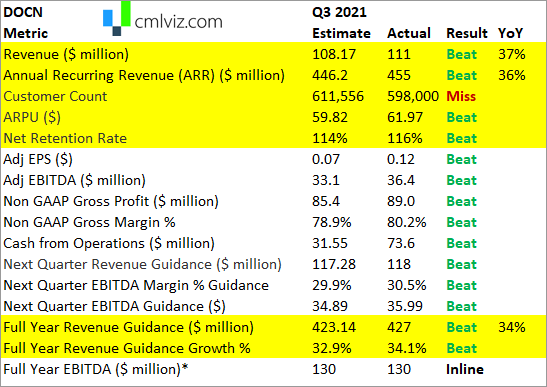

$DOCN Guided to over 30% revenue growth for 2022 as well; an early 2022 preview which is above consensus estimates.

$DOCN Q4 paid advertising is working to accelerate customer acquisitions.

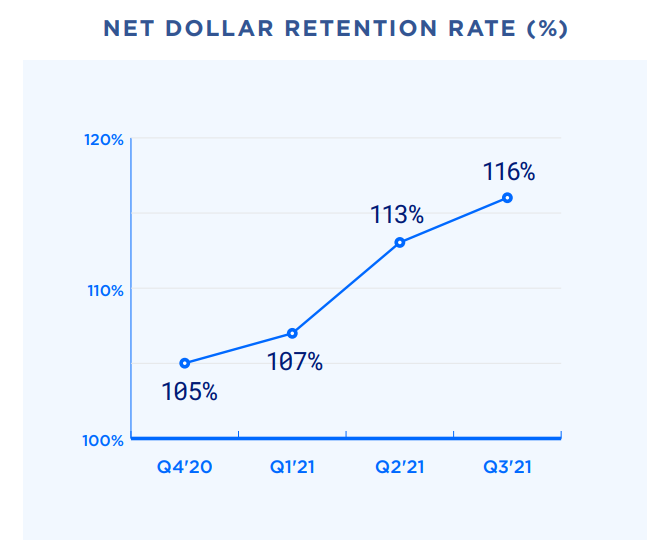

$DOCN DOCN wasn’t supposed to able to do any of these things — revenue growth was supposed to be in 20’s, retention can’t rise in a company that serves SMBs, and certainly there is no way that a CapEx heavy company could deliver margins better than AWS.

...

3/n

...

3/n

$DOCN

But we don’t care what people believe.

We care about what is not believed and happens anyway.

And that’s the DOCN story — what was not believed, but is happening anyway.

4/n

But we don’t care what people believe.

We care about what is not believed and happens anyway.

And that’s the DOCN story — what was not believed, but is happening anyway.

4/n

$DOCN CEO: we're not done at 37% growth; we can go higher.

5/n

5/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh