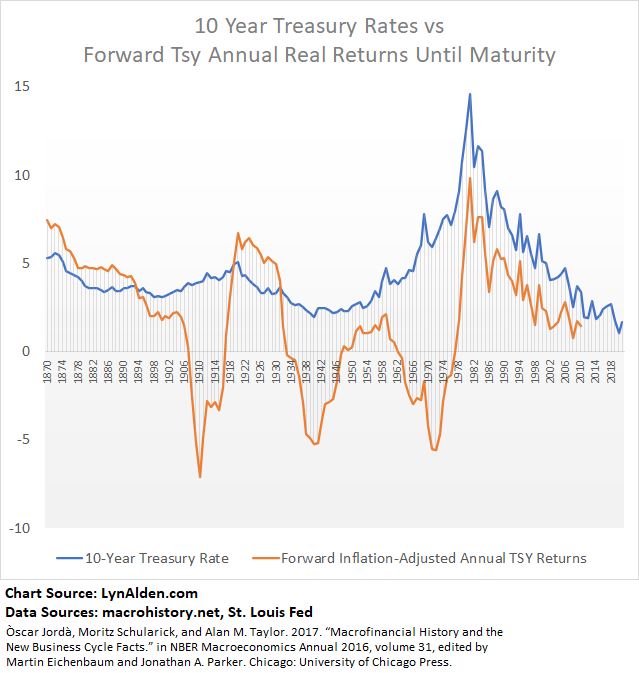

Blue line is 10-year Treasury yields. Orange line is the annualized inflation-adjusted "real" rate of return if you bought a 10-year Treasury note that year and held it until maturity.

Bonds got killed on a real basis in all three inflationary decades (1910s, 1940s, 1970s).

Bonds got killed on a real basis in all three inflationary decades (1910s, 1940s, 1970s).

If you compound -4% annual inflation-adjusted returns over a decade, you lose a third of your purchasing power on consumer goods by the end of the period.

And during that period, you probably lose more than that in terms of your purchasing power of prime capital goods.

And during that period, you probably lose more than that in terms of your purchasing power of prime capital goods.

So the bond market is "smart money" in that it does a good job of grasping tactical acceleration/deceleration moves, but isn't smart enough to avoid 30-40% losses of purchasing power over the course of a decade on three separate occasions.

So we get big disconnects sometimes:

So we get big disconnects sometimes:

Every country that goes over 90-100% debt/GDP or so ends up with the central bank owning an increasing share of the country's sovereign debt.

The signal on those yields, at least in terms of overall magnitude, ends up telling us little about long-term forward inflation.

The signal on those yields, at least in terms of overall magnitude, ends up telling us little about long-term forward inflation.

Blue line is nominal GDP growth. Red line is 10-year Treasury yield.

Green line is their difference: 10-year yields minus nominal GDP growth.

Being overweight bonds when they don't compete with nominal GDP growth (which includes inflation), generally doesn't work out well.

Green line is their difference: 10-year yields minus nominal GDP growth.

Being overweight bonds when they don't compete with nominal GDP growth (which includes inflation), generally doesn't work out well.

The tactical attractiveness of bonds of course depends on timelines; there are always trading opportunities.

But it's a question of where to store capital if you don't want to trade actively and don't want it to lose purchasing power over a 5-to-10 year period.

But it's a question of where to store capital if you don't want to trade actively and don't want it to lose purchasing power over a 5-to-10 year period.

• • •

Missing some Tweet in this thread? You can try to

force a refresh