Being a liquidity provider for tokens that shoot up in price is a pain. You want to respect the pump but you can't because you are getting rekt by "impermanent" loss. Just look at this LP for $AXS-ETH. Rekt.

It doesn't have to be this way. Check out how! 🧵👇

It doesn't have to be this way. Check out how! 🧵👇

1)

Have you been there?

You buy a token that you think will rally like $AXS or $MATIC. You have conviction and patience to hodl. To earn some "passive income" while waiting, you deposit this token to AMM. The pump finally comes and you realize you got rekt by impermanent loss...

Have you been there?

You buy a token that you think will rally like $AXS or $MATIC. You have conviction and patience to hodl. To earn some "passive income" while waiting, you deposit this token to AMM. The pump finally comes and you realize you got rekt by impermanent loss...

2)

The above story describes the experience of many novice liquidity providers (LPs). The promise of easy "passive income" in the form of liquidity mining (LM) rewards or AMM trading fees encouraged LPs to match their token with ETH or a stablecoin and deposit them into an AMM.

The above story describes the experience of many novice liquidity providers (LPs). The promise of easy "passive income" in the form of liquidity mining (LM) rewards or AMM trading fees encouraged LPs to match their token with ETH or a stablecoin and deposit them into an AMM.

3)

They either were completely unaware of impermanent loss (IL) or thought it wasn't a big deal:

- "It's impermanent."

- "It's only a 6% loss when my token outperforms the other token from the pair by 2x while I earn double digit APR."

- "It's usually very low."

OK. Let's see.

They either were completely unaware of impermanent loss (IL) or thought it wasn't a big deal:

- "It's impermanent."

- "It's only a 6% loss when my token outperforms the other token from the pair by 2x while I earn double digit APR."

- "It's usually very low."

OK. Let's see.

4)

I hope you noticed that the statements in the above tweet are NOT incorrect. If not, let's get familiar with my full thread on IL:

IL can be impermanent (equal to 0) or very low but it only happens if you somehow fail as a good investor.

I hope you noticed that the statements in the above tweet are NOT incorrect. If not, let's get familiar with my full thread on IL:

https://twitter.com/korpi87/status/1372634330451836929

IL can be impermanent (equal to 0) or very low but it only happens if you somehow fail as a good investor.

5)

A good investor outperforms the market. If your token doesn't outperform a benchmark (ETH), it's not a great investment. Why waste time on research and accept extra risk that a project fails or gets exploited if holding ETH can bear comparable or better results?

A good investor outperforms the market. If your token doesn't outperform a benchmark (ETH), it's not a great investment. Why waste time on research and accept extra risk that a project fails or gets exploited if holding ETH can bear comparable or better results?

6)

If a token outperforms ETH, it means that LPing with that token will incur IL. IL is positively correlated with the divergence between the prices of tokens in a pool. The bigger the winner (vs ETH) you picked, the more IL you experience.

$AXS:

If a token outperforms ETH, it means that LPing with that token will incur IL. IL is positively correlated with the divergence between the prices of tokens in a pool. The bigger the winner (vs ETH) you picked, the more IL you experience.

https://twitter.com/korpi87/status/1409449821749006341

$AXS:

7)

No IL means your token performed the same as the other token in the pool. It's not a bad scenario though. You may not have picked a winner but you have earned trading fees on your holdings. Whether they compensate for the risk taken is a very subjective matter.

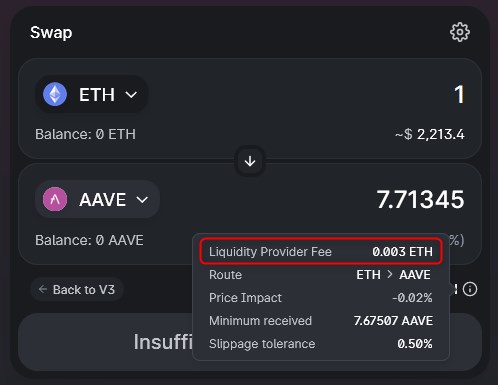

$AAVE:

No IL means your token performed the same as the other token in the pool. It's not a bad scenario though. You may not have picked a winner but you have earned trading fees on your holdings. Whether they compensate for the risk taken is a very subjective matter.

$AAVE:

8)

There is a third scenario too. It's picking a loser - a token that underperformed ETH. In this case, not only did you underperform a market but also, due to IL, ended with less money than you'd have by just holding your loser and ETH (unless LM rewards offset IL).

$BONDLY:

There is a third scenario too. It's picking a loser - a token that underperformed ETH. In this case, not only did you underperform a market but also, due to IL, ended with less money than you'd have by just holding your loser and ETH (unless LM rewards offset IL).

$BONDLY:

9)

There are 3 scenarios for LPs:

1. LPing with a winner = big IL

2. LPing with a mediocre = low IL

3. LPing with a loser = big IL

Of course, LPs don't know how their token (TKN) will perform. But let's assume we know the future. What would be the best strategies then?

There are 3 scenarios for LPs:

1. LPing with a winner = big IL

2. LPing with a mediocre = low IL

3. LPing with a loser = big IL

Of course, LPs don't know how their token (TKN) will perform. But let's assume we know the future. What would be the best strategies then?

10)

1. TKN is a winner - buy & hold (long)

2. TKN is a mediocre - buy & LP / borrow & LP

3. TKN is a loser - borrow & sell (short)

Conclusion: if you expect your token to be a winner, don't provide liquidity to an AMM. It's usually better to just hold. Unless…

1. TKN is a winner - buy & hold (long)

2. TKN is a mediocre - buy & LP / borrow & LP

3. TKN is a loser - borrow & sell (short)

Conclusion: if you expect your token to be a winner, don't provide liquidity to an AMM. It's usually better to just hold. Unless…

11)

Unless there is an AMM which protects you from IL and allows you to have full exposure to a single token only.

There is. It's @Bancor.

When you deposit TKN into Bancor, you are NOT exposed to both assets in the pool like in other AMMs. You still hold a long position on TKN.

Unless there is an AMM which protects you from IL and allows you to have full exposure to a single token only.

There is. It's @Bancor.

When you deposit TKN into Bancor, you are NOT exposed to both assets in the pool like in other AMMs. You still hold a long position on TKN.

12)

If TKN moons, you don't lose due to IL. Bancor has invented and implemented a novel mechanism to distribute the risk of IL across a wide array of pools in order to completely eliminate this risk for LPs. Think of Bancor as an insurance company.

If TKN moons, you don't lose due to IL. Bancor has invented and implemented a novel mechanism to distribute the risk of IL across a wide array of pools in order to completely eliminate this risk for LPs. Think of Bancor as an insurance company.

https://twitter.com/NateHindman/status/1409506456248930313

13)

IL-protection is a killer feature for token holders seeking yield. Let's use $AXS as an example:

- Left graph: IL-exposed pool on Sushiswap

- Right graph: IL-protected pool on Bancor

In 109 days LPs on Sushiswap lost 25% vs holding (🟩) while LPs on Bancor earned 2.2% (🟨).

IL-protection is a killer feature for token holders seeking yield. Let's use $AXS as an example:

- Left graph: IL-exposed pool on Sushiswap

- Right graph: IL-protected pool on Bancor

In 109 days LPs on Sushiswap lost 25% vs holding (🟩) while LPs on Bancor earned 2.2% (🟨).

14)

2.2% in 109 days is 7.5% APR. It may not look impressive at first glance but it's real, risk-minimized passive income on your holdings. High APRs in IL-exposed pools are often very misleading and can disguise negative net APR when IL is accounted for.

2.2% in 109 days is 7.5% APR. It may not look impressive at first glance but it's real, risk-minimized passive income on your holdings. High APRs in IL-exposed pools are often very misleading and can disguise negative net APR when IL is accounted for.

https://twitter.com/korpi87/status/1410555717141024768

15)

I also strongly believe that APRs on Bancor have a huge potential to grow. Revenues for LPs come from trading fees, so the higher Volume to Liquidity ratio (V/L), the higher the APRs. Liquidity is already very deep on many pairs but volume is still not as high as it could be.

I also strongly believe that APRs on Bancor have a huge potential to grow. Revenues for LPs come from trading fees, so the higher Volume to Liquidity ratio (V/L), the higher the APRs. Liquidity is already very deep on many pairs but volume is still not as high as it could be.

16)

Take $FARM as an example. Bancor has substantially deeper liquidity than Uniswap v2 and should capture the great majority of the total volume due to better rates. Yet many buyers still go to Uniswap and unconsciously accept worse prices.

Take $FARM as an example. Bancor has substantially deeper liquidity than Uniswap v2 and should capture the great majority of the total volume due to better rates. Yet many buyers still go to Uniswap and unconsciously accept worse prices.

https://twitter.com/korpi87/status/1426267365252206598

17)

If all $FARM trades were done on aggregators like 1inch, Bancor would be an unquestionable leader in terms of volume. The fact that Uniswap still has higher V/L than Bancor is an example of market inefficiency probably caused by brand awareness.

If all $FARM trades were done on aggregators like 1inch, Bancor would be an unquestionable leader in terms of volume. The fact that Uniswap still has higher V/L than Bancor is an example of market inefficiency probably caused by brand awareness.

https://twitter.com/korpi87/status/1426267385451929604

18)

I believe that the market won't stay inefficient for a long period. Because Bancor offers a superior product for passive LPs, more and more DeFi users discover the benefits of the protocol. But to enjoy higher passive yield, Bancor also needs DEX traders to become more aware.

I believe that the market won't stay inefficient for a long period. Because Bancor offers a superior product for passive LPs, more and more DeFi users discover the benefits of the protocol. But to enjoy higher passive yield, Bancor also needs DEX traders to become more aware.

19)

If you are an LP on Bancor, it's in your own interest to spread the news about the protocol to build stronger brand awareness and attract more traders. Tell other DeFi users to compare rates between DEXes or use aggregators for their own good. Bancor will benefit too.

If you are an LP on Bancor, it's in your own interest to spread the news about the protocol to build stronger brand awareness and attract more traders. Tell other DeFi users to compare rates between DEXes or use aggregators for their own good. Bancor will benefit too.

20)

Do you know aggregators or wallets that don't have direct integration of Bancor swaps? Contact @Bancor and let them work on that. Direct integrations are essential since aggregators sometimes route trades to private market maker pools at worse rates.

Do you know aggregators or wallets that don't have direct integration of Bancor swaps? Contact @Bancor and let them work on that. Direct integrations are essential since aggregators sometimes route trades to private market maker pools at worse rates.

21)

If every DEX user on Ethereum made optimal decisions today, Bancor would have much higher volume. DEX traders would benefit from better rates and Bancor would generate higher passive yields for LPs. It's a net positive change and a step towards market efficiency.

If every DEX user on Ethereum made optimal decisions today, Bancor would have much higher volume. DEX traders would benefit from better rates and Bancor would generate higher passive yields for LPs. It's a net positive change and a step towards market efficiency.

22)

The combination of single-asset exposure and IL protection turns Bancor pools into interest-bearing accounts for token holders. It's the best product for LPs now but it will be even better when traders start making optimal decisions. And it's not all!

The combination of single-asset exposure and IL protection turns Bancor pools into interest-bearing accounts for token holders. It's the best product for LPs now but it will be even better when traders start making optimal decisions. And it's not all!

https://twitter.com/korpi87/status/1409449804703440897

23)

Bancor core contributors have indicated Bancor V3 will offer novel trading features aimed at attracting more volume and fees for LPs. Not many details have been released yet but judging by the level of innovation introduced in V2.1 I suppose V3 may be pure fire...

Bancor core contributors have indicated Bancor V3 will offer novel trading features aimed at attracting more volume and fees for LPs. Not many details have been released yet but judging by the level of innovation introduced in V2.1 I suppose V3 may be pure fire...

• • •

Missing some Tweet in this thread? You can try to

force a refresh