Concentrated liquidity in Uniswap V3 has usually been considered as a net positive innovation. It's definitely good for traders, arbitrageurs and parasitic MEV wizards. But is it good for LPs? According to a recent study, half of LPs are actually losing money!

See more: 🧵👇

See more: 🧵👇

TL;DR:

- While Uni V3 generates the highest trading fees of any DeFi protocol, impermanent loss dominates the fee income in most pools, leaving a net loss for liquidity providers.

- Half of liquidity providers in Uni V3 get negative returns when compared to HODLing.

- While Uni V3 generates the highest trading fees of any DeFi protocol, impermanent loss dominates the fee income in most pools, leaving a net loss for liquidity providers.

- Half of liquidity providers in Uni V3 get negative returns when compared to HODLing.

1)

The study I'm referring to in this thread is the most in-depth analysis of LPing in Uni V3 I've seen so far. Other publications usually focus on capital efficiency and LP fees but they ignore the cost of LPing, i.e. impermanent loss. This one doesn't.

The study I'm referring to in this thread is the most in-depth analysis of LPing in Uni V3 I've seen so far. Other publications usually focus on capital efficiency and LP fees but they ignore the cost of LPing, i.e. impermanent loss. This one doesn't.

https://twitter.com/odtorson/status/1463126535955750925

2)

Before we start, a short reminder what impermanent loss (IL) is.

Imagine you have assets X and Y. In one universe you provide liquidity to an AMM, in another universe you decide to hodl. The difference in value between the positions in these universes is called IL.

Before we start, a short reminder what impermanent loss (IL) is.

Imagine you have assets X and Y. In one universe you provide liquidity to an AMM, in another universe you decide to hodl. The difference in value between the positions in these universes is called IL.

3)

This difference comes from the fact that an AMM always sells the outperforming asset and buys the underperforming asset. When ETH rallies, ETH-USDC pool is selling ETH for USDC on the way up. AMMs simply have paper hands.

This difference comes from the fact that an AMM always sells the outperforming asset and buys the underperforming asset. When ETH rallies, ETH-USDC pool is selling ETH for USDC on the way up. AMMs simply have paper hands.

4)

Selling the outperforming asset and buying the underperforming asset is the rule that applies for all types of AMMs, be it a constant function AMM (CFAMM, e.g. Bancor or Uni V2) or a concentrated liquidity AMM (e.g. Uni V3). In other words, all AMMs incur IL.

Selling the outperforming asset and buying the underperforming asset is the rule that applies for all types of AMMs, be it a constant function AMM (CFAMM, e.g. Bancor or Uni V2) or a concentrated liquidity AMM (e.g. Uni V3). In other words, all AMMs incur IL.

5)

However, the impact of IL is different between CFAMM and Uni V3. Concentrated liquidity means that the outperforming asset is sold much faster than in a CFAMM to the extent that when the price goes beyond the LP's range, an LP is left with 100% of the underperforming token.

However, the impact of IL is different between CFAMM and Uni V3. Concentrated liquidity means that the outperforming asset is sold much faster than in a CFAMM to the extent that when the price goes beyond the LP's range, an LP is left with 100% of the underperforming token.

6)

So if you are an LP for ETH-USDC in Uni V3 and the ETH price goes above your range, there is no ETH left in your position. You sold ETH for USDC and no longer benefit from ETH appreciation. The IL you incur is much higher than in a CFAMM which always holds 50:50 ETH and USDC.

So if you are an LP for ETH-USDC in Uni V3 and the ETH price goes above your range, there is no ETH left in your position. You sold ETH for USDC and no longer benefit from ETH appreciation. The IL you incur is much higher than in a CFAMM which always holds 50:50 ETH and USDC.

7)

In other words, concentrated liquidity amplifies IL. And that's why analysing Uni v3 with IL focus is so interesting.

💡If you still find it confusing why concentrated liquidity increases the risk of IL, I made a long thread about it with nice visuals:

In other words, concentrated liquidity amplifies IL. And that's why analysing Uni v3 with IL focus is so interesting.

💡If you still find it confusing why concentrated liquidity increases the risk of IL, I made a long thread about it with nice visuals:

https://twitter.com/korpi87/status/1400963737578782724

8)

The Uni V3 study analyzed pools narrowed down by size (excl. pools with less than $10M TVL), data availability and pool composition (excl. like-kind pools like renBTC/WBTC and USDC/DAI). This led to 17 pools accounting for 43% of Uni V3's TVL at the time of the study.

The Uni V3 study analyzed pools narrowed down by size (excl. pools with less than $10M TVL), data availability and pool composition (excl. like-kind pools like renBTC/WBTC and USDC/DAI). This led to 17 pools accounting for 43% of Uni V3's TVL at the time of the study.

9)

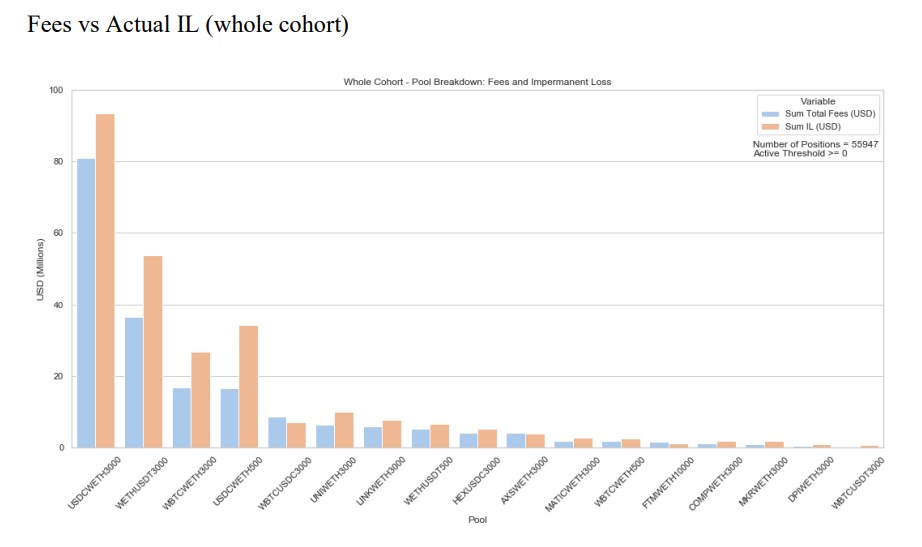

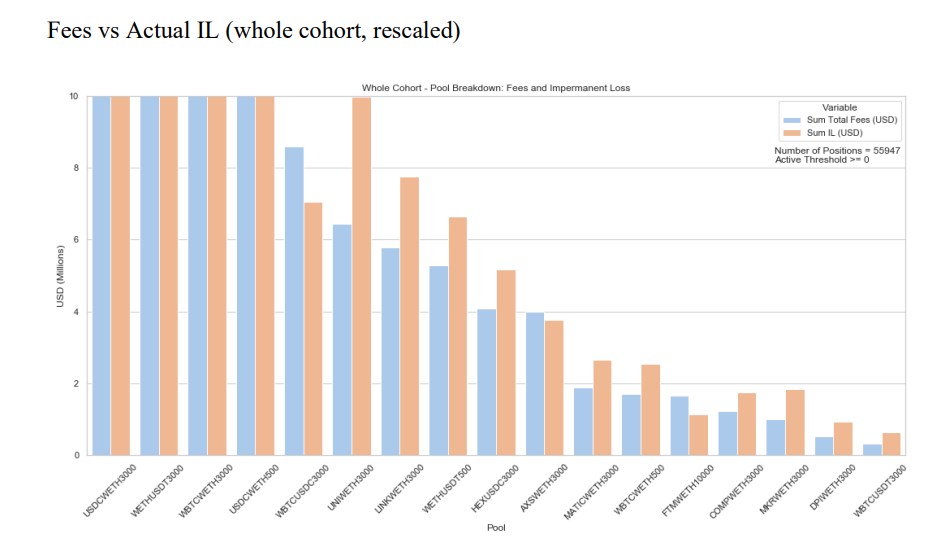

In the analyzed period (05.05 - 20.09) the pools generated an impressive $108.5B in trading volume and $199M in fee income. However, they also incurred over $260M in IL, leaving a net loss of over $60M. Despite high fee income, the protocol on average did worse than HODL.

In the analyzed period (05.05 - 20.09) the pools generated an impressive $108.5B in trading volume and $199M in fee income. However, they also incurred over $260M in IL, leaving a net loss of over $60M. Despite high fee income, the protocol on average did worse than HODL.

10)

For example, LPs in USDC/ETH pool with 0.3% fee (USDCWETH3000) earned $80M in fees but also incurred $90M in IL. It means they would have made $90M if they had just HODLd instead of LPing. High fees didn't compensate for IL and they were $10M worse off than HODLing.

For example, LPs in USDC/ETH pool with 0.3% fee (USDCWETH3000) earned $80M in fees but also incurred $90M in IL. It means they would have made $90M if they had just HODLd instead of LPing. High fees didn't compensate for IL and they were $10M worse off than HODLing.

11)

Out of all the analyzed pools only three have fees (modestly) higher than IL: $WBTC/USDC $AXS/ETH and $FTM/ETH. In the remaining pools, LPs, on average, lose money - they would do better by HODLing.

To be precise, almost half (49.5%) of LPs had negative returns!

Out of all the analyzed pools only three have fees (modestly) higher than IL: $WBTC/USDC $AXS/ETH and $FTM/ETH. In the remaining pools, LPs, on average, lose money - they would do better by HODLing.

To be precise, almost half (49.5%) of LPs had negative returns!

12)

In some pools the percentage of "losers" (🟥), i.e. LPs with negative returns, was even above 60%: $MKR/ETH (74%), $UNI/ETH (64%). On the low end, in the $FTM/ETH, "only" 34% of LPs had negative returns. Percentage of "losers" was generally between 40-60% per pool.

In some pools the percentage of "losers" (🟥), i.e. LPs with negative returns, was even above 60%: $MKR/ETH (74%), $UNI/ETH (64%). On the low end, in the $FTM/ETH, "only" 34% of LPs had negative returns. Percentage of "losers" was generally between 40-60% per pool.

13)

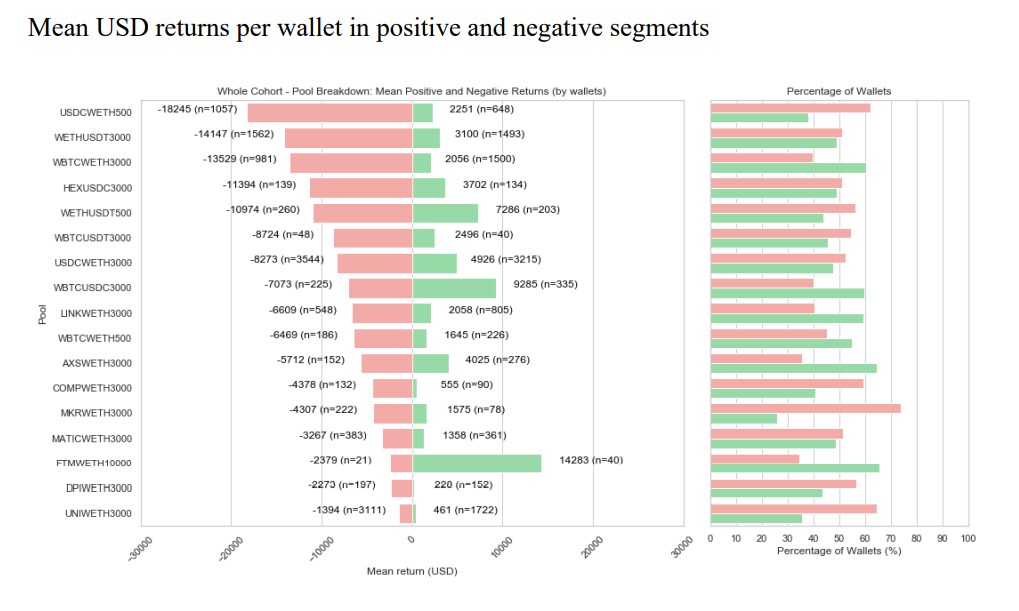

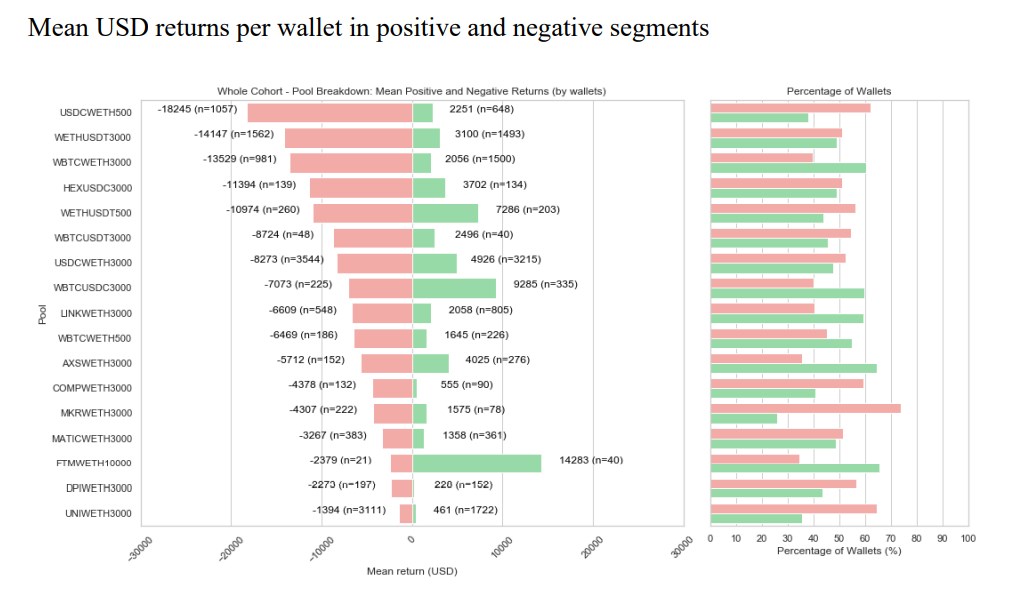

The below graph shows the mean returns for "winners" and "losers" in each pool. For example, in USDC/ETH pool with 0.05% fee (USDCWETH500), 62% of LPs lost money, with a mean return of -$18.2k, whereas 38% of LPs earned money, with a mean return of $2.2k.

The below graph shows the mean returns for "winners" and "losers" in each pool. For example, in USDC/ETH pool with 0.05% fee (USDCWETH500), 62% of LPs lost money, with a mean return of -$18.2k, whereas 38% of LPs earned money, with a mean return of $2.2k.

14)

One can notice that the red bars tend to be longer than the green bars, so the

average loss is bigger than the average gain which is consistent with the average LP losing

money. The one outlier here is $FTM/ETH pool where average gain is much higher than average loss.

One can notice that the red bars tend to be longer than the green bars, so the

average loss is bigger than the average gain which is consistent with the average LP losing

money. The one outlier here is $FTM/ETH pool where average gain is much higher than average loss.

15)

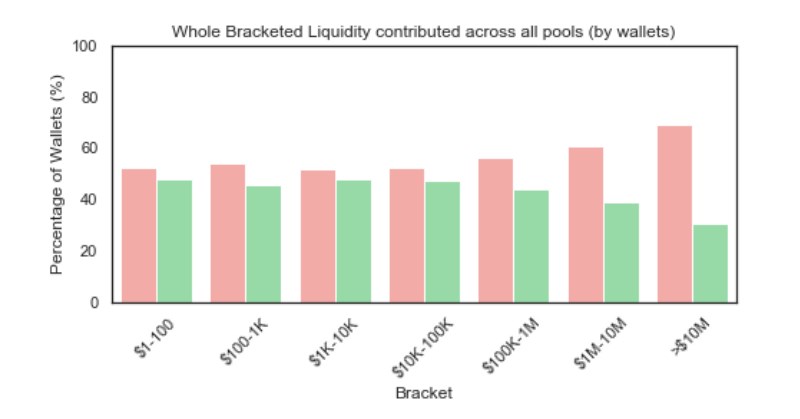

There is an interesting observation when LPs are segmented by the amount of capital contributed: not only are there more "losers" than "winners" in each group but also the percentage of "losers" grows with the size of the capital contributed (more "losers" within large LPs).

There is an interesting observation when LPs are segmented by the amount of capital contributed: not only are there more "losers" than "winners" in each group but also the percentage of "losers" grows with the size of the capital contributed (more "losers" within large LPs).

16)

In other words, large LPs are less successful than small LPs!

Who are "winners" then? How do they differentiate from "losers"? The authors of the study tried to find out if "active" LPs, who adjust their positions more frequently, performed better than "passive" LPs.

In other words, large LPs are less successful than small LPs!

Who are "winners" then? How do they differentiate from "losers"? The authors of the study tried to find out if "active" LPs, who adjust their positions more frequently, performed better than "passive" LPs.

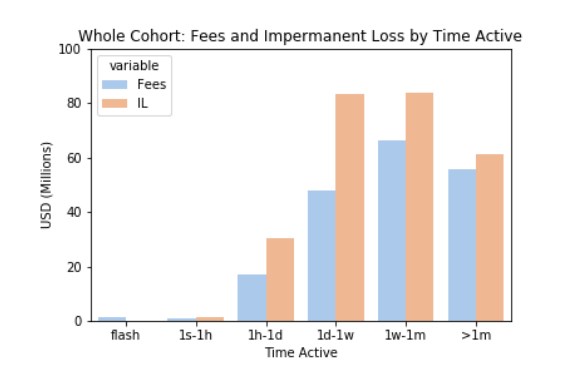

17)

To do so, the profitability of LP positions was broken down by duration. The assumption was that shorter-term positions belong to more active LPs. The outcome is quite surprising. Across all groups, IL outpaced fees - positions underperformed HODLing regardless of duration.

To do so, the profitability of LP positions was broken down by duration. The assumption was that shorter-term positions belong to more active LPs. The outcome is quite surprising. Across all groups, IL outpaced fees - positions underperformed HODLing regardless of duration.

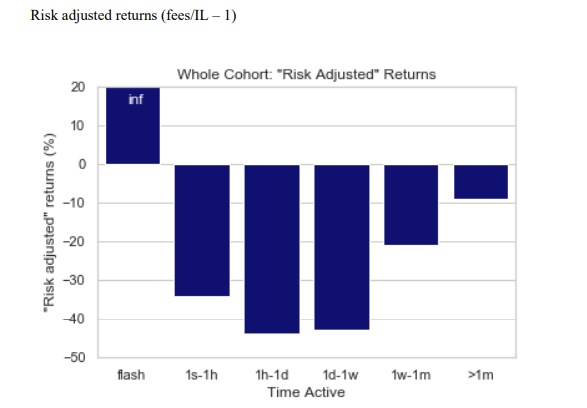

18)

By calculating Fees/IL-1 we get the return for the various durations. Positive numbers = positions outperformed HODLing, negative = underperformed HODLing. Only flash positions (bots LPing for a single block to absorb fees from upcoming trades) made money vs HODLing.

By calculating Fees/IL-1 we get the return for the various durations. Positive numbers = positions outperformed HODLing, negative = underperformed HODLing. Only flash positions (bots LPing for a single block to absorb fees from upcoming trades) made money vs HODLing.

19)

The existence of just-in-time LPs is very alarming. These bots steal profits from legit LPs by adding and removing liquidity in one block to capture the fees from sandwiched trades. They incur minimum IL and get maximum upside by sponging on other LPs.

The existence of just-in-time LPs is very alarming. These bots steal profits from legit LPs by adding and removing liquidity in one block to capture the fees from sandwiched trades. They incur minimum IL and get maximum upside by sponging on other LPs.

https://twitter.com/ChainsightA/status/1458537399160614912?s=20

20)

The main conclusion from the study is that an average LP in Uni v3 loses money vs a simple buy-and-hold strategy. There are LPs who outperform HODLing but this research didn't identify a clear segment of "winners". The protocol as a whole on average does worse than HODL.

The main conclusion from the study is that an average LP in Uni v3 loses money vs a simple buy-and-hold strategy. There are LPs who outperform HODLing but this research didn't identify a clear segment of "winners". The protocol as a whole on average does worse than HODL.

21)

Capital efficiency in Uni V3 is not a magical superior solution that outshines competitive approaches as a lot of advocates seem to suggest. There is no free lunch. Concentrated liquidity is a trade-off between profitability of traders and LPs.

Capital efficiency in Uni V3 is not a magical superior solution that outshines competitive approaches as a lot of advocates seem to suggest. There is no free lunch. Concentrated liquidity is a trade-off between profitability of traders and LPs.

https://twitter.com/haydenzadams/status/1374795493155483649

22)

LPs who don't want to gamble with their chances of being one of the "winners" in Uni V3 may be interested in an AMM that fully protects them from IL. It's @Bancor. Single-asset staking allows them to maintain an exposure to their preferred asset only and earn fees IL-free.

LPs who don't want to gamble with their chances of being one of the "winners" in Uni V3 may be interested in an AMM that fully protects them from IL. It's @Bancor. Single-asset staking allows them to maintain an exposure to their preferred asset only and earn fees IL-free.

23)

High gas fees on Ethereum has made Bancor V2.1 very expensive to use but this is soon going to change. Bancor V3 is around the corner with new, less gas-intensive smart contracts, the code ready to be deployed to other chains and many other features improving user experience.

High gas fees on Ethereum has made Bancor V2.1 very expensive to use but this is soon going to change. Bancor V3 is around the corner with new, less gas-intensive smart contracts, the code ready to be deployed to other chains and many other features improving user experience.

24)

I don't have any doubts that Bancor V3 will be 🔥. Bancor V2.1 was already ahead of its time by introducing the concept of PCV (protocol-controlled value) in a form of protocol-owned $BNT long before it was popularized by other projects like $OHM.

I don't have any doubts that Bancor V3 will be 🔥. Bancor V2.1 was already ahead of its time by introducing the concept of PCV (protocol-controlled value) in a form of protocol-owned $BNT long before it was popularized by other projects like $OHM.

https://twitter.com/korpi87/status/1405847206779838467

25)

When more users realise high fee APRs in IL-exposed pools don't guarantee attractive yields on their assets when IL is taken into account, they will turn to @Bancor. It's already a superior solution for LPs and I'm sure it will be even better in V3.

When more users realise high fee APRs in IL-exposed pools don't guarantee attractive yields on their assets when IL is taken into account, they will turn to @Bancor. It's already a superior solution for LPs and I'm sure it will be even better in V3.

https://twitter.com/korpi87/status/1409449809283530753

Appendix 1)

Critics of the study point out that not all the Uni V3 positions should be included in the analysis. Some of them may represent range orders - positions used to buy/sell a token in a chosen price range while earning fees during their execution.

Critics of the study point out that not all the Uni V3 positions should be included in the analysis. Some of them may represent range orders - positions used to buy/sell a token in a chosen price range while earning fees during their execution.

https://twitter.com/haydenzadams/status/1383154978680942592

Appendix 2)

While I agree that users setting up range orders are not LPs but traders and, therefore, aren't really subject to IL, I also understand the problem study authors faced. How can you separate traders setting range orders from LPs if they only differ in intentions?

While I agree that users setting up range orders are not LPs but traders and, therefore, aren't really subject to IL, I also understand the problem study authors faced. How can you separate traders setting range orders from LPs if they only differ in intentions?

Appendix 3)

Assuming positions that start with a single token always represent range orders is a big oversimplification. Even if this rule was applied, excluding some positions from the study based on arbitrary criteria could lead to the "cherry-picking" accusations.

Assuming positions that start with a single token always represent range orders is a big oversimplification. Even if this rule was applied, excluding some positions from the study based on arbitrary criteria could lead to the "cherry-picking" accusations.

Appendix 4)

Imo, it's better to start with the analysis of the whole data set as the authors did. If there is a consensus on how to narrow down the data set to make it less "controversial", the numbers can be re-ran and conclusions re-tested.

Imo, it's better to start with the analysis of the whole data set as the authors did. If there is a consensus on how to narrow down the data set to make it less "controversial", the numbers can be re-ran and conclusions re-tested.

• • •

Missing some Tweet in this thread? You can try to

force a refresh