WHY STOP LOSS OF 8% ?

To make money in stocks, you must protect the money you have. Live to invest another day by following this simple rule:

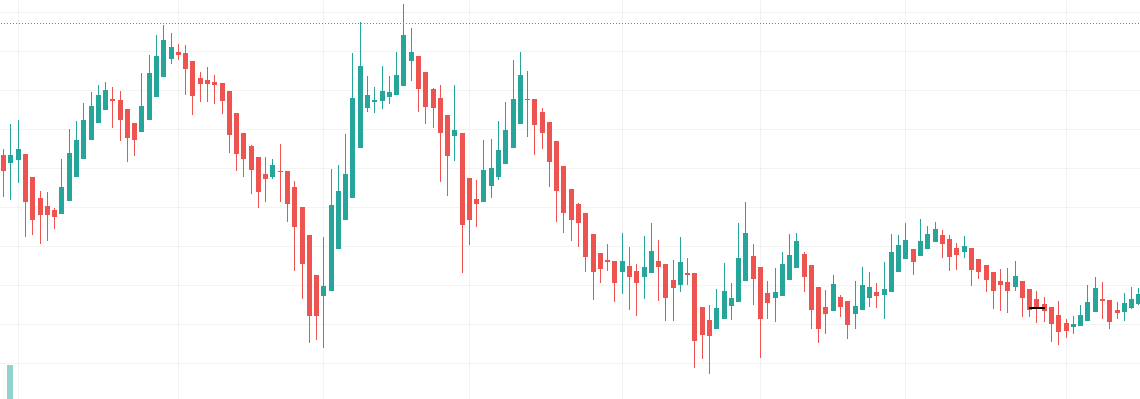

Always sell a stock if it falls 7–8% below what you paid for it. This basic principle helps you cap your potential downside.

1/n

To make money in stocks, you must protect the money you have. Live to invest another day by following this simple rule:

Always sell a stock if it falls 7–8% below what you paid for it. This basic principle helps you cap your potential downside.

1/n

And it is the simplest way to make sure you never let a small loss become a BIG one.

Why 7–8%?

The 7–8% sell rule is based on an ongoing study covering over 100 years of stock market history. Even the best stocks will sometimes breat out and then drop slightly below their buy

2

Why 7–8%?

The 7–8% sell rule is based on an ongoing study covering over 100 years of stock market history. Even the best stocks will sometimes breat out and then drop slightly below their buy

2

When they do, they typically do not fall more than 8% below it. If your stock does decline more than 8%, it usually means something is wrong with your chosen entry point, the company, its industry, the general market, or all of the above.

3/n

3/n

Even if you sell at an 8% loss and the lstock quickly rebounds, it does not mean you made the wrong decision. You were proactively protecting your portfolio.

4/n

4/n

Taking a small loss from time to time is like paying an insurance premium to make sure you don't suffer a devastating hit.

And you can always buy a stock back if it shows strength again

Received this in mail from

End //

@MarketSmithIND @markminervini

And you can always buy a stock back if it shows strength again

Received this in mail from

End //

@MarketSmithIND @markminervini

• • •

Missing some Tweet in this thread? You can try to

force a refresh