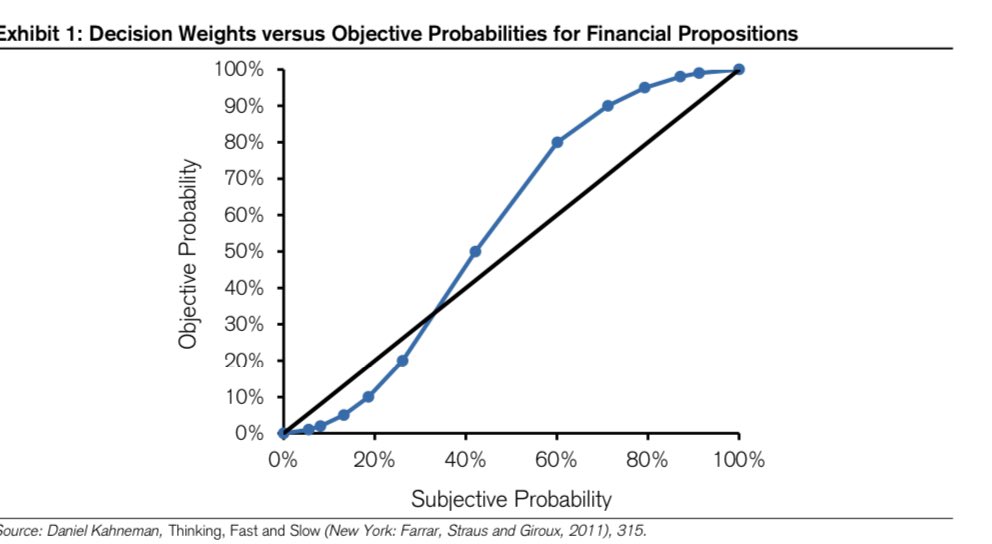

1/ "The possibility effect in the bottom left cell explains why lotteries are popular. When the top prize is very large, ticket buyers appear indifferent to the fact that their chance of winning is minuscule. A lottery ticket is the ultimate example of the possibility effect."

2/ "Without a ticket you cannot win, with a ticket you have a chance, and whether the chance is tiny or merely small matters little. Of course, what people acquire with a ticket is more than a chance to win; it is the right to dream pleasantly of winning.” Kahneman

3/ Humans "tend to overweight low-probability events. Imagine you have a 1 percent chance of winning $1 million, and you’ll know the outcome tomorrow. Subjects place a decision weight of 5.5 percent on a 1 percent objective probability." Mauboussin research-doc.credit-suisse.com/docView?langua…

4/ The root cause of the possibility effect is availability bias, which is a tendency to overweight what is easiest to recall (e.g. more vivid and recent).

Does our digital world make the possibility effect stronger today by making the outcomes of lucky people more available?

Does our digital world make the possibility effect stronger today by making the outcomes of lucky people more available?

5/ Do people who are constantly connected to feeds about new millionaires and billionaires have a greater propensity to gamble when trading, even though the bet has negative expected value? Has the possibility effect been fed steroids by modern media?

• • •

Missing some Tweet in this thread? You can try to

force a refresh