1/ Have been thinking about the evolution of VC investing in crypto, if we believe it to be as big or bigger than the internet shift of the late 90s and mobile of the 00s. Today, there are no more “internet” or “mobile” tech investors. To not be is to be irrelevant.

2/ In the last 5 years, early in the cycle, crypto-focused VC funds, mostly early-stage, achieved 5-100x returns with both index and concentrated strategies, with significant gains from those early in DeFi. Mean returns 7-8x. Notable funds all 10x+.

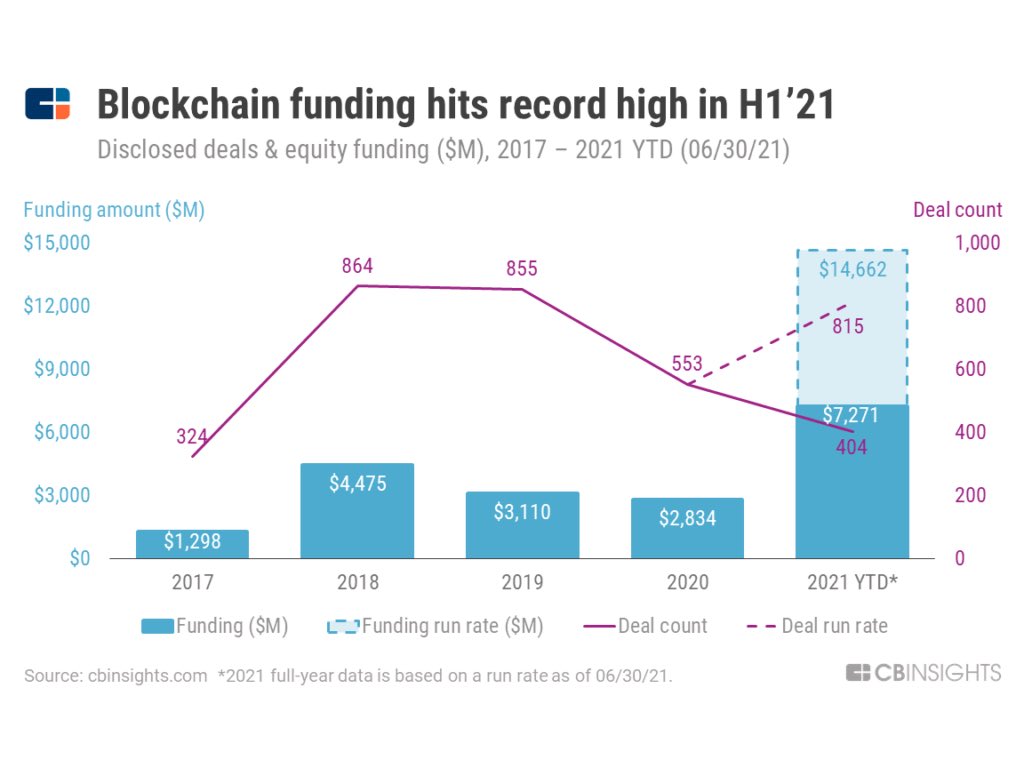

3/ This yr, generalist VCs and HFs have entered, while crypto-native funds have raised or grown larger from asset value growth. Crypto funding is on track to more than 10x this year vs 2020. Valuations grew commensurately.

4/ And still it feels so early. Current total mkt cap of all tokens is similar to that of just MSFT ($2.5T). There is still under 10M unique participants in DeFi. There is ~same daily txns on Eth as there are on Nasdaq in seconds.

5/ How will crypto investing evolve? Some predictions: (1) In the next 12-24 months, VCs with focused crypto expertise and a flexible mandate to fully participate in token investment and governance will continue to dominate, especially in early stage.

6/ (2) But as crypto expands, the majority of consumer tech (gaming, social etc) may become synonymous with web3, while other sectors like infra, security, iot, fintech++ will also touch blockchain. Every VC partner may need to become crypto fluent.

7/ (3) In the next 2 yrs, infra/dev ops/security will be a big category after DeFi, web3, and NFTs. Blockchain congestion will continue, developer experiences will transform, as it has in web2. Barriers of entry are higher than in consumer in both product and ideology.

8/ A “crypto investor” may eventually sound as redundant as a “internet investor”. Specialization by sector will occur, and is already (DeFi, web3, NFT, infra, etc). This is a world where the next generation of $100B and $1T companies may well be web3 / blockchain ones.

9/ Just as many funds dominant in the 90s are irrelevant today, crypto may cause another restacking. Crypto-native funds will need to adapt. General funds have faced paradigm shifts - internet, mobile, cloud, Tiger, now crypto.

10/ It will be interesting to see how investing evolves in web3. One thing is clear, it’s never been a better time to be a builder. Would love your thoughts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh