The founders of Food Lovers Market Group, Brian and Mike Coppin have done extremely well and are making big moves in "silence".

The business was founded in 1993 as Fruit & Veg City and has rebranded into Food Lovers Market Group with an estimated annual turnover of +-12bn.

The business was founded in 1993 as Fruit & Veg City and has rebranded into Food Lovers Market Group with an estimated annual turnover of +-12bn.

Food Lover's Market is one of the last few independent food retailers of scale on the African continent.

It has added categories such as bakery grocery, butchery and deil foods to complement its market leading position in fresh produce.

It has added categories such as bakery grocery, butchery and deil foods to complement its market leading position in fresh produce.

The Food Lover's Group now includes several retail brands like Seattle Coffee, Food Lover's Eateries, two liquor store brands and FVC International.

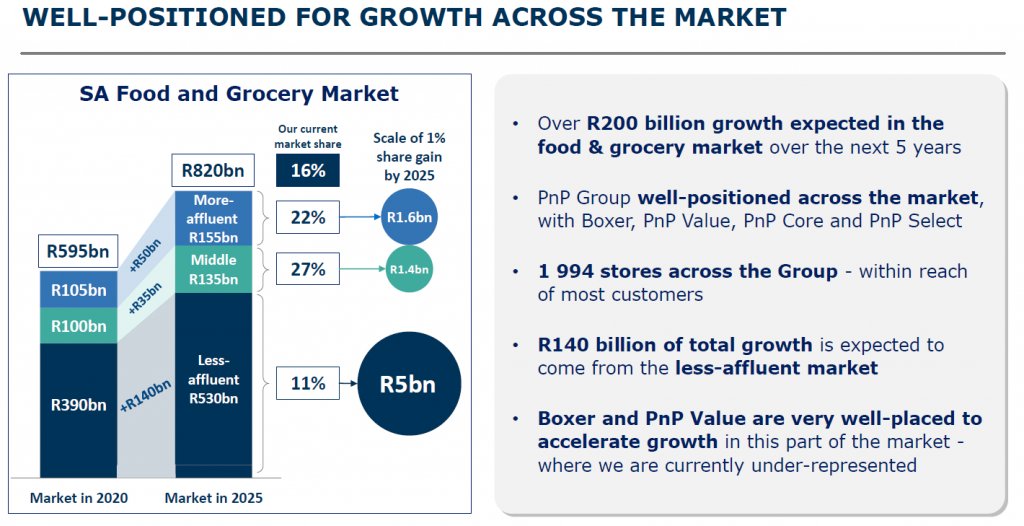

Food retail is the largest retail sub sector in South Africa valued at ~R471bn.

It has grown historically by 9.5% and forecast to continue at this pace.

Whoever is operating in this space, with proper capital and support, is positioned to harvest proper fruits.

It has grown historically by 9.5% and forecast to continue at this pace.

Whoever is operating in this space, with proper capital and support, is positioned to harvest proper fruits.

FVC International fits so well within the Food Lover's Market Group (FLM).

It supplies all stores within the FLM Group.

It is deemed to be South Africa’s leading import and export company (largest importer of fresh produce into SA and also export to more than 35 countries).

It supplies all stores within the FLM Group.

It is deemed to be South Africa’s leading import and export company (largest importer of fresh produce into SA and also export to more than 35 countries).

Food Lover’s Market biggest bet was when they partnered and subsequently acquired a 51% stake in Seattle Coffee Company from Pete Howie and Barry Parker in 2015.

Seattle Coffee Company has gain popularity over the years and you can find it in schools such as St Johns College.

Seattle Coffee Company has gain popularity over the years and you can find it in schools such as St Johns College.

Seattle Coffee's story deserves its own thread.

Seattle Coffee Company was formed the same year (1993) as Food Lover's Market in London, UK by husband and wife, Alley and Scott Svenson .

In 1996, Barry Parker and Peter Howie brought Seattle Coffee Company to Cape Town.

Seattle Coffee Company was formed the same year (1993) as Food Lover's Market in London, UK by husband and wife, Alley and Scott Svenson .

In 1996, Barry Parker and Peter Howie brought Seattle Coffee Company to Cape Town.

In 1998, Starbucks bought out Seattle UK and converted all 65 Seattle stores into Starbucks.

Starbucks acquired Seattle UK by exchange ~1.8 million Starbucks shares for 100% of Seattle in a deal worth ~$83 million.

Starbucks acquired Seattle UK by exchange ~1.8 million Starbucks shares for 100% of Seattle in a deal worth ~$83 million.

When Peter Howie and Barry Parker brought Seattle Coffee Company to Cape Town in 1996, they also acquired the Southern Africa naming rights.

So when Starbucks bought out Alley and Scott Svenson in 1998, the Cape Town store owned by Peter and Barry was the only Seattle left.

So when Starbucks bought out Alley and Scott Svenson in 1998, the Cape Town store owned by Peter and Barry was the only Seattle left.

Taste Holdings bought the South African master licence agreement for Starbucks for R226m in 2015 for 25 years and caught serious hands.

Taste was required to pay yearly royalties to Starbucks US of R2.5m.

Taste planned on establishing 12 to 15 outlets within first 24 months.

Taste was required to pay yearly royalties to Starbucks US of R2.5m.

Taste planned on establishing 12 to 15 outlets within first 24 months.

Capital expenditure and pre-opening expenses for the first 12 to 15 stores were estimated at R108m.

Market opportunity was estimated at 150-200 outlets, at an estimated capital expenditure per store of R3m-R10m.

We all know they never got to that 150-200 outlets.

Market opportunity was estimated at 150-200 outlets, at an estimated capital expenditure per store of R3m-R10m.

We all know they never got to that 150-200 outlets.

October 2015, Taste raised R226m via a rights offer of 75m new shares at R3 each. This was shortly after it acquired the South African master licence agreement for Starbucks for 25 years.

This was the start (or continuion) of the destruction of shareholders' wealth.

This was the start (or continuion) of the destruction of shareholders' wealth.

December 2017, it (Taste) did other capital raising and raised ~R398m by issuing 442 million shares at 90c.

That rights offer came just 6 months after a “claw-back offer” in June 2017 in which Taste Holdings had raised R120m by issuing 80 million new shares at R1.50 each.

That rights offer came just 6 months after a “claw-back offer” in June 2017 in which Taste Holdings had raised R120m by issuing 80 million new shares at R1.50 each.

Inclusive of debt and share multiple rights issues, Taste management raised and squandered R1.4bn to keep Starbucks afloat.

The wealth destroyed over that period is one for the history books.

The wealth destroyed over that period is one for the history books.

Taste management estimated that it would require ~R700m, including amount raised in the prior rights offers, to reach positive free cash flow and that the Starbucks network will need to expand to between 150 and 200 cafés and Domino’s to between 220 and 280 restaurants.

Taste Holdings later disposed of 13 Starbucks stores for a mere lousy R7m, which was ~R538k a store as well as the franchise master to Rand Capital Coffee.

The estimated cost of opening a Starbucks store in South Africa was around R3m-R10m at the time.

The estimated cost of opening a Starbucks store in South Africa was around R3m-R10m at the time.

Back to Food Lover's Market Group.

Food Lover's Market FreshStop convenience stores located in Caltex stations is a hit as well.

There are +-330 FreshStop at Caltex outlets nationwide which are open 24 hours.

Food Lover's Market FreshStop convenience stores located in Caltex stations is a hit as well.

There are +-330 FreshStop at Caltex outlets nationwide which are open 24 hours.

The early bird catches the worm.

In 2016, Actis, through its private equity arm invested R760 million for a minority stake in Food Lover’s Market.

Food Lover's Market used the proceeds to boost its local growth potential.

Actis has positioned itself well here.

In 2016, Actis, through its private equity arm invested R760 million for a minority stake in Food Lover’s Market.

Food Lover's Market used the proceeds to boost its local growth potential.

Actis has positioned itself well here.

Actis said that they are backing the founders.

Actis private equity portfolio focuses on consumer, financial services and healthcare.

It has ~$15bn funds under management and has raised $24bn since inception.

Actis PE has invested $5.7bn in 150 transactions and exited 100.

Actis private equity portfolio focuses on consumer, financial services and healthcare.

It has ~$15bn funds under management and has raised $24bn since inception.

Actis PE has invested $5.7bn in 150 transactions and exited 100.

In 2016 when Actis invested R760m, FLM had;

~120 Food Lover's Market stores in 11 countries,

200 FreshStop convenience stores in Caltex stations.

2021;

130 Food Lover's Market stores in 22 countries

330 FreshStop stores

14 eateries.

240 Seattle Coffee.

46 Market Liquors outlets.

~120 Food Lover's Market stores in 11 countries,

200 FreshStop convenience stores in Caltex stations.

2021;

130 Food Lover's Market stores in 22 countries

330 FreshStop stores

14 eateries.

240 Seattle Coffee.

46 Market Liquors outlets.

Should Food Lover's Market go public one day, Actis and the founders (Mike and Brian Coppin) will be rewarded handsomely.

The owners of Food Lover's Market Group said that for year ended 28 Feb 2021, Food Lover's Market turnover, excluding Seattle and FreshStop was R11bn-R12bn.

The owners of Food Lover's Market Group said that for year ended 28 Feb 2021, Food Lover's Market turnover, excluding Seattle and FreshStop was R11bn-R12bn.

With the R760m investment from Actis and the strength of Food Lover's Market balance sheet, the group has the following expansions in the pipeline;

1) continue opening 20 to 30 FreshStop convenience stores a year

2)open 2-3 Food Lover's Market stores a year + refurb 5-6 stores.

1) continue opening 20 to 30 FreshStop convenience stores a year

2)open 2-3 Food Lover's Market stores a year + refurb 5-6 stores.

Food Lover’s Market offers opportunities to own a store via a franchise agreement.

Average setup cost is R8m-12m, with an owner contribution of 50%.

Franchise/Royality fee is 2% and marketing contribution is 0.5%of turnover.

Initial franchise agreement term is set at 10 years.

Average setup cost is R8m-12m, with an owner contribution of 50%.

Franchise/Royality fee is 2% and marketing contribution is 0.5%of turnover.

Initial franchise agreement term is set at 10 years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh