🧵/ @astroport_fi has been billed as a next-gen Automated Market Maker and is one of the most exciting projects coming to @terra_money

But what makes this AMM different?

✦ Astroport combines features from @Uniswap, @CurveFinance, and @BalancerLabs to create a unified super-AMM

But what makes this AMM different?

✦ Astroport combines features from @Uniswap, @CurveFinance, and @BalancerLabs to create a unified super-AMM

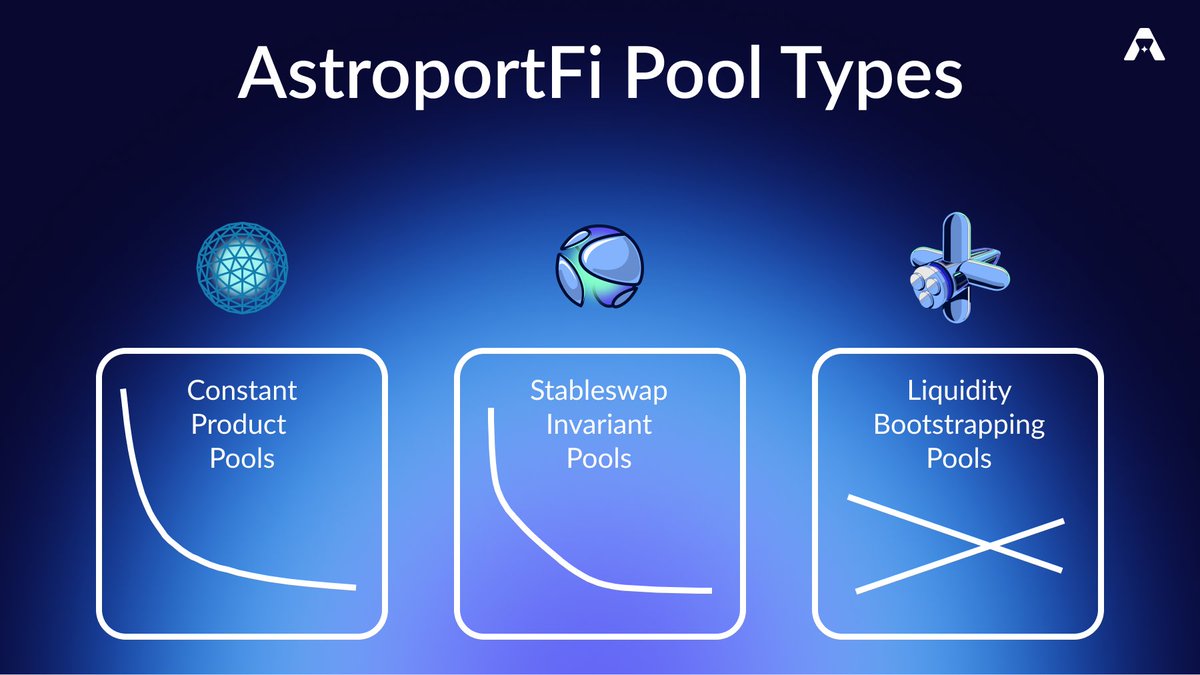

1/ Astroport's AMM will offer 3 types of Liquidity Pools that each serve a specific function:

✦ Constant Product Pools

✦ Stableswap Invariant Pools

✦ Liquidity Bootstrapping Pools

This thread goes medium-depth about the mechanics of each pool type that @astroport_fi offers

✦ Constant Product Pools

✦ Stableswap Invariant Pools

✦ Liquidity Bootstrapping Pools

This thread goes medium-depth about the mechanics of each pool type that @astroport_fi offers

2/ Before we dive deeper in to each pool type, let's start with the basics

A familiarity with these terms and a brief history of Decentralized Exchanges (DEXs) will help to convey the enormous scope of the Astroport team's ambitions

A familiarity with these terms and a brief history of Decentralized Exchanges (DEXs) will help to convey the enormous scope of the Astroport team's ambitions

3/ History

In the early stages of Defi, all the way back in 2018 (we're early guys 😉), the crypto community was seeking ways to escape the fees and centralized nature of of CEXs (Centralized Exchanges) like Coinbase, Binance, and others

In the early stages of Defi, all the way back in 2018 (we're early guys 😉), the crypto community was seeking ways to escape the fees and centralized nature of of CEXs (Centralized Exchanges) like Coinbase, Binance, and others

4/ Decentralized Exchanges, or DEXs, that utilized the CEX order book were popular at the time to facilitate P2P exchanges

However, the order book model was incredibly inefficient for decentralized P2P trading at scale, resulting in illiquid token markets and disuse

However, the order book model was incredibly inefficient for decentralized P2P trading at scale, resulting in illiquid token markets and disuse

5/ Liquidity Pools

In 2018 @Bancor introduced the concept of liquidity pools, offering an alternative to P2P trading

In 2018 @Bancor introduced the concept of liquidity pools, offering an alternative to P2P trading

6/ A Liquidity Pool is a pool of paired assets of equal value that allows for trading of each individual asset in a Peer-to-Contract AMM model

Example: if $LUNA is trading at $50, a balanced LUNA-UST pool would be 20 LUNA and 1000 UST

Example: if $LUNA is trading at $50, a balanced LUNA-UST pool would be 20 LUNA and 1000 UST

7/ s/o to @finematics 🚀

8/ What is an AMM?

An AMM is an algorithmically priced and executed DEX

The most popular DEXs in Defi today all utilize the AMM model including @Uniswap, @SushiSwap, @PancakeSwap, @mangomarkets

An AMM is an algorithmically priced and executed DEX

The most popular DEXs in Defi today all utilize the AMM model including @Uniswap, @SushiSwap, @PancakeSwap, @mangomarkets

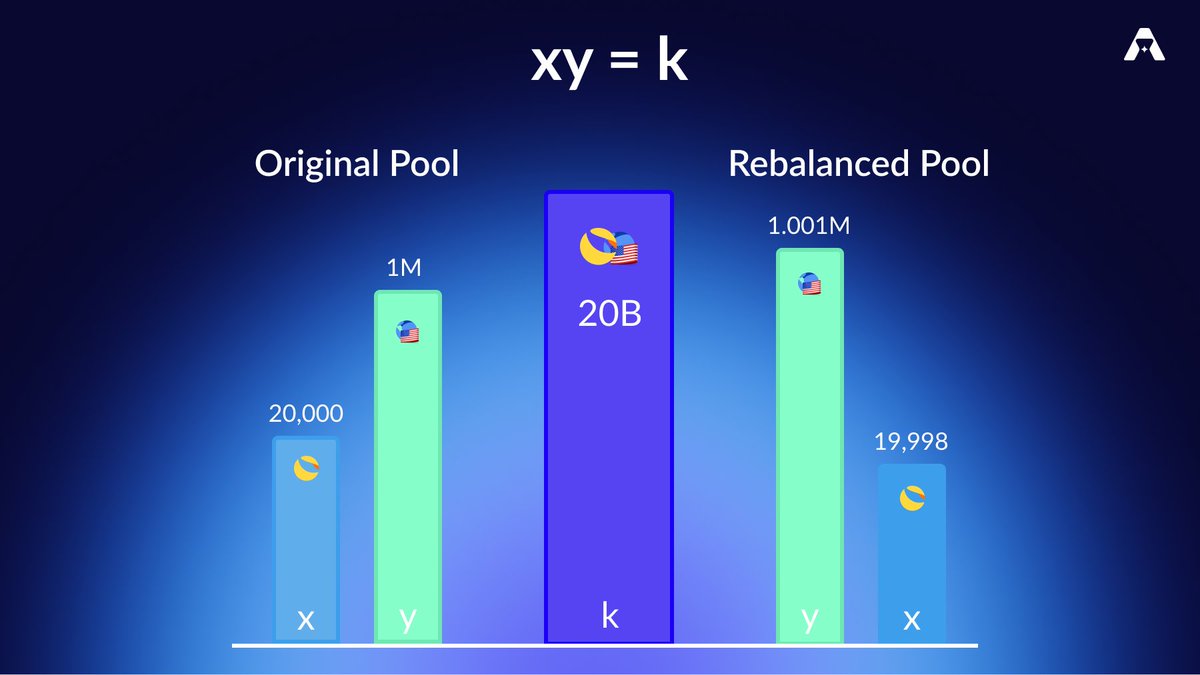

9/ xy = k

Uniswap popularized AMM trading with the introduction of Constant Product Pools which utilize the xy=k price curve for paired assets in 2018

This formula allowed for the creation of the defi infrastructure we see today and is a pivotal moment in cryptocurrency history

Uniswap popularized AMM trading with the introduction of Constant Product Pools which utilize the xy=k price curve for paired assets in 2018

This formula allowed for the creation of the defi infrastructure we see today and is a pivotal moment in cryptocurrency history

10/ xy = k

This formula simply means that the reserves of Token X and the reserves of Token Y in the LP will always multiply to a constant, k

This formula simply means that the reserves of Token X and the reserves of Token Y in the LP will always multiply to a constant, k

11/ How does an AMM work?

In an AMM, the first liquidity provider (LP) sets the price for each asset in the pool and is incentivized to provide equal dollar values of each, like in our LUNA-UST pool example above

The first LP is usually the protocol team

In an AMM, the first liquidity provider (LP) sets the price for each asset in the pool and is incentivized to provide equal dollar values of each, like in our LUNA-UST pool example above

The first LP is usually the protocol team

12/ When the initial LP sets the price of each asset in the pool, the relative prices are theoretically arbitrary

However, the value of each will quickly come to match the real-world Fair Market Value (FMV) of the assets by way of arbitrage opportunities

However, the value of each will quickly come to match the real-world Fair Market Value (FMV) of the assets by way of arbitrage opportunities

13/ AMM Arbitrage

Any deviation by the AMM from the FMV price of each asset creates a profitable opportunity for arbitrageurs to buy an asset from the pool and sell it on a CEX or alternative DEX for a profit

This automatically brings the pool back into FMV balance

Any deviation by the AMM from the FMV price of each asset creates a profitable opportunity for arbitrageurs to buy an asset from the pool and sell it on a CEX or alternative DEX for a profit

This automatically brings the pool back into FMV balance

14/ Arb Example (not accounting for slippage)

Assume the following

Pool of 20,000 LUNA (x) and 1M UST (y) for a k value of 20B

Astro(AMM DEX) LUNA Price: $50.0

KuCoin(CEX)/FMV LUNA price: $50.1

Assume the following

Pool of 20,000 LUNA (x) and 1M UST (y) for a k value of 20B

Astro(AMM DEX) LUNA Price: $50.0

KuCoin(CEX)/FMV LUNA price: $50.1

15/ Arbitrage

If the CEX price of LUNA is $50.1, but it's available on Astro at $50.0, arbitrageurs will purchase LUNA from Astro and sell LUNA on the KuCoin as long as it is possible to do so, making money on the spread

If the CEX price of LUNA is $50.1, but it's available on Astro at $50.0, arbitrageurs will purchase LUNA from Astro and sell LUNA on the KuCoin as long as it is possible to do so, making money on the spread

16/ Arbitrage

17/ This arb opportunity exists as long as LUNA DEX price < CEX price

This can be calculated as follows:

$50.1/$50.0 = 1.002

1.002 - 1 = 0.002 = 0.2% total delta

0.02%/2 (# of assets in the pair) = 0.01% change in reserves for both assets in opposite directions to keep xy=k

This can be calculated as follows:

$50.1/$50.0 = 1.002

1.002 - 1 = 0.002 = 0.2% total delta

0.02%/2 (# of assets in the pair) = 0.01% change in reserves for both assets in opposite directions to keep xy=k

18/ Because the opportunity exists to profitably buy LUNA, the reserves of LUNA will go down. The arb'er will purchase LUNA up to:

20,000 LUNA in the pool /1.001 = 19,980.02 LUNA remaining in the pool

20,000 LUNA in the pool /1.001 = 19,980.02 LUNA remaining in the pool

19/ This means that the arb'er will buy 19.98 LUNA at $50 each for a total of ~$999, selling it on a CEX for $1001

Making $2 on the spread

Making $2 on the spread

20/ Oppositely, the UST reserve quantity will increase by 1.001 times in order to maintain xy=k

1M UST x 1.001 = 1,001,000 UST

The pool is now rebalanced at 1,001,000 UST (y) x 19,980.02 LUNA (x) = ~20B (k)

1M UST x 1.001 = 1,001,000 UST

The pool is now rebalanced at 1,001,000 UST (y) x 19,980.02 LUNA (x) = ~20B (k)

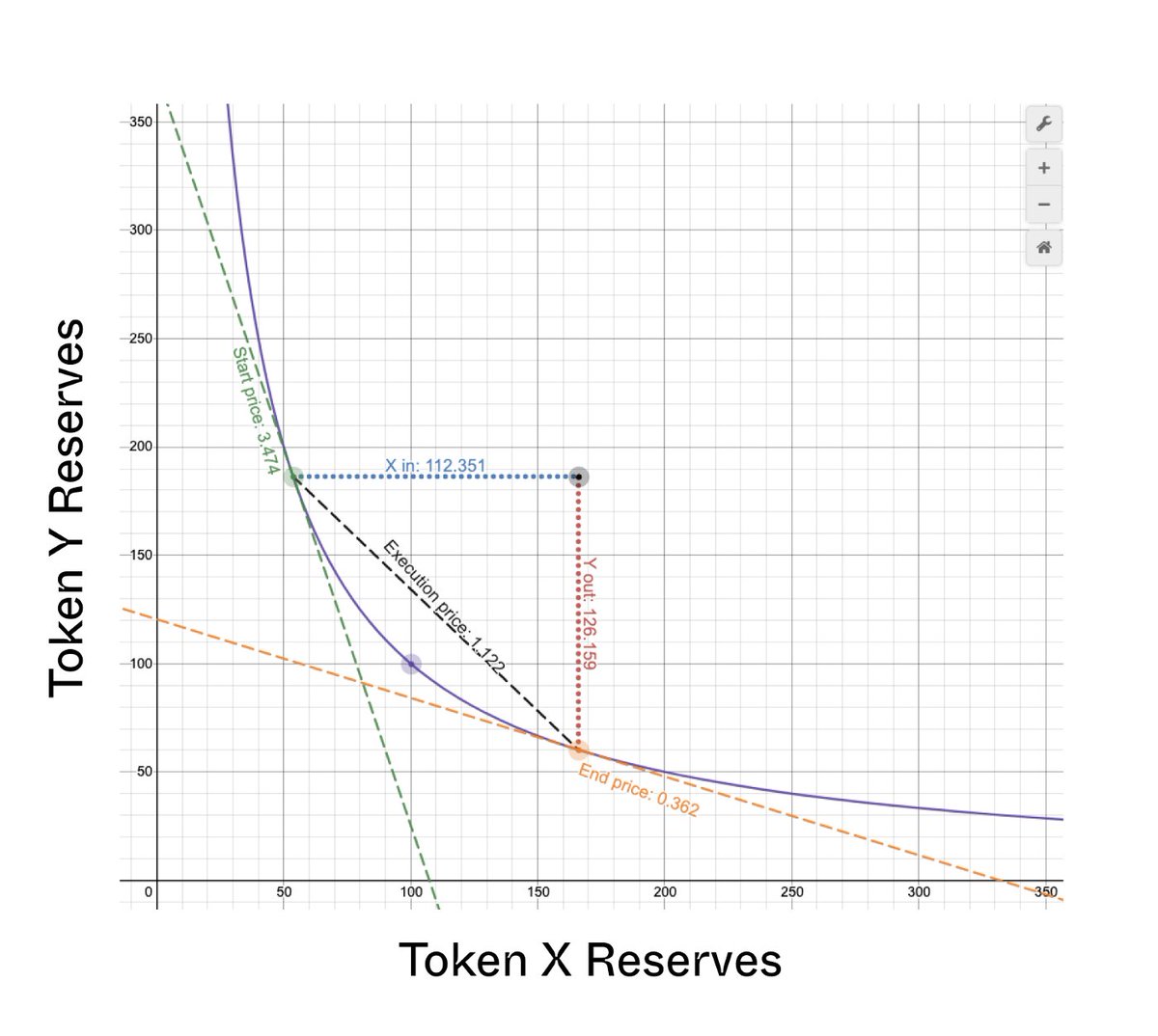

21/ ✦ Constant Product Pools (CPPs)

CPPs utilize the xy=k curve from the example above

They are the most widely used pool type and are the best way for AMMs to facilitate trades between relatively volatile assets as they are simple and adaptable to large market swings

CPPs utilize the xy=k curve from the example above

They are the most widely used pool type and are the best way for AMMs to facilitate trades between relatively volatile assets as they are simple and adaptable to large market swings

22/ Constant Product Pools are the backbone of defi's most popular AMMs, including @Uniswap, @SushiSwap, @PancakeSwap, and is the pool type offered on @terraswap_io and @loop_finance

23/ ✦ Stableswap Invariant Pools

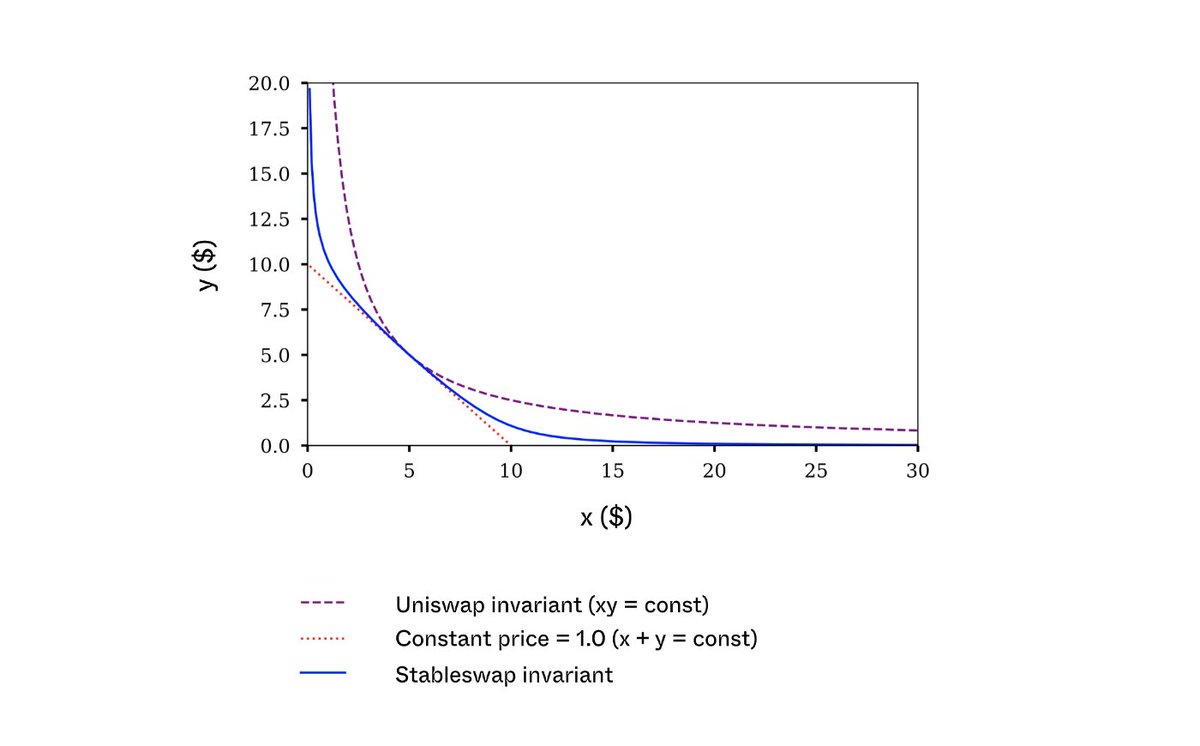

@CurveFinance realized that the xy = k model is inefficient for trading assets of a similar value such as assets in a UST-USDT or LUNA-bLUNA pool

The pool size required to achieve reasonable slippage between stableswaps is unfeasible via CPP

@CurveFinance realized that the xy = k model is inefficient for trading assets of a similar value such as assets in a UST-USDT or LUNA-bLUNA pool

The pool size required to achieve reasonable slippage between stableswaps is unfeasible via CPP

24/ Curve created a new model that operates between Constant Product Pools (CPPs)(xy=k) and Constant Price Pools (C$Ps)(x+y=D)

The stableswap invariant curve acts like a C$P between certain price ranges, allowing for little to no slippage between stable assets

The stableswap invariant curve acts like a C$P between certain price ranges, allowing for little to no slippage between stable assets

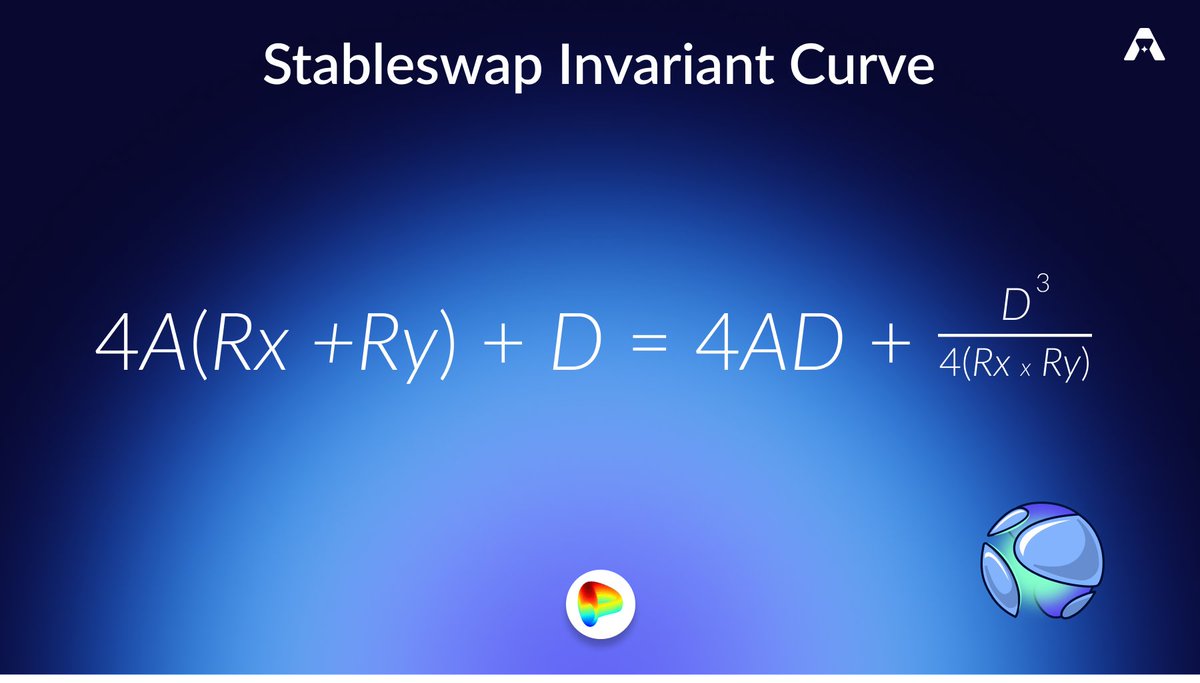

25/ Stableswap invariant (SSI) pools utilize an amplification parameter (A) that determines how closely the curve mirrors that of either the CPP curve or the C$P curve

Higher values of A push the SSI curve closer to that of a C$P, resulting in a 1:1 exchange within a range

Higher values of A push the SSI curve closer to that of a C$P, resulting in a 1:1 exchange within a range

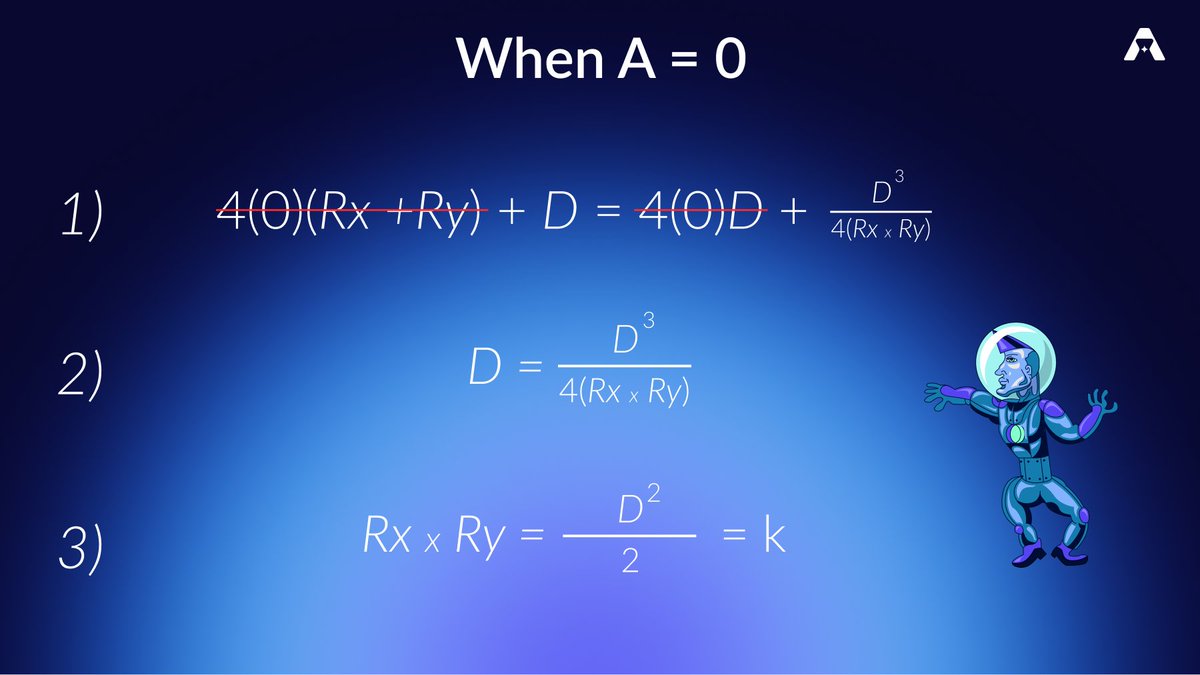

26/ D is a constant that represents the total number of tokens in the pool when token X and token Y have equal price

When A = 0, the SSI formula is identical to that of a CPP

When A = 0, the SSI formula is identical to that of a CPP

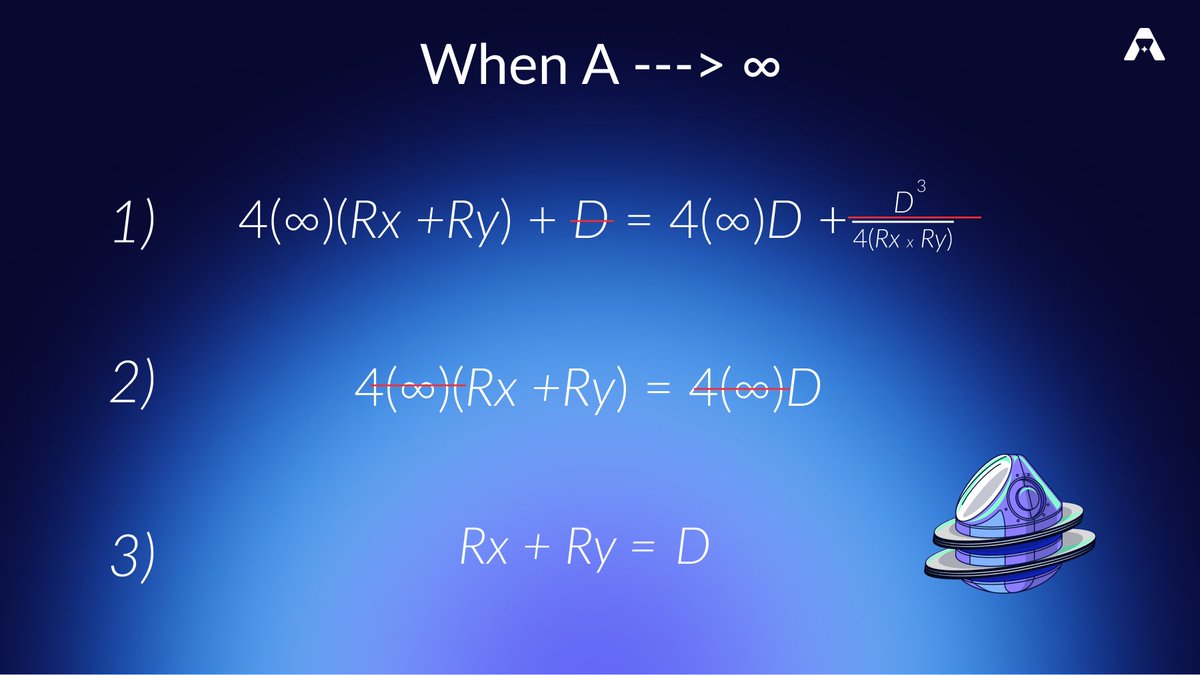

27/ However, as A approaches infinity, the SSI curve becomes more and more identical to that of a C$P

This allows the SSI curve to be able to facilitate trading with minimal slippage within a range, while also giving it the flexibility to accommodate trades at the extremes

This allows the SSI curve to be able to facilitate trading with minimal slippage within a range, while also giving it the flexibility to accommodate trades at the extremes

28/ You can read more about the Stableswap Invariant formula from the Curve whitepaper, here:

curve.fi/files/stablesw…

curve.fi/files/stablesw…

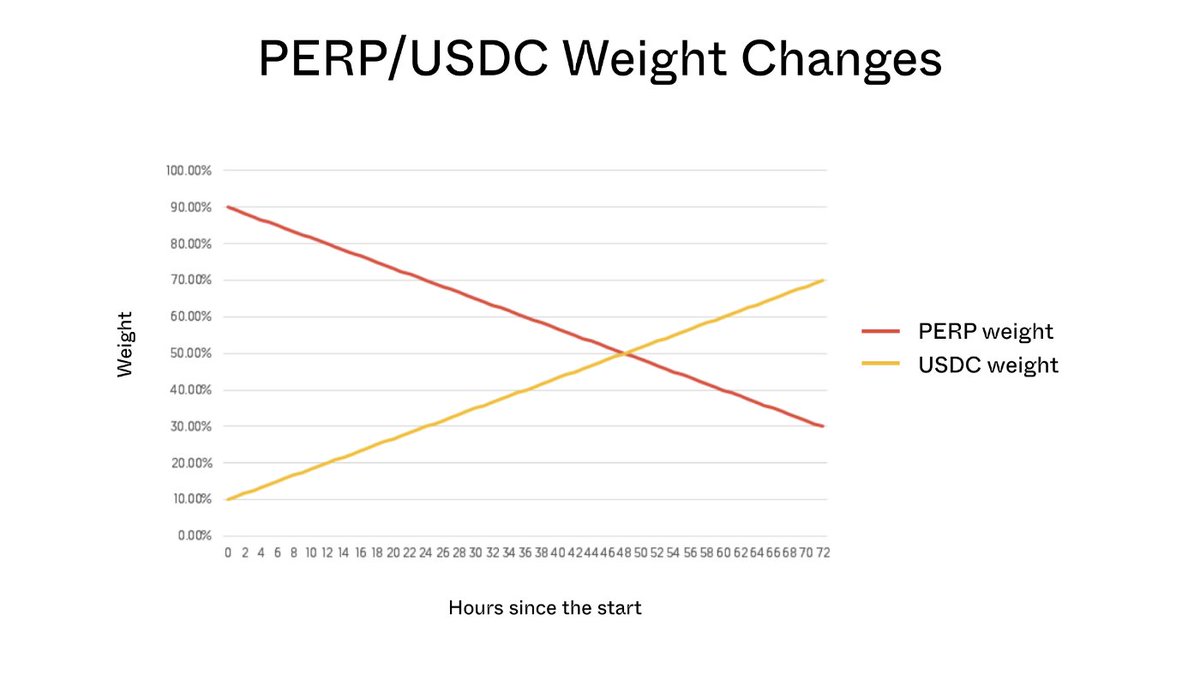

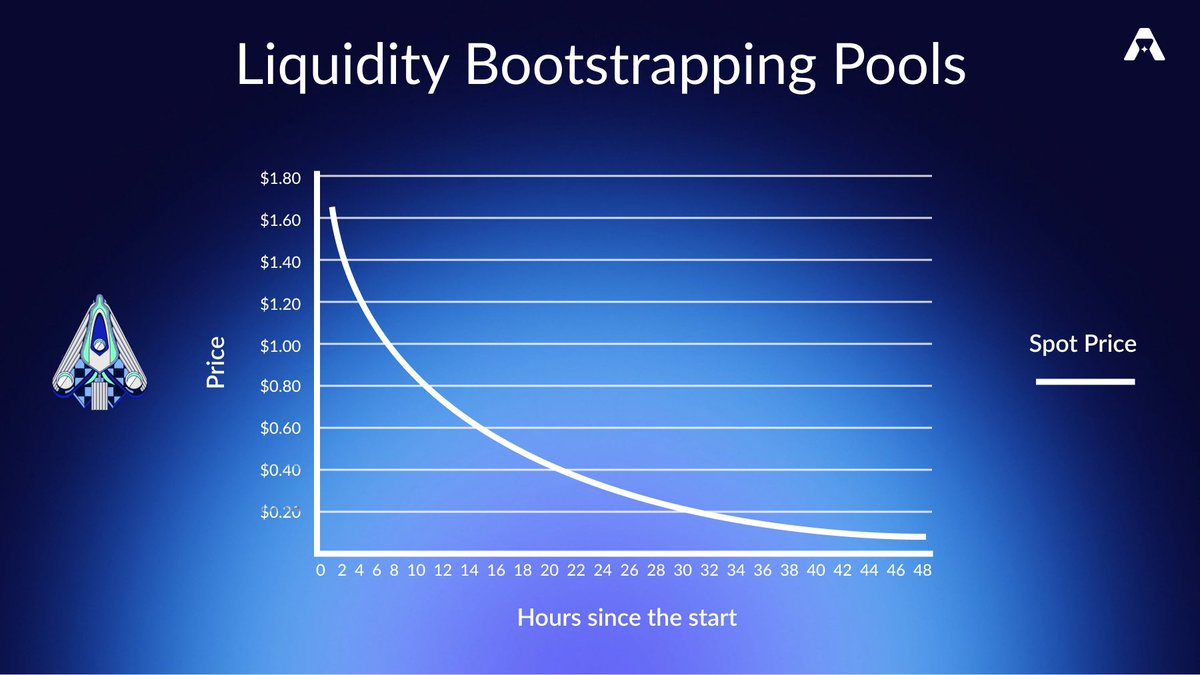

29/ ✦ Liquidity Bootstrapping Pools (LBPs)

An LBP is a token launch mechanism created to prevent bot front-running/sniping, promote fair access, and lower the amount of initial capital required to achieve reasonable slippage in an AMM IDO

An LBP is a token launch mechanism created to prevent bot front-running/sniping, promote fair access, and lower the amount of initial capital required to achieve reasonable slippage in an AMM IDO

30/ First introduced by the team at @BalancerLabs, LBPs work by adjusting the relative ‘weights’ of the two pooled tokens

The price is slowly lowered, spreading price discovery over a longer period as participants wait for a fair price to buy

The price is slowly lowered, spreading price discovery over a longer period as participants wait for a fair price to buy

31/ LBPs can be thought of as an AMM "Dutch auction"

Because the price of the token goes down gradually, there is little to no benefit to front-running the launch

Because the price of the token goes down gradually, there is little to no benefit to front-running the launch

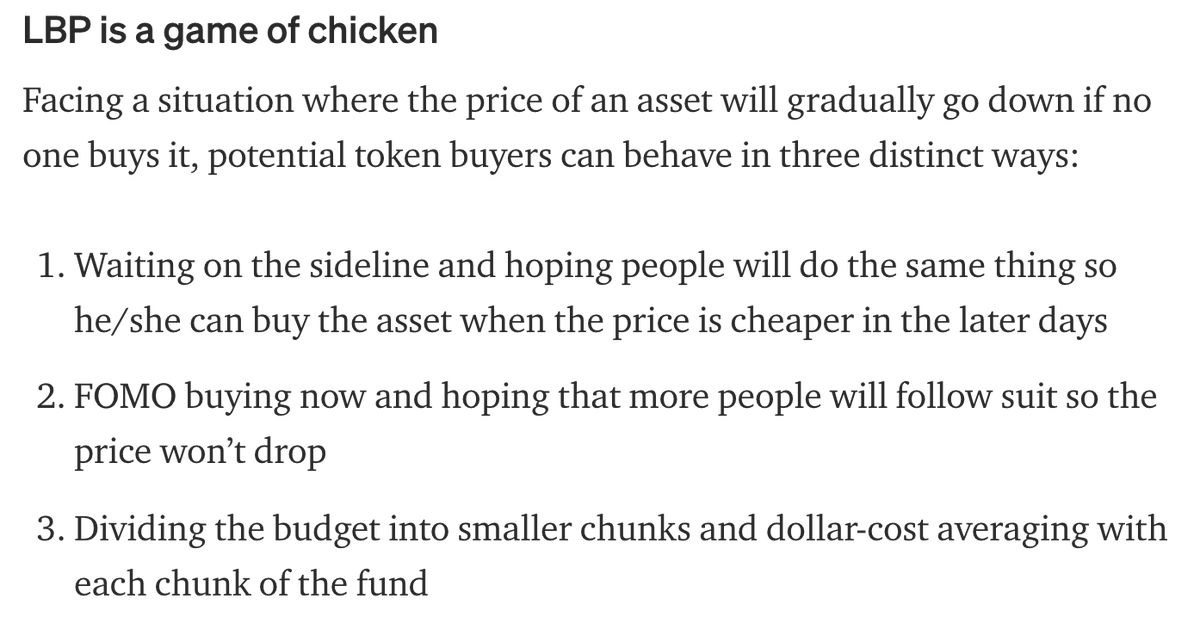

32/ However, buying/selling activity increases/decreases the price of the asset in a way that alters the theoretical price path of the token shown in the curve above, coming to more closely resemble the path in the graph here:

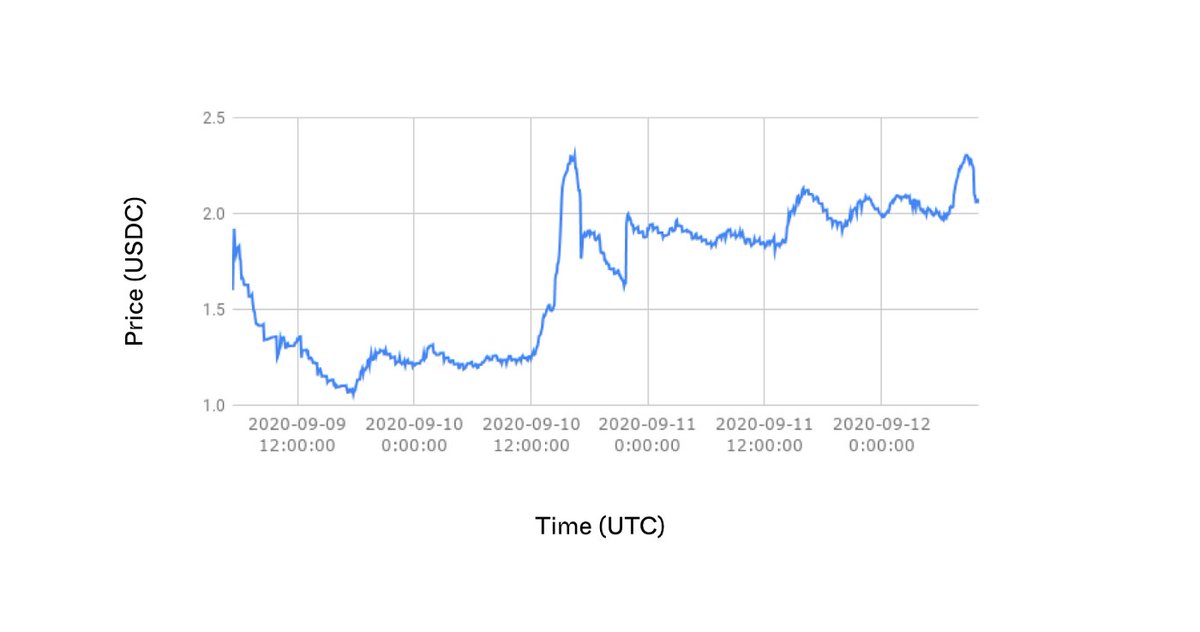

33/ The LBP equation is a version of the constant product pool equation that allows for different weights applied to each token

Here Wx and Wy refer to the respective weights of token x and y

When Wx and Wy are both equal to 0.5, the LBP curve is identical to that of a CPP

Here Wx and Wy refer to the respective weights of token x and y

When Wx and Wy are both equal to 0.5, the LBP curve is identical to that of a CPP

35/ Example: if $ASTRO were to launch via LBP consisting of ASTRO-UST and Wx of $ASTRO > 0.5, this means that significantly less UST would be required to create meaningful liquidity and distribution for $ASTRO at launch

36/ You can read more about @BalancerLabs vision for Liquidity Bootstrapping Pools here

https://twitter.com/perpprotocol/status/1303017985368489984

37/ In addition to the 3 pool types laid out in this thread, $ASTRO stakers will be able to add more pool types in the future via governance

38/ @lukedelphi has already suggested the ability for Astroport to integrate with Mirror to allow for a modified version of SSI pools to facilitate trades of relatively non-volatile assets (FAANG stocks) with reduced slippage

https://twitter.com/lukedelphi/status/1462758346449211394

39/ This is just a single example of the new and innovative pool types that #lunatics will propose in order to make @astroport_fi the best DEX in all of Defi

40/ While this thread has covered just the different pool types available in Astroport, there are numerous other #LUNAtics that have given a more well-rounded overview of the protocol's tokenomics, roadmap, and vision

https://twitter.com/_/status/1453369406181060610

43/ @astroport_fi will be launching via a liquidity lockdrop beginning December 6th. You can read more about the 💧🔒 mechanism below:

https://twitter.com/astroport_fi/status/1460985888771555330

44/ Incredibly excited for Astroport, a project that I believe will open the @terra_money ecosystem up to all of Defi

45/ S/o to some of the Terra gigabrains out there for exposing me to this ecosystem

46/ @TheMoonMidas @WestieCapital @cryptosmiff @JordanSoufian @NicolasFlamelX @wengzilla @ZeMariaMacedo @CryptoHarry_ @theryanlion @remi_tetot @nicdors @Speicherx @AnonNgmi @mooneybagz @gtcapital_ @Danxia_Capital @CitrusMimosa @Josephliow @stablekwon

• • •

Missing some Tweet in this thread? You can try to

force a refresh