6 months ago I covered $OHM before the project officially launched. Investment of 570$ into Initial Discord Offering would be worth more than $1.5M now if staked all the time... Absolutely incredible.

Today I want to share a project which gives me similar vibes. Meet $TEMPLE.

Today I want to share a project which gives me similar vibes. Meet $TEMPLE.

1)

I must admit I had seen $TEMPLE being mentioned here and there many times but I was reluctant to research "another $OHM fork" as it was pitched to me. However, when I finally invested my time to go through Medium articles and Discord I understood it was a premature assessment.

I must admit I had seen $TEMPLE being mentioned here and there many times but I was reluctant to research "another $OHM fork" as it was pitched to me. However, when I finally invested my time to go through Medium articles and Discord I understood it was a premature assessment.

2)

First and foremost, I don't think @TempleDAO is a competitor to @OlympusDAO. $TEMPLE definitely borrows some ideas from $OHM but innovates on them to create a new set of products with a different objective.

Good comparison between Olympus and Temple:

First and foremost, I don't think @TempleDAO is a competitor to @OlympusDAO. $TEMPLE definitely borrows some ideas from $OHM but innovates on them to create a new set of products with a different objective.

Good comparison between Olympus and Temple:

https://twitter.com/ishaheen10/status/1426256807048073218

3)

The purpose of @TempleDAO is not to create an algorithmic currency but to build a safe place to shelter investors from market volatility. $TEMPLE is just the first product - it's the governance token with a design inspired by $OHM but it's not the end game.

The purpose of @TempleDAO is not to create an algorithmic currency but to build a safe place to shelter investors from market volatility. $TEMPLE is just the first product - it's the governance token with a design inspired by $OHM but it's not the end game.

4)

@TempleDAO's roadmap leaks they want to build the next generation of DeFi investing. Instead of actively managing your portfolio, you will be able to choose an investment pool that fits your risk preference and uses automated trading strategies to grow your portfolio.

@TempleDAO's roadmap leaks they want to build the next generation of DeFi investing. Instead of actively managing your portfolio, you will be able to choose an investment pool that fits your risk preference and uses automated trading strategies to grow your portfolio.

5)

In other words, a future set of products from @TempleDAO turns it into a community owned, decentralized investment fund which offers sophisticated strategies transparently packed into easy-to-use staking pools.

Check roadmap for more details: templedao.medium.com/temple-roadmap…

In other words, a future set of products from @TempleDAO turns it into a community owned, decentralized investment fund which offers sophisticated strategies transparently packed into easy-to-use staking pools.

Check roadmap for more details: templedao.medium.com/temple-roadmap…

6)

Back to $TEMPLE. This is the first product from @TempleDAO which is also a governance token. Unlike many other "worthless governance tokens" we have seen so far, $TEMPLE has very unique mechanics that protect it from unhealthy volatility while delivering yield to stakers.

Back to $TEMPLE. This is the first product from @TempleDAO which is also a governance token. Unlike many other "worthless governance tokens" we have seen so far, $TEMPLE has very unique mechanics that protect it from unhealthy volatility while delivering yield to stakers.

7)

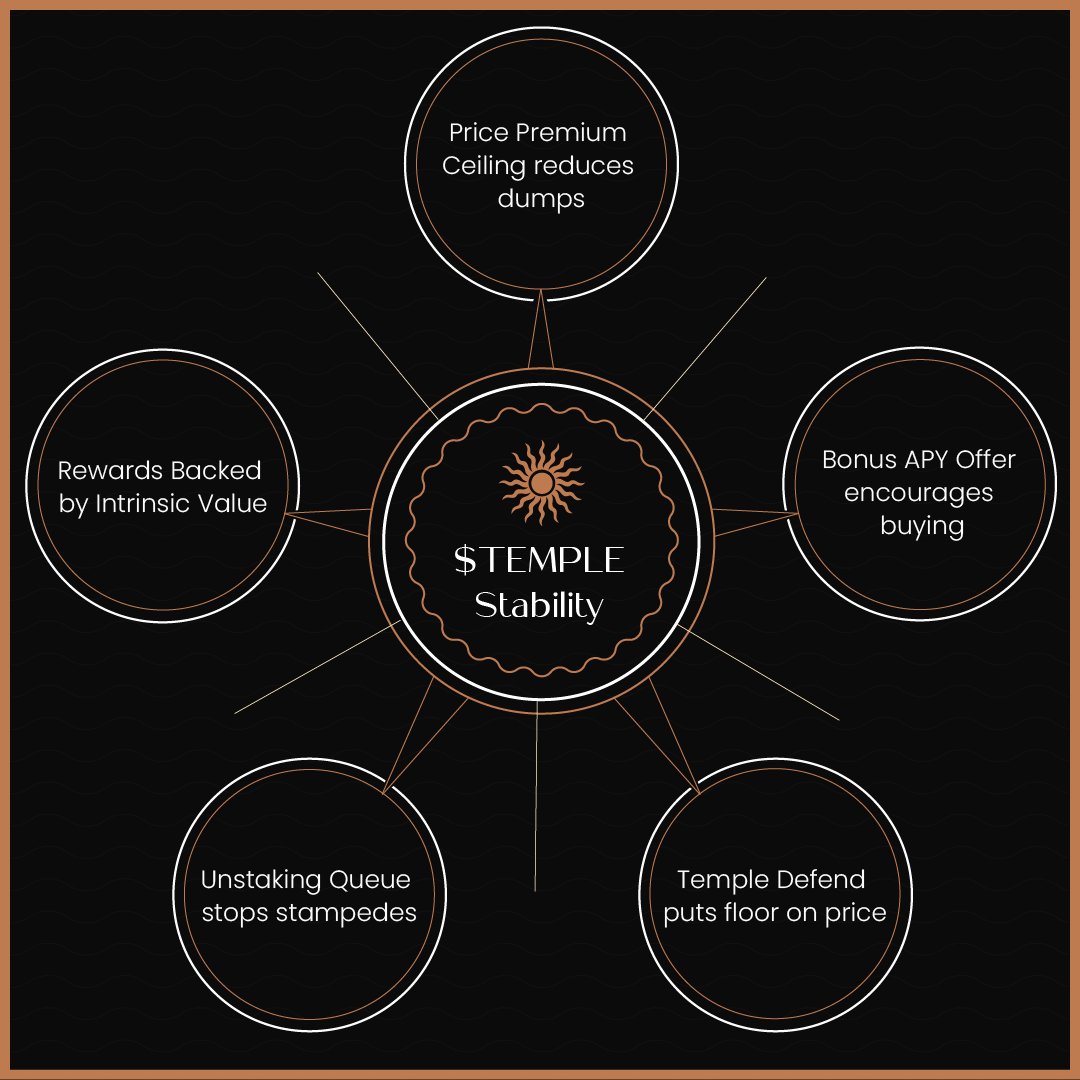

There are 5 pillars to stabilise the protocol:

1. Rewards Backed by Intrinsic Value

2. Price Premium Ceiling reduces dumps

3. Bonus APY Offer encourages buying

4. Unstaking Queue stops stampedes

5. Temple Defend puts floor on price

Let's shortly explain what they mean.

There are 5 pillars to stabilise the protocol:

1. Rewards Backed by Intrinsic Value

2. Price Premium Ceiling reduces dumps

3. Bonus APY Offer encourages buying

4. Unstaking Queue stops stampedes

5. Temple Defend puts floor on price

Let's shortly explain what they mean.

8)

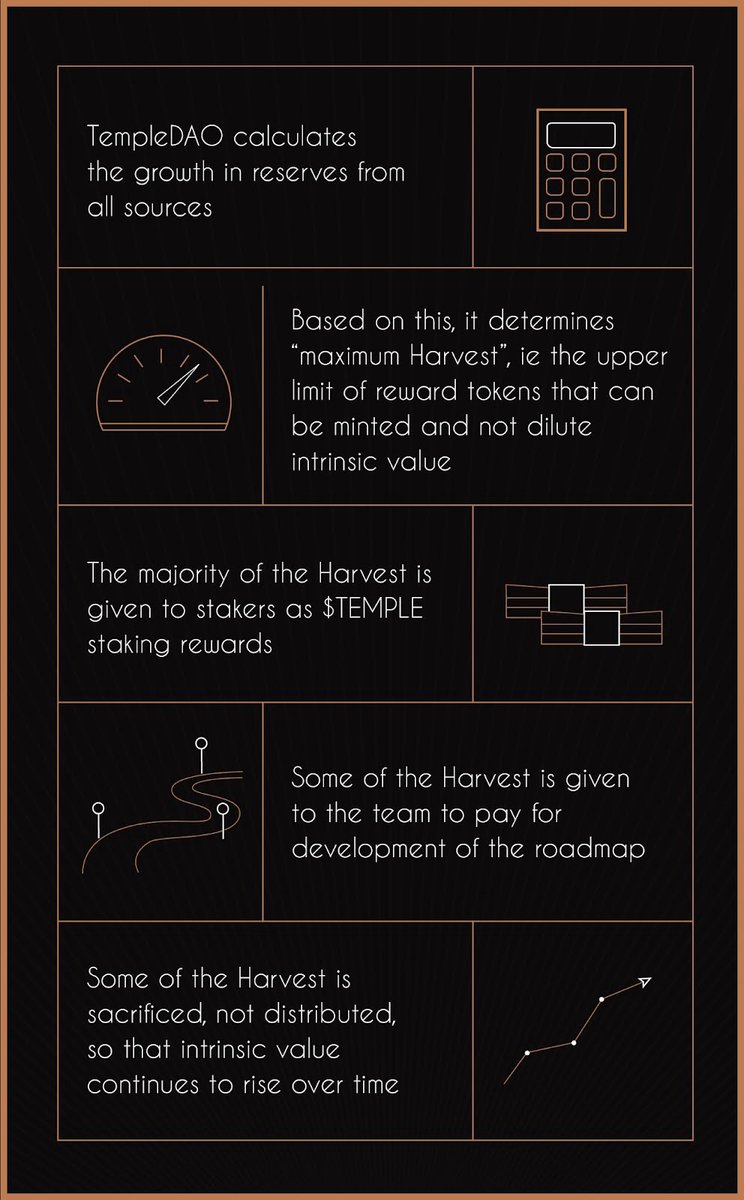

1. Rewards Backed by Intrinsic Value

Intrinsic Value (IV) represents the backing of $TEMPLE. If there are 50 $TEMPLE tokens and $100 in the treasury, Intrinsic Value is $100/50=$2 per token. It's very similar to Risk Free Value per $OHM and represents an objective floor price.

1. Rewards Backed by Intrinsic Value

Intrinsic Value (IV) represents the backing of $TEMPLE. If there are 50 $TEMPLE tokens and $100 in the treasury, Intrinsic Value is $100/50=$2 per token. It's very similar to Risk Free Value per $OHM and represents an objective floor price.

9)

1. cont.

Many protocols issue new tokens at predetermined rates which dilute the value of each token. $TEMPLE can only be minted when there is a growth in protocol reserves and IV. Therefore, rewards cannot be minted excessively and they don't dilute stakers.

1. cont.

Many protocols issue new tokens at predetermined rates which dilute the value of each token. $TEMPLE can only be minted when there is a growth in protocol reserves and IV. Therefore, rewards cannot be minted excessively and they don't dilute stakers.

10)

2. Price Premium Ceiling reduces dumps

Users will be able to buy $TEMPLE either from AMM or the protocol itself. The protocol sells $TEMPLE at a fixed multiple of the IV so if price on AMM goes above that level, users will be able to buy from the protocol and sell on AMM.

2. Price Premium Ceiling reduces dumps

Users will be able to buy $TEMPLE either from AMM or the protocol itself. The protocol sells $TEMPLE at a fixed multiple of the IV so if price on AMM goes above that level, users will be able to buy from the protocol and sell on AMM.

11)

2. cont.

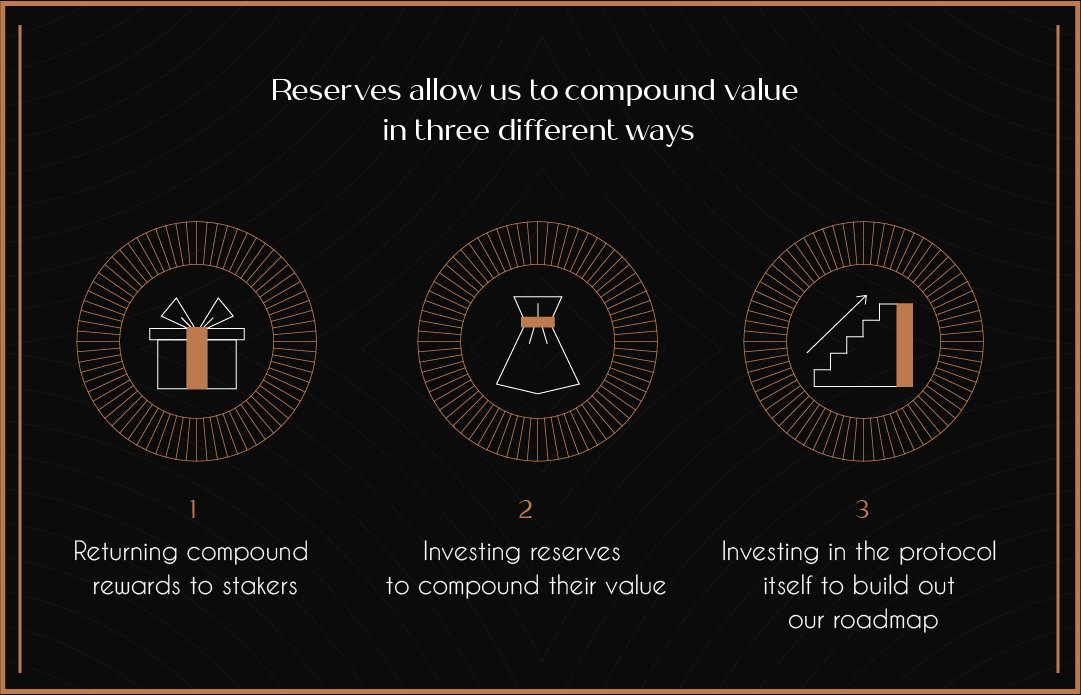

Price ceiling doesn't limit earning opportunities for $TEMPLE holders. Actually, it's a clever mechanism to redirect buying pressure from the AMM into the protocol. This way Temple grows its reserves which are the source of rewards for stakers.

2. cont.

Price ceiling doesn't limit earning opportunities for $TEMPLE holders. Actually, it's a clever mechanism to redirect buying pressure from the AMM into the protocol. This way Temple grows its reserves which are the source of rewards for stakers.

12)

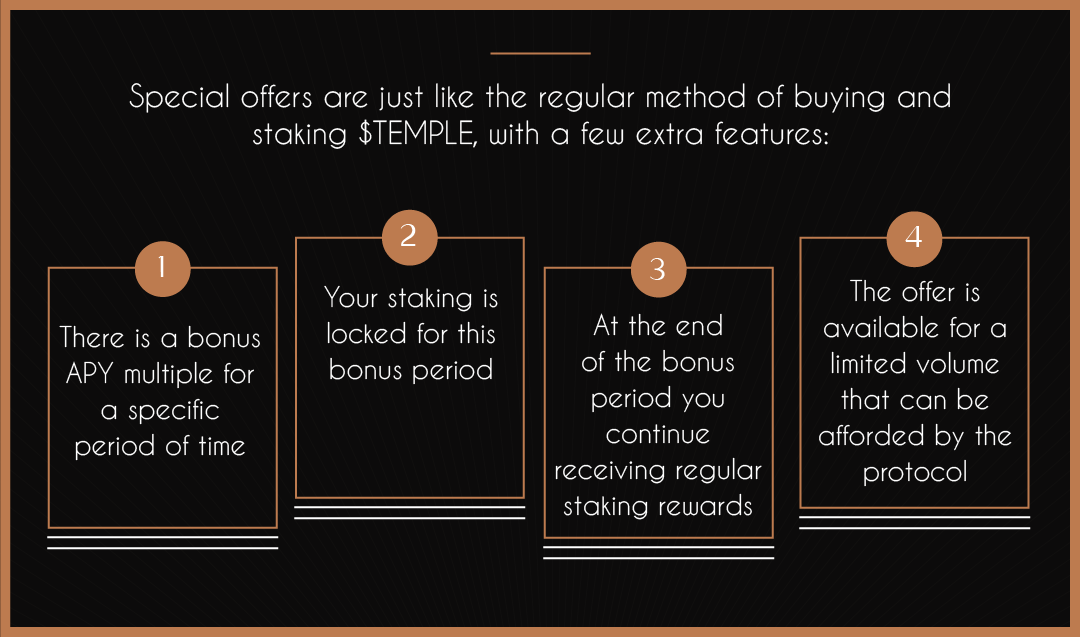

3. Bonus APY Offer encourages buying

Occasionally TempleDAO will have accumulated some excess rewards which can be used as a special offer to earn higher APY for a limited time. The purpose is to incentivize buying, e.g. during times of lower demand for $TEMPLE.

3. Bonus APY Offer encourages buying

Occasionally TempleDAO will have accumulated some excess rewards which can be used as a special offer to earn higher APY for a limited time. The purpose is to incentivize buying, e.g. during times of lower demand for $TEMPLE.

13)

4. Unstaking Queue stops stampedes

In a time of panic, negative feedback loop may lead to an unnecessary bank run. To prevent that, users who want to unstake $TEMPLE, enter a queue to exit. It reduces volatility and promotes long-term staking.

4. Unstaking Queue stops stampedes

In a time of panic, negative feedback loop may lead to an unnecessary bank run. To prevent that, users who want to unstake $TEMPLE, enter a queue to exit. It reduces volatility and promotes long-term staking.

14)

5. Temple Defend puts floor on price

If the price on the AMM is lower than the floor price, users can buy cheap $TEMPLE on the AMM and sell to the protocol. This would be enough to defend the floor price but @TempleDAO made it even better for its users.

5. Temple Defend puts floor on price

If the price on the AMM is lower than the floor price, users can buy cheap $TEMPLE on the AMM and sell to the protocol. This would be enough to defend the floor price but @TempleDAO made it even better for its users.

15)

5. cont.

The protocol gives users right but not the obligation to sell. If price goes back up, they can keep holding their $TEMPLE and profit from the gains. If $TEMPLE doesn't go back up, they can proceed with the sale.

5. cont.

The protocol gives users right but not the obligation to sell. If price goes back up, they can keep holding their $TEMPLE and profit from the gains. If $TEMPLE doesn't go back up, they can proceed with the sale.

16)

The 5 pillars of TempleDAO stability create very interesting market dynamics. Intrinsic value, floor price, ceiling price, bonus rewards, unstaking queue - these are all different ways to achieve stable and sustainable growth for $TEMPLE. And this is just the first product...

The 5 pillars of TempleDAO stability create very interesting market dynamics. Intrinsic value, floor price, ceiling price, bonus rewards, unstaking queue - these are all different ways to achieve stable and sustainable growth for $TEMPLE. And this is just the first product...

17)

Last but not least, the way how @TempleDAO enters the market and builds the community may be even more important than the product itself. Slow and fair launch, plethora of memes - these are, imo, prerequisites for a success story. Come and join!

templedao.medium.com/templedao-fire…

Last but not least, the way how @TempleDAO enters the market and builds the community may be even more important than the product itself. Slow and fair launch, plethora of memes - these are, imo, prerequisites for a success story. Come and join!

templedao.medium.com/templedao-fire…

• • •

Missing some Tweet in this thread? You can try to

force a refresh