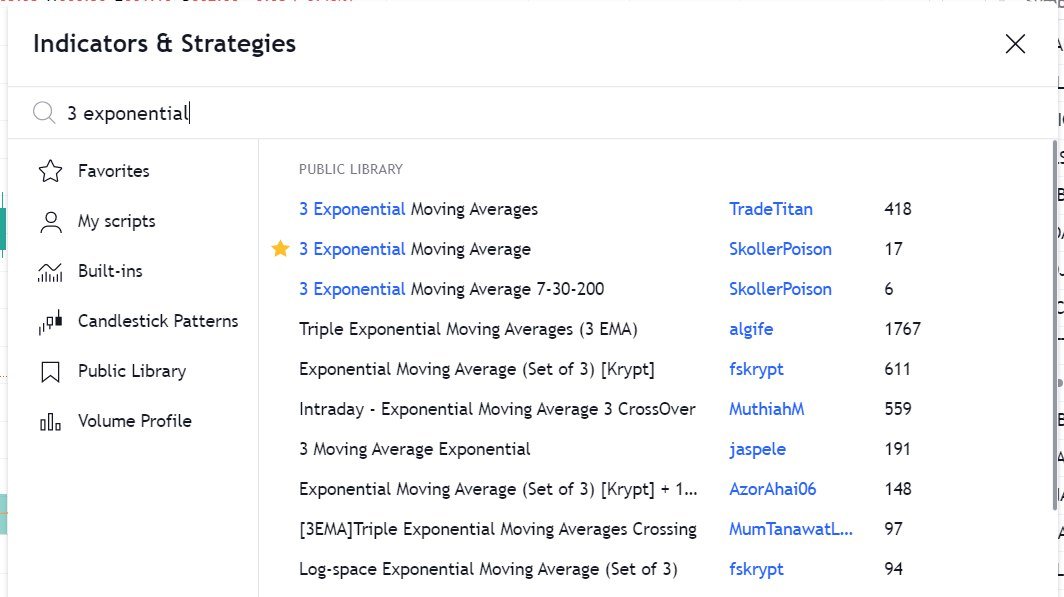

A thread on how to draw trendlines!

Confused between connecting wicks or bodies while drawing a trendline ?

Our main aim to draw trendline is to get maximum points of price on a line .

It can be through wicks tails or body and there is no fixed rule !

RETWEET SHARE🔄 !

1/n

Confused between connecting wicks or bodies while drawing a trendline ?

Our main aim to draw trendline is to get maximum points of price on a line .

It can be through wicks tails or body and there is no fixed rule !

RETWEET SHARE🔄 !

1/n

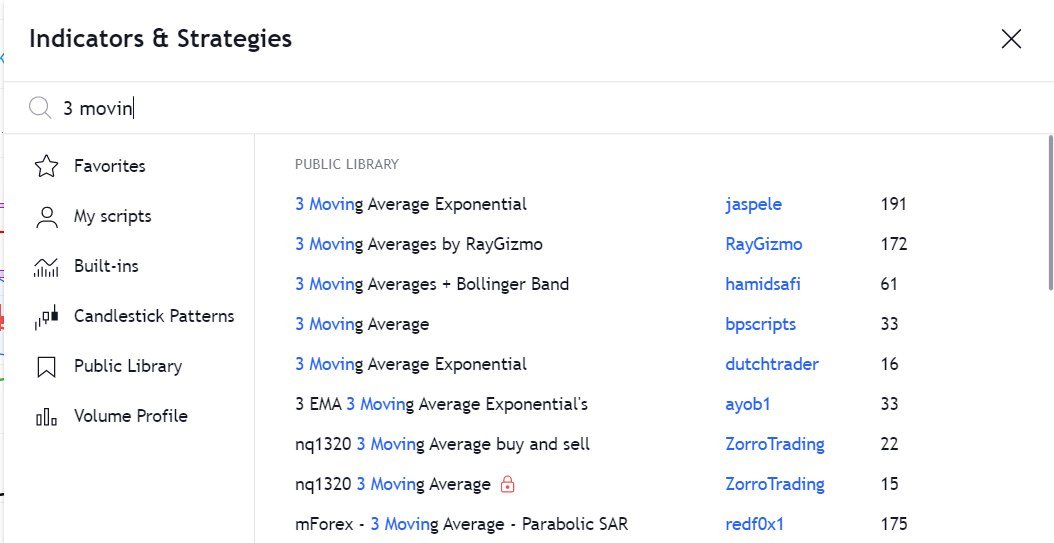

Trendline as Trailing Stop Loss.

1. Trending stock Tends to pullback near Moving averages and trendlines .

2. This could be areas of fresh buying or you can shift your Stop loss to upside

3. As soon as trendline is broken then you can sell a stock and take reverse position

2/n

1. Trending stock Tends to pullback near Moving averages and trendlines .

2. This could be areas of fresh buying or you can shift your Stop loss to upside

3. As soon as trendline is broken then you can sell a stock and take reverse position

2/n

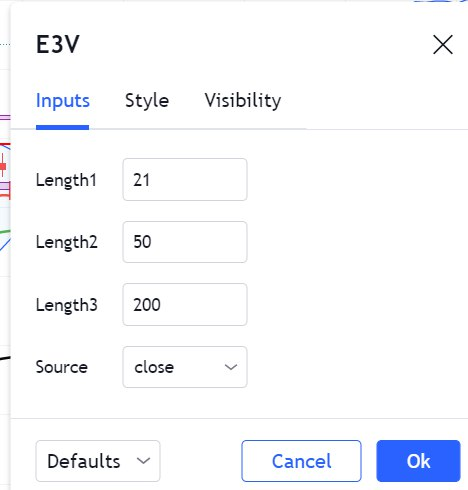

Trendline as Trendreversal

1. You can Buy breakouts of trendline in a downtrend

once the trend is changed with emergence of HH HL structure

2. You can initiate long postion with Stop at previous swing low

3. Sometimes you may find retest on trendline also

3/n

1. You can Buy breakouts of trendline in a downtrend

once the trend is changed with emergence of HH HL structure

2. You can initiate long postion with Stop at previous swing low

3. Sometimes you may find retest on trendline also

3/n

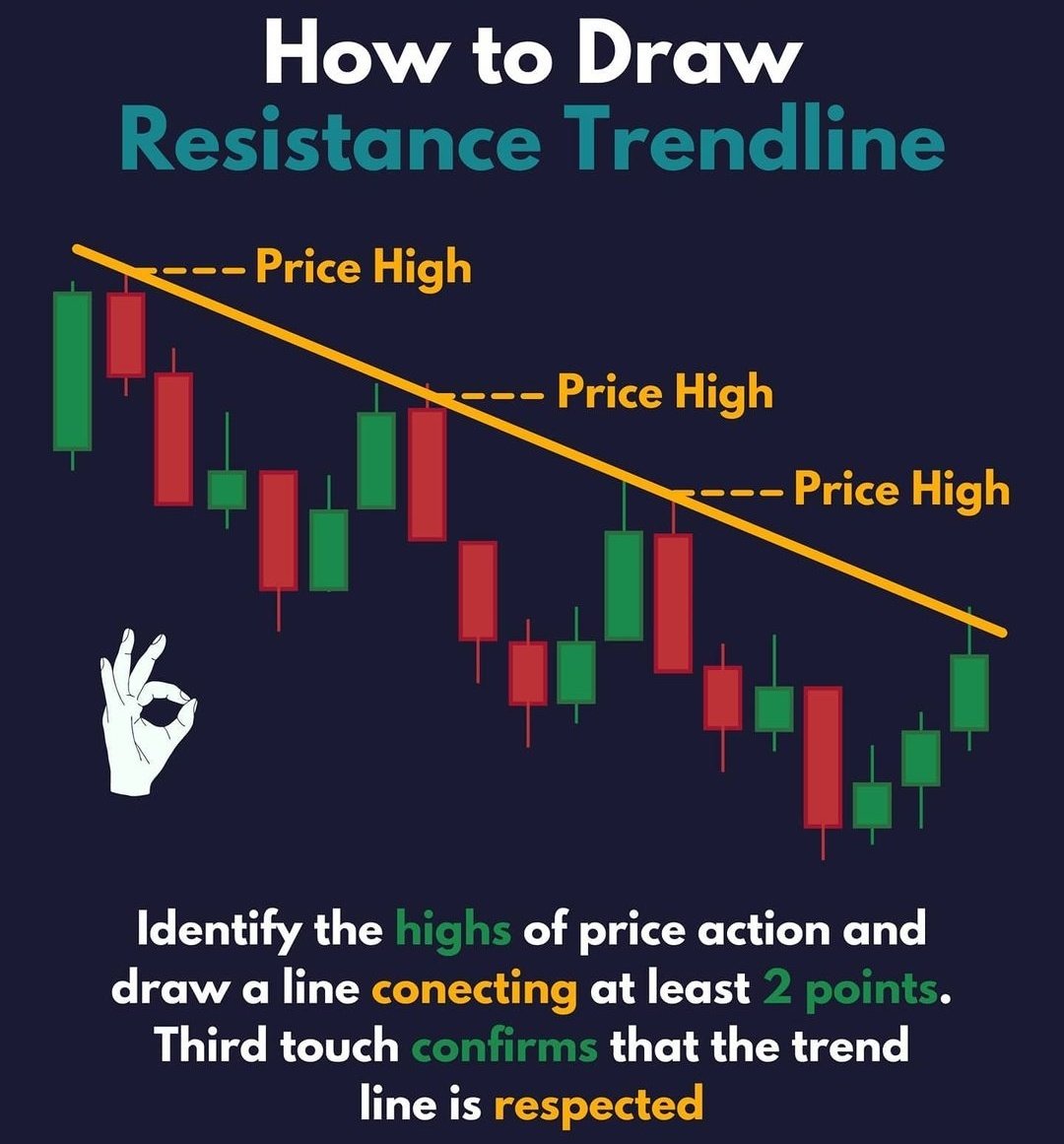

Trendline will act as Support and Resistance

Simple Strategy of Buy Low Sell High works best combined with other buying rules

5/n

@kuttrapali26 @AmitabhJha3 @rohanshah619

Simple Strategy of Buy Low Sell High works best combined with other buying rules

5/n

@kuttrapali26 @AmitabhJha3 @rohanshah619

@rattibha compile

• • •

Missing some Tweet in this thread? You can try to

force a refresh