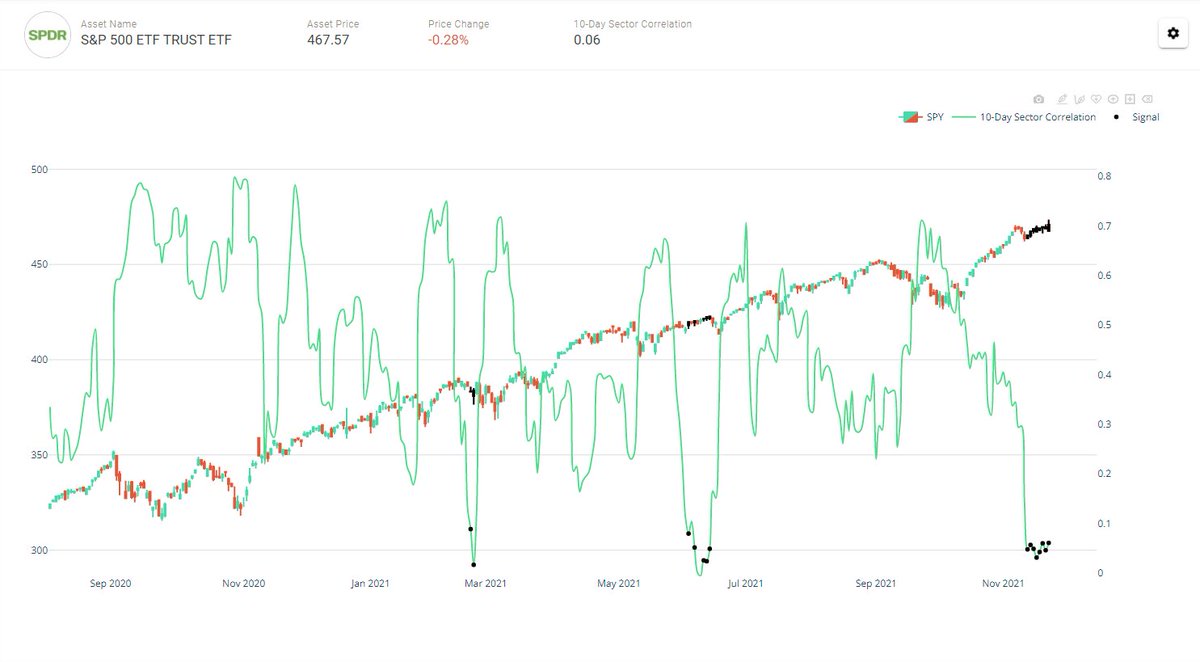

S&P500, $SPY short-term (10-day) Sector Correlations are ultra low closing at .06. In 2021 this condition has preceded sell-offs.

Minor-sell offs that is. Black candles highlight days when the short-term #correlation was between 0 and .1.

There have been two persistent periods of low-correlation amongst S&P500 sectors those were 2000/2001 and 2017 -- in 2000/2001 it was unfavorable for the index and in 2017 favorable...

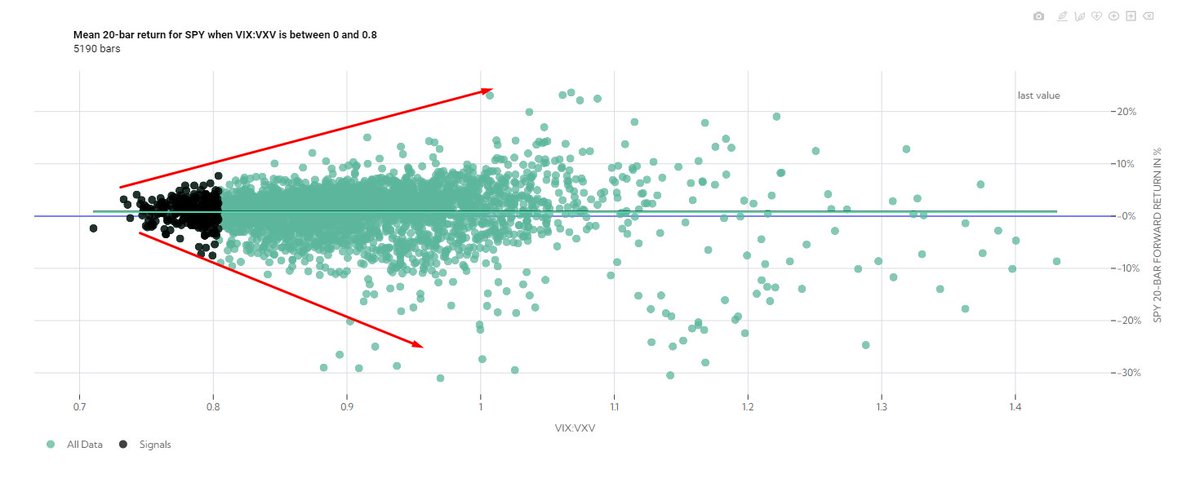

Across all data, the mean return has been negative for mean returns of -1.65%.

Across all data, the mean return has been negative for mean returns of -1.65%.

The evidence that suggests it might be foreshadowing short-term turbulence. $VIX has remain elevated trading 10 pts above realized volatility (black dots) despite the index taking a nap -- and yet it has not materially spiked.

Black dots highlighted a spread of 10pts or higher

Black dots highlighted a spread of 10pts or higher

It has been high both before the minor sell offs of 2021, and at the bottoms.

The blue line shows the 1 week rate of change of the spread, it's not really gone anywhere, closing at 2 points as of Friday the 19th.

The blue line shows the 1 week rate of change of the spread, it's not really gone anywhere, closing at 2 points as of Friday the 19th.

Likewise you can see that that by applying a 50 day percentage rank to that spread (90pct to 100pct filtered in black dots), it has been high at both tops and bottoms.

And the periodic reminder until I get ATM vol.

https://twitter.com/HalfersPower/status/1429163569099141126?s=20

Thanks and I hope you found this thread useful. If you did please give it a like and retweet.

All this data can be tracked and backtested on. tradewell.app

All this data can be tracked and backtested on. tradewell.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh