Get a simple overview of 50+ #Bitcoin #onchain analytics by zooming out.

🤗#BTC changed my life. I'm sharing these to help others leverage the edge of onchain analytics.

👉Follow me @BinkiePondarosa for a weekly cycle summary

🙏Please Retweet to help others!

A thread🧵1/5

🤗#BTC changed my life. I'm sharing these to help others leverage the edge of onchain analytics.

👉Follow me @BinkiePondarosa for a weekly cycle summary

🙏Please Retweet to help others!

A thread🧵1/5

MARKET TOPS - reveal themselves in the data:

-->🟥 Most indicators turn RED

-->🎯BTC price > top price predictions

-->🪙Cycle Valuation % is > 100%

How the last cycle peak looked:

2/5

-->🟥 Most indicators turn RED

-->🎯BTC price > top price predictions

-->🪙Cycle Valuation % is > 100%

How the last cycle peak looked:

2/5

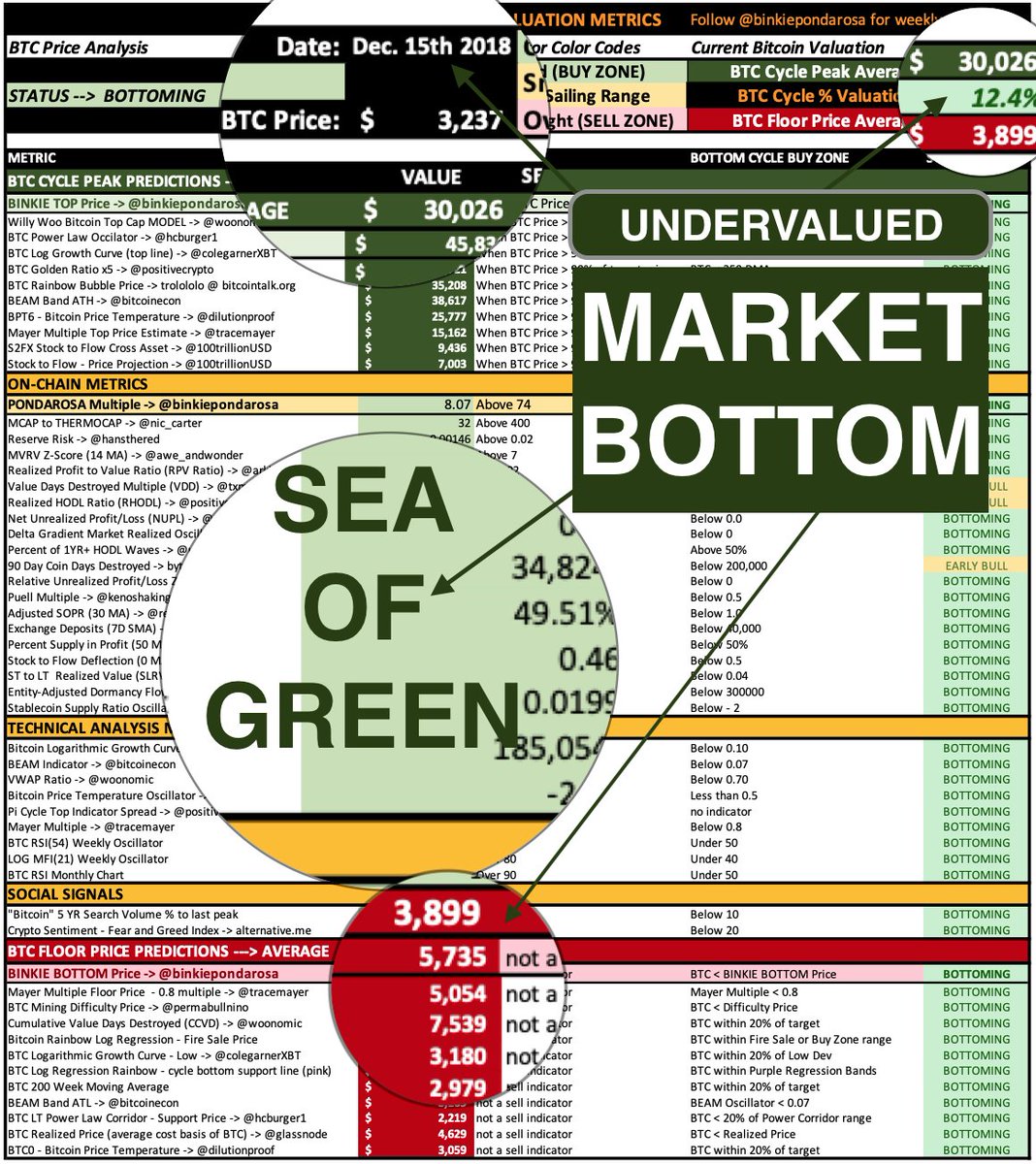

MARKET BOTTOMS - reveal themselves in the data:

-->🟩 Most indicators turn GREEN

-->🎯BTC price < price floor predictions

-->🪙Cycle Valuation % is < 30%

How the last cycle bottom looked:

3/5

-->🟩 Most indicators turn GREEN

-->🎯BTC price < price floor predictions

-->🪙Cycle Valuation % is < 30%

How the last cycle bottom looked:

3/5

MID CYCLES - also reveal themselves in the data:

-->🟨 Most indicators turn YELLOW

-->🎯BTC price between peak & floor predictions

-->🪙Cycle Valuation % is between 30-90%

How a mid cycle run looks:

4/5

-->🟨 Most indicators turn YELLOW

-->🎯BTC price between peak & floor predictions

-->🪙Cycle Valuation % is between 30-90%

How a mid cycle run looks:

4/5

Onchain data and analytics is the one edge we have over traditional market analysis.

🪙Let's use it to our advantage and fix the world in the process. Buy Bitcoin.

🙏Please Retweet so others don't get REKT.

5/5

🪙Let's use it to our advantage and fix the world in the process. Buy Bitcoin.

🙏Please Retweet so others don't get REKT.

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh