“…in the long run, we continue to see growth opportunities…with new features, new modes, new collaborations, and new IPs being introduced into it…

“…improved not only YoY but also QoQ versus very tough comps…”

“…in the long run, we continue to see growth opportunities…with new features, new modes, new collaborations, and new IPs being introduced into it…

7 | Garena near-term softness vs tough comps, still positive (cont’d)

“…growing game pipeline through self-development, publishing and investment partnerships. So we're very positive on the game outlook as well.”

“…growing game pipeline through self-development, publishing and investment partnerships. So we're very positive on the game outlook as well.”

8 | Shopee - Taking Market Share 💪🏻📈

“Shopee continues to grow much more quickly than the overall market as we deliver ever greater value to our sellers and buyers.”

“Shopee continues to grow much more quickly than the overall market as we deliver ever greater value to our sellers and buyers.”

9 | Shopee - Improving Adj EBITDA 📈

“Shopee's total adj EBITDA loss per order across all markets was $0.41 cents in Q3.

…adjusted EBITDA loss per order improved both on a YoY and QoQ basis in Southeast Asia &Taiwan combined, as well as in Shopee's other markets combined.

“Shopee's total adj EBITDA loss per order across all markets was $0.41 cents in Q3.

…adjusted EBITDA loss per order improved both on a YoY and QoQ basis in Southeast Asia &Taiwan combined, as well as in Shopee's other markets combined.

10 | Shopee - Good Traction in Brazil

Sellers: “…that >1 mil local sellers in Brazil have registered with Shopee since…mid-2020.”

Buyers: “Shopee also continued to make good progress in Brazil.

Sellers: “…that >1 mil local sellers in Brazil have registered with Shopee since…mid-2020.”

Buyers: “Shopee also continued to make good progress in Brazil.

10 | Shopee - Good Traction in Brazil (cont’d)

➡️ Leading with App Downloads first…

In the Q3…ranked 1st by downloads and the total time spent in app and 2nd by average monthly active MAUs for the shopping category according to App Annie.

➡️ Leading with App Downloads first…

In the Q3…ranked 1st by downloads and the total time spent in app and 2nd by average monthly active MAUs for the shopping category according to App Annie.

10 | Shopee - Good Traction in Brazil (cont’d)

➡️ But still lots to do to…not there yet

“…still a young market for us, our local teams are focused on better understanding our growing community of local buyers and sellers and improving the experience we offer to them.”

➡️ But still lots to do to…not there yet

“…still a young market for us, our local teams are focused on better understanding our growing community of local buyers and sellers and improving the experience we offer to them.”

11 | Shopee - Still 3PL focused for now

“Most of our buyers -- sellers in fact are primarily local sellers. So more focus is on connecting with local 3PLs…”

“While we do have Shopee Express the last mile delivery services in certain markets, as a supplement to 3PL capacity.”

“Most of our buyers -- sellers in fact are primarily local sellers. So more focus is on connecting with local 3PLs…”

“While we do have Shopee Express the last mile delivery services in certain markets, as a supplement to 3PL capacity.”

11 | Shopee - Still 3PL focused for now (cont’d)

“We continue to view it as a holistic …whether we need to ramp up more our own Shopee Express delivery or we can rely more on the 3PLs….we are very open-minded and adopt a highly pragmatic approach on this.”

“We continue to view it as a holistic …whether we need to ramp up more our own Shopee Express delivery or we can rely more on the 3PLs….we are very open-minded and adopt a highly pragmatic approach on this.”

12 | SeaMoney - Focus on Wallet’s Use Case

“…expanding the number of use cases for our mobile wallet...”

“As we grow… use cases…seeing an increase in consumer adoption of our mobile wallet as more people grow to appreciate the ease and convenience that our platform offers.”

“…expanding the number of use cases for our mobile wallet...”

“As we grow… use cases…seeing an increase in consumer adoption of our mobile wallet as more people grow to appreciate the ease and convenience that our platform offers.”

13 | BNPL, DigiBank & Insurtech

“…we have launched early initiatives in other digital financial services such as buy now pay later, digital bank and insurtech.”

“…we have launched early initiatives in other digital financial services such as buy now pay later, digital bank and insurtech.”

14 | Chris Feng promoted to Sea Group President

“…continue to directly report to me and operate our Shopee & the SeaMoney businesses.

…work closely with me…on our long-term, strategic initiatives with an increasing focus on synergy creation across our various businesses.”

“…continue to directly report to me and operate our Shopee & the SeaMoney businesses.

…work closely with me…on our long-term, strategic initiatives with an increasing focus on synergy creation across our various businesses.”

Final Takeaways on Sea Limited $SE:

➡️ Strong combination of rapid revenue growth especially in EC/Shopee & increasingly payments supported by the profitability of DE/Garena/FF. Strong op leverage & rapidly improving profitability with lots of optionality.

➡️ Strong combination of rapid revenue growth especially in EC/Shopee & increasingly payments supported by the profitability of DE/Garena/FF. Strong op leverage & rapidly improving profitability with lots of optionality.

➡️ Remains high conviction, but watch in coming quarters if soft gaming user metrics deteriorate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh