Why #NetZero has opened the biggest TAM ever for @PalantirTech in this decade and next

- COP26 and global activism has already set the world on a path of carbon reporting, mgmt, and compliance

- the biggest challenge is that system relies on polluters themselves to report

- COP26 and global activism has already set the world on a path of carbon reporting, mgmt, and compliance

- the biggest challenge is that system relies on polluters themselves to report

- Also the carbon footprint is very complex measure, for the purpose of modeling it is divided into three categories - Scope 1 covers direct emissions from owned or controlled sources.

- Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company

- Scope 3 includes all other indirect emissions that occur in a company's value chain.

- Scope 3 includes all other indirect emissions that occur in a company's value chain.

- As you can see from above that estimating #NetZero is a data problem and that requires sharing of very large, high volume, real-time and complex data set across your own and vendors supply chain, which creates all kinds of data protection nightmare

- Also No one has addressed the problem at this scale in various commercial settings so its easier said than done

- Also it's a compliance issue i.e. the rules of game will change and companies need to understand now that what could be exposure tomorrow which is not threat today

- Also it's a compliance issue i.e. the rules of game will change and companies need to understand now that what could be exposure tomorrow which is not threat today

- A successful #NetZero tool should have following - ability to connect with very large datasets of different type and sources in matters of hours than weeks, strong supply chain monitoring abilities, strong data protection and understanding of compliance framework, ......

....demographic constraints, ability to build a large relative ontology of total business, ability to plot revenue and margin as a function of carbon footprint mitigation cost, complex scenario simulation and goal-based strategy implementation, extremely high system reliability

- There is no single company that is solving it entirely by its own other than @PalantirTech. Many niche solutions are available and emerging in the market but none has this kind of breadth as of today, most are based on calculation and benchmark only with nice dashboards

- Last but not least, almost all of these companies lack a product that can do it all with min effort as #Foundry

- Nearly 43 trillion$ funds and asset managers have committed for #NetZero investment globally and it all starts from carbon footprint assessment

- Nearly 43 trillion$ funds and asset managers have committed for #NetZero investment globally and it all starts from carbon footprint assessment

- All companies require to do it as it's part of compliance both for regulatory filing and access to finance, also to avoid cross-hair of many activist movements

- Its adoption is GIVEN & #Foundry strength is PROVEN, only question is whether $PLTR SALES can pull it now

- Its adoption is GIVEN & #Foundry strength is PROVEN, only question is whether $PLTR SALES can pull it now

- CLIENT needs a solution today and $PLTR despite all the effort is still constrained by scale-up efforts due to late investment in sales team

- I maintain my view - its a foundational software of future, available today but lacks effort in messaging 2 industries & sales scale-up

- I maintain my view - its a foundational software of future, available today but lacks effort in messaging 2 industries & sales scale-up

Based on the image below, you can see the majority of carbon footprint is driven by Scope 3. In some of the studies, i was involved it could be as high as 60-80% and it can't be estimated without access to 3rd party and vendor data

Image Source: carbon trust

Image Source: carbon trust

The current carbon calculator approach used by organization is low fidelity and not capable to link the carbon emitted to its source, render any bottom-up carbon reduction plan useless without proper cost and business throughput impact --> it needs sophisticated tools #Foundry

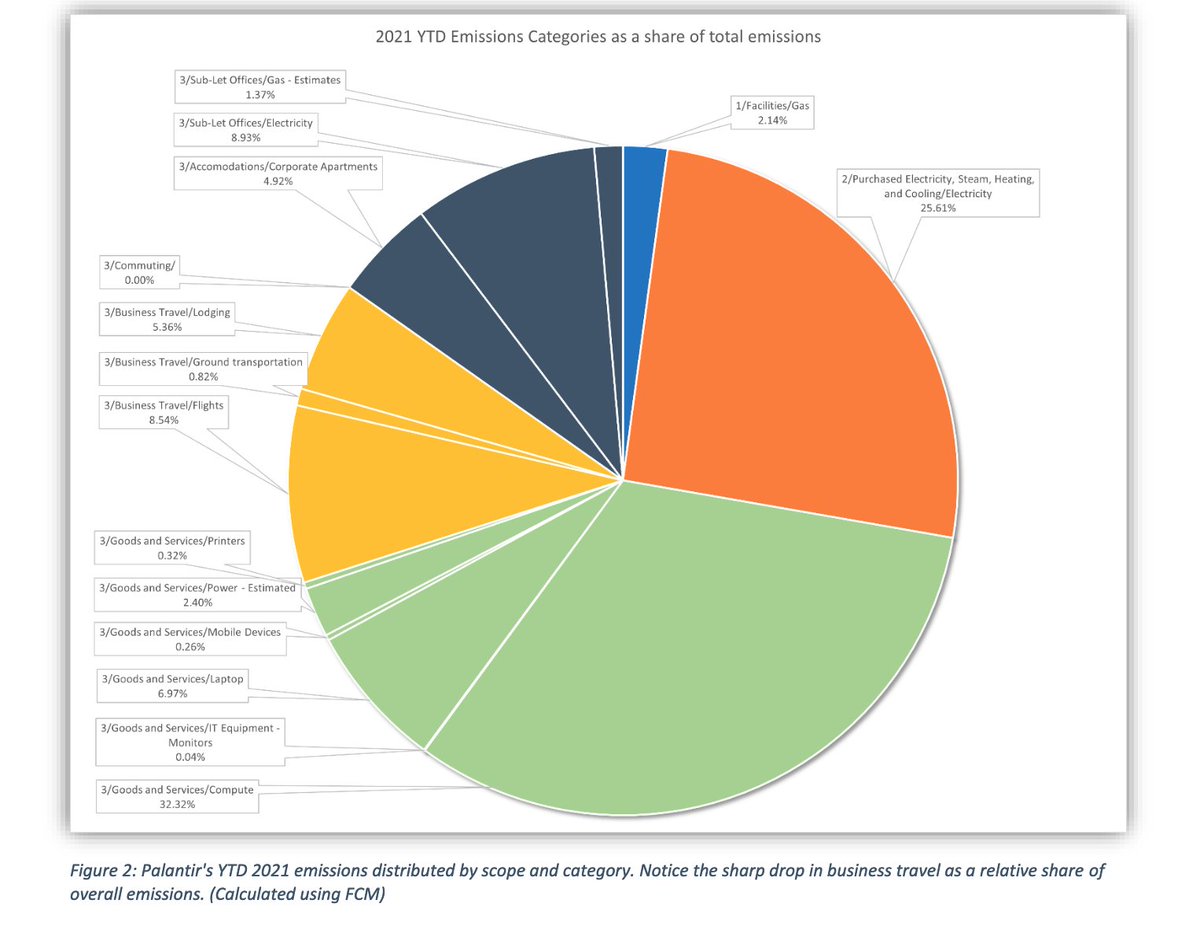

The image below shows the $PLTR own carbon footprint and as you can see it is dominated by Scope 3, My view is that they used #Foundry for assessment as building used case inside is best way to test the product for clients also.

• • •

Missing some Tweet in this thread? You can try to

force a refresh