(i) IMF release its report on Zim

(ii) RBZ move the Fx rate to 105

(iii) Backlog to be cleared

What to make of these.

The IMF article IV consultations are routine chats with it’s member countries. Unfortunately Zim is no longer on SMP & though the IMF & MOF had indicated…

(ii) RBZ move the Fx rate to 105

(iii) Backlog to be cleared

What to make of these.

The IMF article IV consultations are routine chats with it’s member countries. Unfortunately Zim is no longer on SMP & though the IMF & MOF had indicated…

..the resumption of SMP this year, the current report makes no mention. Meaning it’s not in the near future. SMP involves IMF deep dive & interrogation of the state of affairs. In contrast with this report based on feedback from stakeholders. It’s thin on details.

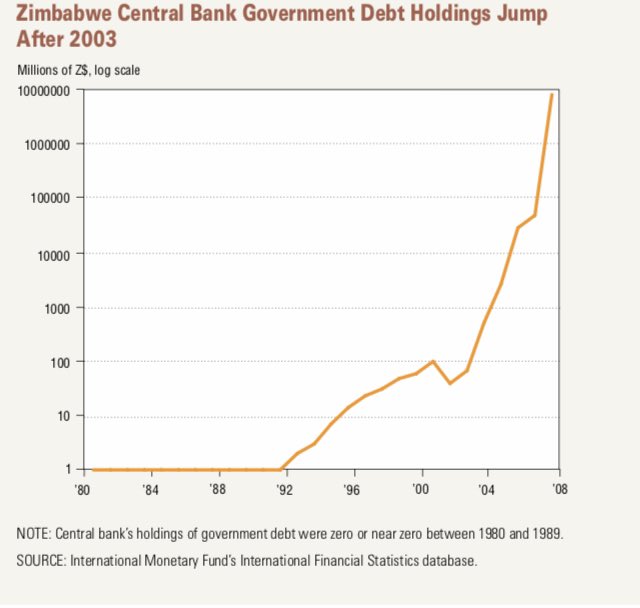

Eg it speaks of unsustainable debt & external arrears without any details. Zim is in a debt trap. With external debt upwards of US$20bn. The RBZ alone has a US$5bn debt problem.

The IMF let the cat out of the bag by highlighting how the RBZ is in control of the Fx rate despite

The IMF let the cat out of the bag by highlighting how the RBZ is in control of the Fx rate despite

RBZ claiming it has a Dutch Auction. This manipulation of the rate saw it move from 85 to 105 in two weeks. Nothing positive about this except to lay bare manipulation by RBZ. Export viability is under threat. Hence the need to respond otherwise exports will dry.

RBZ claims GOZ will clear the backlog. Again the backlog isn’t meant to be there in the first place. GOZ involvement in the backlog perhaps reveals why the backlog was there in the first place. The level of manipulation in monetary affairs is astounding. RBZ & GOZ

Intervene greatly to the detriment of proper markets. After all the arrests the parallel market remains stubbornly northwards of 180. Its RBZ rate that’s had to move.

In a nutshell the incoherent IMF report stems from the authorities nonchalance on economic matters

In a nutshell the incoherent IMF report stems from the authorities nonchalance on economic matters

and devastating dishonesty about its level of intervention in the markets & its policies. Zimbabwe at the moment is ruled by iron fist and clamp downs.

That’s not reflective of an economy growing at 7.8%. Not one bit

That’s not reflective of an economy growing at 7.8%. Not one bit

• • •

Missing some Tweet in this thread? You can try to

force a refresh