$JMIA was asked about the bullish thesis.

Not gonna go through the whole thing.

If interested, you can pay a few shekels for CMLPro.com to get...

... the full report and ongoing CEO interviews, but...

... in (very short)...

1/n

Not gonna go through the whole thing.

If interested, you can pay a few shekels for CMLPro.com to get...

... the full report and ongoing CEO interviews, but...

... in (very short)...

1/n

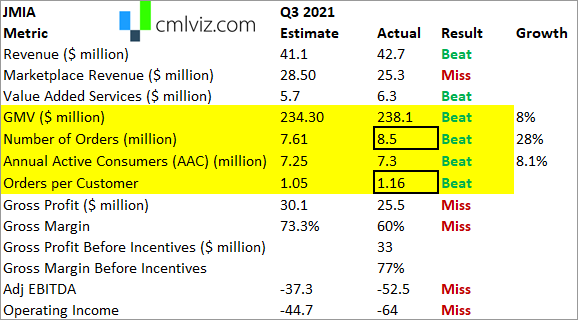

Platform:

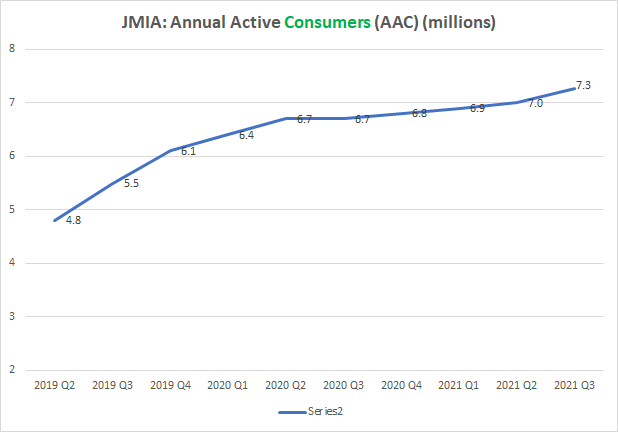

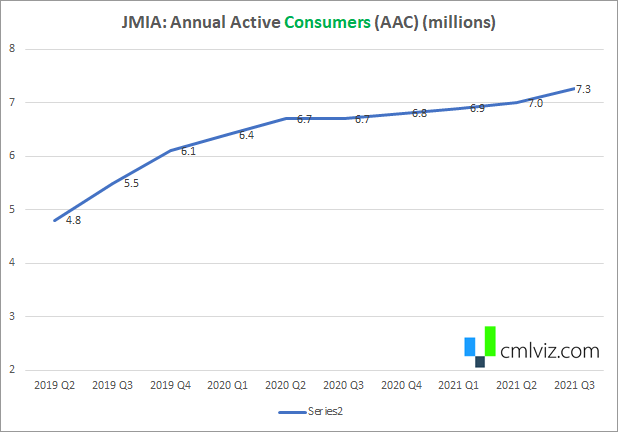

* Customers: +8%

... but

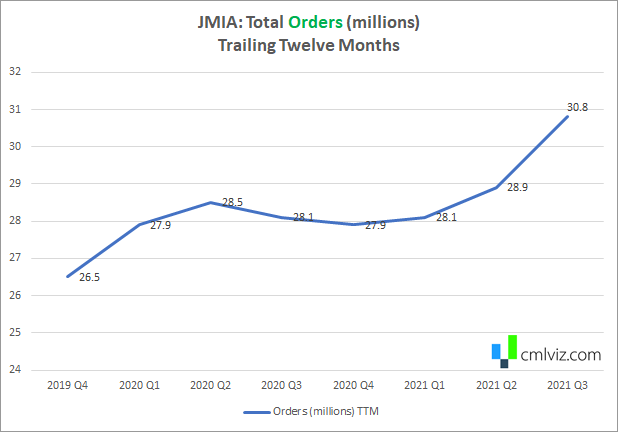

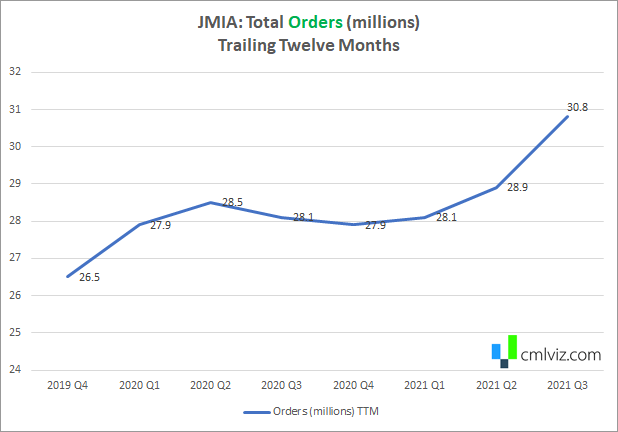

* E-comm: Orders +28%

* Payments: Txns +34%

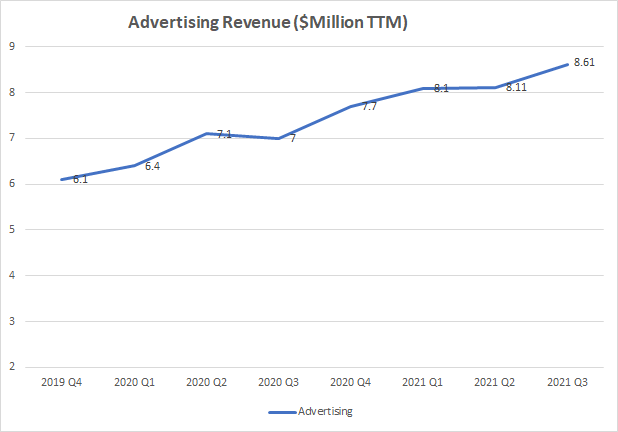

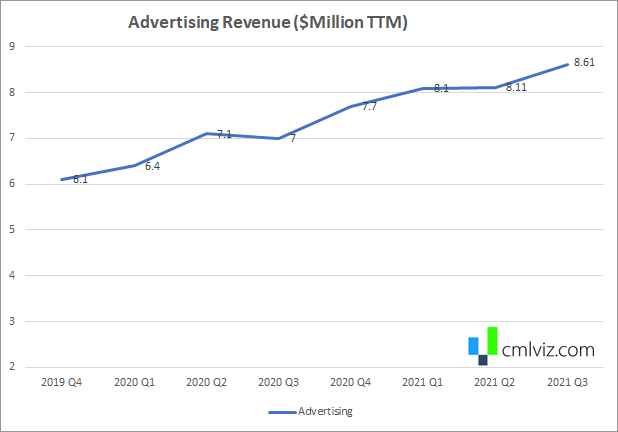

* Advertising Rev: +23%

And then...

/2

* Customers: +8%

... but

* E-comm: Orders +28%

* Payments: Txns +34%

* Advertising Rev: +23%

And then...

/2

* Logistics: Provides the "pick-axe to the gold rush" now with 3PL revenue

(Other sellers use Jumia's logistics)

* 50M downloads vs top comp 1M

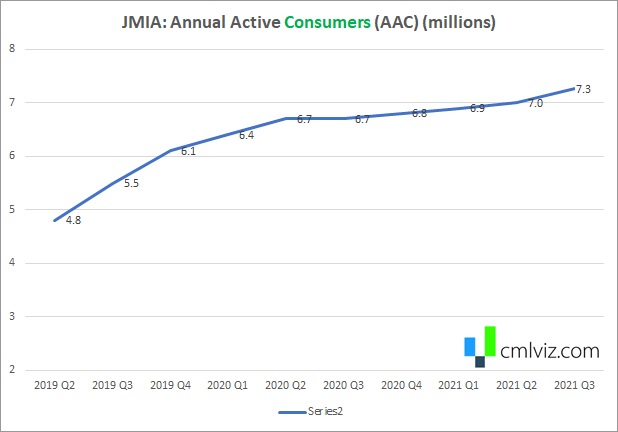

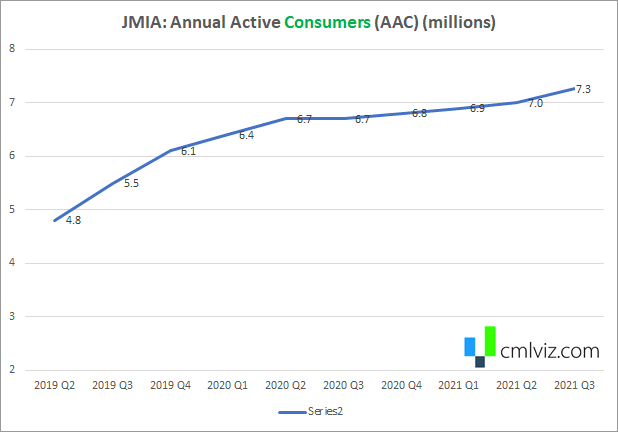

* Accounts: 7.3M (TAM 500M)

* Profitable per order after logistics

* Partners: $KO $PG $INTC Nestle

...

/3

(Other sellers use Jumia's logistics)

* 50M downloads vs top comp 1M

* Accounts: 7.3M (TAM 500M)

* Profitable per order after logistics

* Partners: $KO $PG $INTC Nestle

...

/3

* Gross margins ~75% and have been for years

* $560M in cash, no debt, while burning ~$50M per quarter with new focus on growth, lots of room

* Did not grow during COVID on *purpose* bc at that time was still losing money per order.

Can't "make it up on volume" like that.

/4

* $560M in cash, no debt, while burning ~$50M per quarter with new focus on growth, lots of room

* Did not grow during COVID on *purpose* bc at that time was still losing money per order.

Can't "make it up on volume" like that.

/4

* Now making more than $1 per order even after logistics, so here comes the S&M push, and yes, larger losses.

* Platform revenue outside of the the marketplace grows more than linearly, finally, so can be thought of as a land and expand, like an enterprise software company.

/5

* Platform revenue outside of the the marketplace grows more than linearly, finally, so can be thought of as a land and expand, like an enterprise software company.

/5

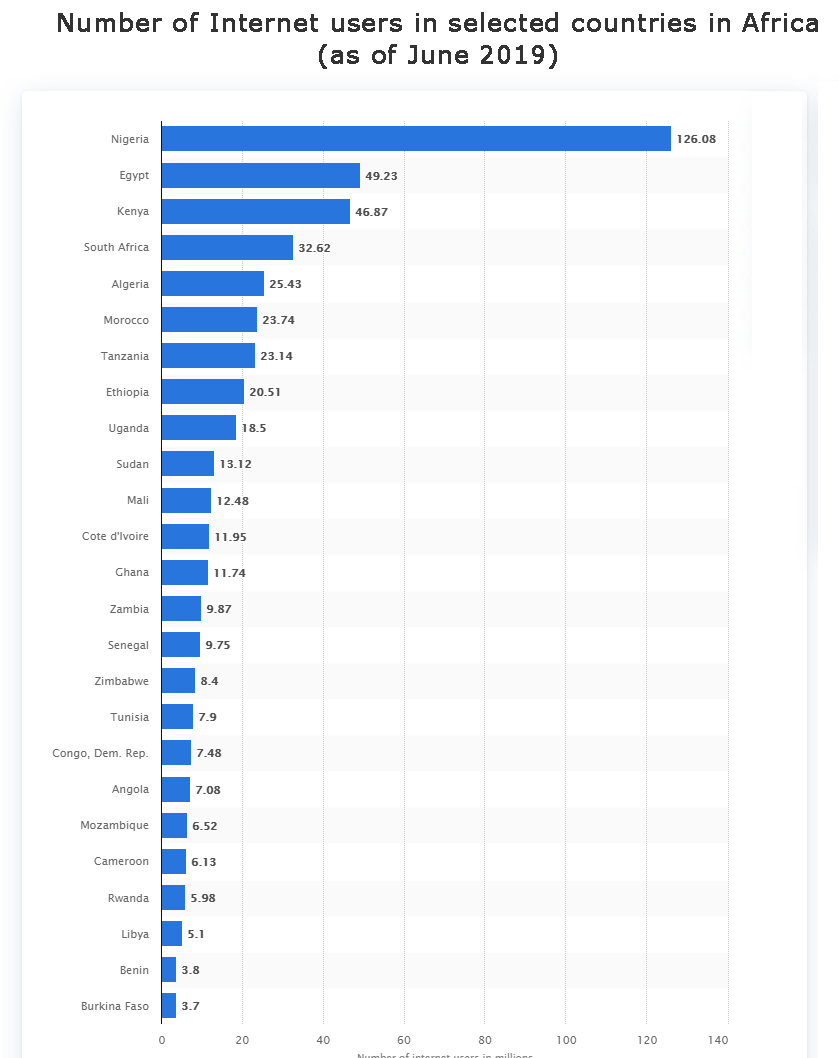

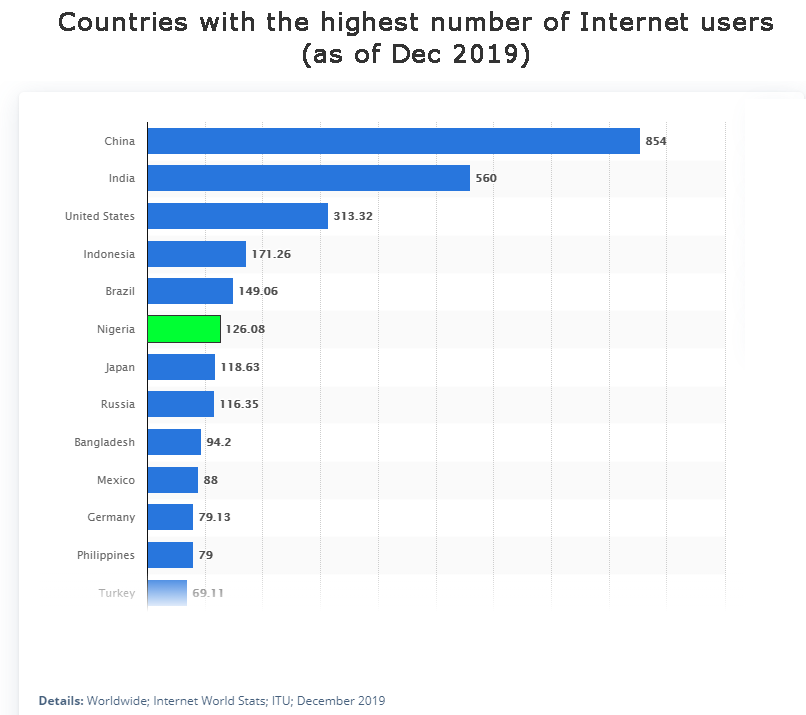

* And some charts of trends.

* Image 1: Jumia generates ~50% of revenue from Nigeria and Egypt and this is why.

* Image 2: The Internet is not lost in Africa, it's just mobile.

Then...

/6

* Image 1: Jumia generates ~50% of revenue from Nigeria and Egypt and this is why.

* Image 2: The Internet is not lost in Africa, it's just mobile.

Then...

/6

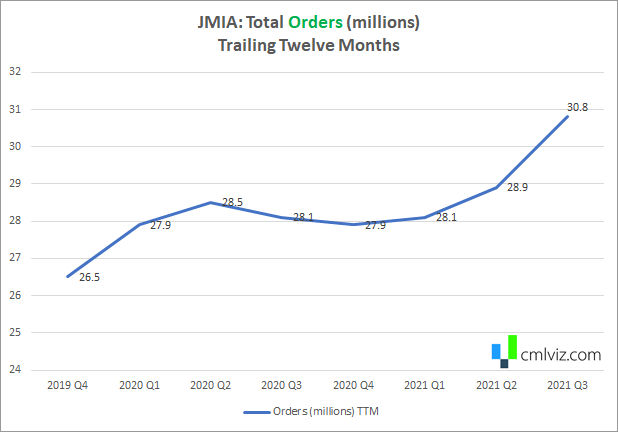

* Some charts for JMIA's platform thesis.

* Accounts a slow rise.

* Orders exponential.

* Advertising is eating the world.

* $800M EV. I see at least $10B in 10-years.

Get more: CMLPro.com

/7

* Accounts a slow rise.

* Orders exponential.

* Advertising is eating the world.

* $800M EV. I see at least $10B in 10-years.

Get more: CMLPro.com

/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh