EasyEquities growth is impressive (+/-570 000 active users/accounts).

For 6 months ended 28 Feb 2021, EasyEquities revenue ⬆️ by 197.6% from R28.6m to R85.03m.

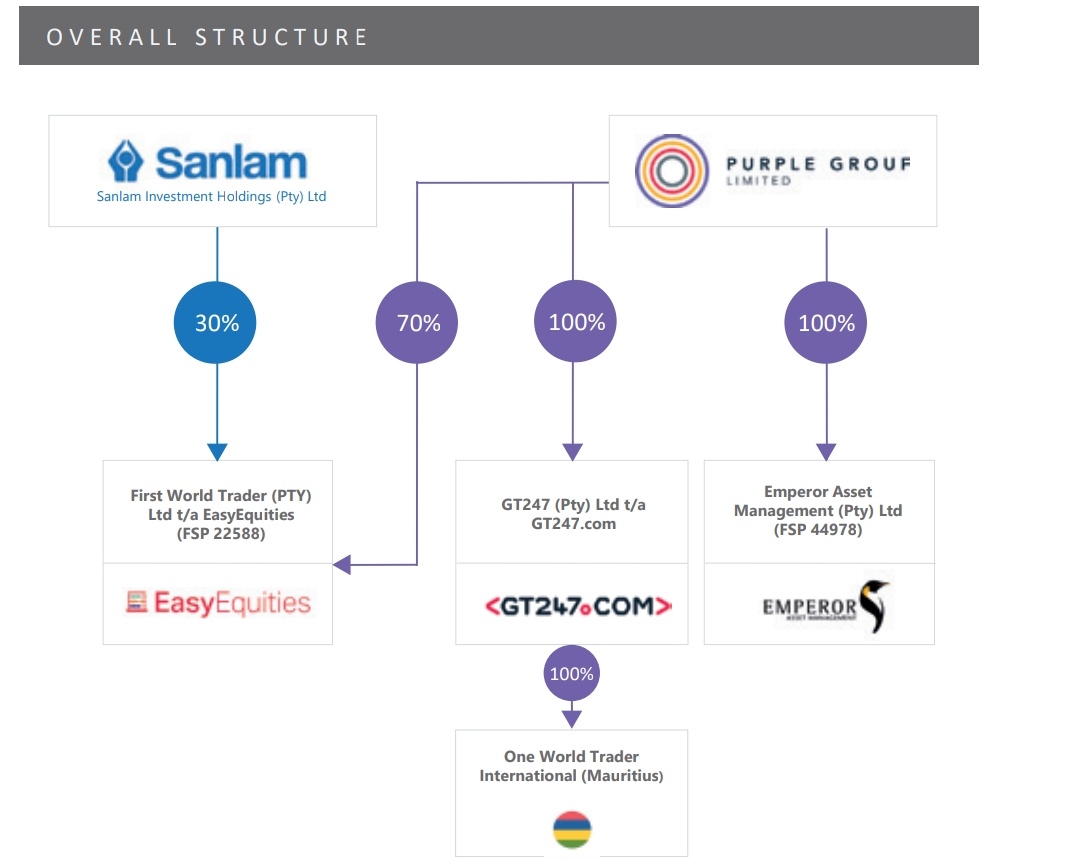

Sanlam Investments Holdings (ABSA Financial Services and African Rainbow Capital FS now) hold a stake in EasyEquities.

For 6 months ended 28 Feb 2021, EasyEquities revenue ⬆️ by 197.6% from R28.6m to R85.03m.

Sanlam Investments Holdings (ABSA Financial Services and African Rainbow Capital FS now) hold a stake in EasyEquities.

Who owns EasyEquities and how did Sanlam Investment Holdings get involved?

Purple Group owns 70% of EasyEquities SA and Sanlam

Investment Holdings owns the remaining 30%.

Sanlam Investment Holdings bought the 30% from the Purple Group for R100 million in 2017.

Purple Group owns 70% of EasyEquities SA and Sanlam

Investment Holdings owns the remaining 30%.

Sanlam Investment Holdings bought the 30% from the Purple Group for R100 million in 2017.

How does ABSA get into the thick of things?

Early Oct 2021, Sanlam announced that it has concluded agreements with Absa which will result in Absa Financial Services exchanging its investment management business for a ~17.5% stake in Sanlam Investment Holdings(SIH).

Early Oct 2021, Sanlam announced that it has concluded agreements with Absa which will result in Absa Financial Services exchanging its investment management business for a ~17.5% stake in Sanlam Investment Holdings(SIH).

Absa Financial Services (together with other subsidiaries of Absa) and Sanlam Investments have also entered into a distribution agreement pursuant to which SIH will be the preferred provider of investment products for distribution through certain Absa distribution channels.

30 June 2021, SIH and Absa Investments had assets under management, administration and advice of R879bn and R238bn, respectively.

Therefore, on conclusion of the transaction, SIH is expected to have assets under management, administration and advice in excess of R1 trillion.

Therefore, on conclusion of the transaction, SIH is expected to have assets under management, administration and advice in excess of R1 trillion.

The Absa businesses that Sanlam Investment Holdings will acquire are:

Absa Asset Management,

Absa Alternative Asset Management,

Absa Fund Managers (excluding the Absa Prudential Money Market Fund),

Absa Multi Management and

Absa’s NewFunds (RF) Proprietary Limited.

Absa Asset Management,

Absa Alternative Asset Management,

Absa Fund Managers (excluding the Absa Prudential Money Market Fund),

Absa Multi Management and

Absa’s NewFunds (RF) Proprietary Limited.

Absa Financial Services will exchange its entire interest in the above-mentioned units (previous tweet) for a shareholding of up to 17.5% in Sanlam Investment Holdings, determined with reference to the relative values of Sanlam Investments Holdings and Absa Investments.

Following an internal reorganisation at Sanlam, Sanlam Investment Holdings consisted of an asset management business covering an extensive range of asset classes, including South Africa’s leading index tracking business, Satrix.

Satrix has ~R130bn assets under management.

Satrix has ~R130bn assets under management.

Satrix will acquire the exchange traded funds business of Absa’s NewFunds (excluding its commodity ETF business) and the intention is that Absa will enter into agreements to dispose of its market Linked Investment Services Provider (LISP) business to Glacier by Sanlam for ~R80m.

What is African Rainbow Capital Financial Services involvement in Absa Financial Services will exchanging its investment management business for a ~17.5% stake in SIH?

And what will be the effect on ARC FS 25% stake in Sanlam’s South African 3rd-party Asset Management unit?

And what will be the effect on ARC FS 25% stake in Sanlam’s South African 3rd-party Asset Management unit?

Understanding the relationship between Sanlam and Ubuntu-Botho is important in understanding how African Rainbow Capital was birthed.

Where does the relationship emanate from?

It all started in 2003 when Sanlam established a black owned and controlled company.

Where does the relationship emanate from?

It all started in 2003 when Sanlam established a black owned and controlled company.

The deal saw the Ubuntu-Botho consortium take an initial 8% stake in Sanlam.

Shareholding was extended to include broad-based groups; trade union companies, religious organisations, women and youth groups,provincial companies from all the provinces, representing 700 shareholders

Shareholding was extended to include broad-based groups; trade union companies, religious organisations, women and youth groups,provincial companies from all the provinces, representing 700 shareholders

By 31 December 2013, the 8% equity stake had grown to 14% through a combination of share buybacks and the reclassification of an additional 66.5 million deferred shares to ordinary shares.

UBI’s shareholding of ~14% in Sanlam has declined slightly over the years and as at 31 Dec 2020 was 13,3%.

This stake is currently valued at ~R17 billion based on Sanlam’s current share price.

UBI is the biggest shareholder in Sanlam with the GEPF right on its heels.

This stake is currently valued at ~R17 billion based on Sanlam’s current share price.

UBI is the biggest shareholder in Sanlam with the GEPF right on its heels.

At the beginning of 2014, the initial 10-year lock-up period and all of UBI’s contractual obligations towards Sanlam came to an end with the repayment of the original debt (initial investment of R1.3-billion (all debt and interest on debt was fully settled).

Ubuntu-Botho Investments used the returns on its 14% shareholding in Sanlam to establish African Rainbow Capital.

ARC Investments was registered and incorporated in Mauritius as a private company on 30 June 2017 and was converted to a public company on 2 August 2017.

ARC Investments was registered and incorporated in Mauritius as a private company on 30 June 2017 and was converted to a public company on 2 August 2017.

ARC Financial Services (ARC FS) houses all of the financial services investments (excluding Sanlam, which is held in UBI).

Majority shareholding (50.1%) is directly held in ARC to ensure the empowerment status of financial services investee companies remain intact.

Majority shareholding (50.1%) is directly held in ARC to ensure the empowerment status of financial services investee companies remain intact.

This is how African Rainbow Capital Financial Services got involved with Sanlam Investments Holdings.

In 2020, Sanlam signed agreements with ARC FS in respect of a transaction to establish one of the largest black-empowered asset management companies in South Africa.

In 2020, Sanlam signed agreements with ARC FS in respect of a transaction to establish one of the largest black-empowered asset management companies in South Africa.

ARC FS then subscribed for a 25% economic interest in Sanlam’s South African third-party asset management business other than the investment management business conducted by Sanlam Private Wealth Proprietary Limited and the Sanlam Specialised Finance division.

ARC FS has a 25% effective interest in SIH (the one ABSA is buying a 17.5% stake in) through its 25% shareholding in SIH’s holding company, with Sanlam owning the other 75%.

Sanlam Investments Holdings is a black-owned asset manager as defined in the Financial Sector Charter.

Sanlam Investments Holdings is a black-owned asset manager as defined in the Financial Sector Charter.

ARC FS purchased shares in a newly established holding company that was initially a wholly-owned subsidiary of Sanlam and which, in turn, owned 100% of SIH.

The ARC FS purchase price was calculated with reference to a base value of R787.5m at the time of negotiations.

The ARC FS purchase price was calculated with reference to a base value of R787.5m at the time of negotiations.

The transaction price was settled in part by utilising the Ubuntu-Botho facility that was approved by Sanlam shareholders in 2018 for up to 80% of the ARC FS purchase price. 20% funded from ARC FS’ own cash resources.

Purchase price was a 25% discount to the valuation of SIH.

Purchase price was a 25% discount to the valuation of SIH.

The agreement allowed for an adjustment to the base value by a factor equal to the Ubuntu-Botho facility funding rate from 30 April 2020 to the transaction effective date.

The final transaction price was R815.2 million and closed in December 2020.

The final transaction price was R815.2 million and closed in December 2020.

After the 17.5% Absa is getting, the remaining 82.5% of Sanlam Investment Holdings (held 75% by Sanlam and 25% by ARC) will surely be diluted relative to their shareholdings.

Quick condom box calculation;

Sanlam: 75% ⬇️ to 61.9% (75*0.825)

ARC FS: 25% ⬇️ to 20.6% (25*0.825)

Quick condom box calculation;

Sanlam: 75% ⬇️ to 61.9% (75*0.825)

ARC FS: 25% ⬇️ to 20.6% (25*0.825)

In a nutshell, African Rainbow Capital Financial Services got to benefit from EasyEquities when it bought 25% of Sanlam Investment Holdings (owns 30% of EasyEquities) and now ABSA will also benefit from EasyEquities after agreeing to buy 17.5% of Sanlam Investment Holdings.

• • •

Missing some Tweet in this thread? You can try to

force a refresh