1/ A valuation has two parts:

1) normal operations, which represent business as usual. You value these by taking the present value of future free cash flow.

2) real options value.

Some people are better at determining real options value than others.

morganstanley.com/im/publication…

1) normal operations, which represent business as usual. You value these by taking the present value of future free cash flow.

2) real options value.

Some people are better at determining real options value than others.

morganstanley.com/im/publication…

2/ Some people compare investments that are similar and conclude if X is worth $1 trillion then Y must be worth $100 billion. This is pricing an asset rather than valuing it. The value of an asset may be very different from its price. pages.stern.nyu.edu/~adamodar/pdfi…

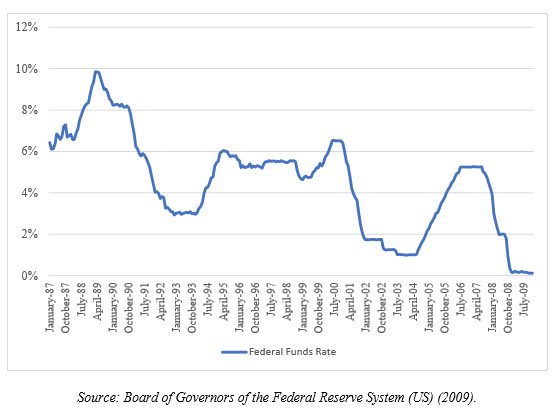

3/ A difference between then now and 2000 is interest rates. The Fed raised interest rates: three times in 1999 and twice in early 2000. Not just goods and services inflation is being driven by a "demand shock" right now.

4/ When assets like options trade based on popularity, rather than fundamentals, does it follow that the Matthew Effect is applicable? People don’t make decisions independently? Preferential attachment happens in some situations which produces the nonlinear phenomena we observe?

• • •

Missing some Tweet in this thread? You can try to

force a refresh