Why @mystockedge premium is a must have for all swing traders and retail investors ? I call it an ATM machine. But one should know how to get money out of it.

See this powerful thread for key features. If you find them useful don't forget to support us by subscribing.

See this powerful thread for key features. If you find them useful don't forget to support us by subscribing.

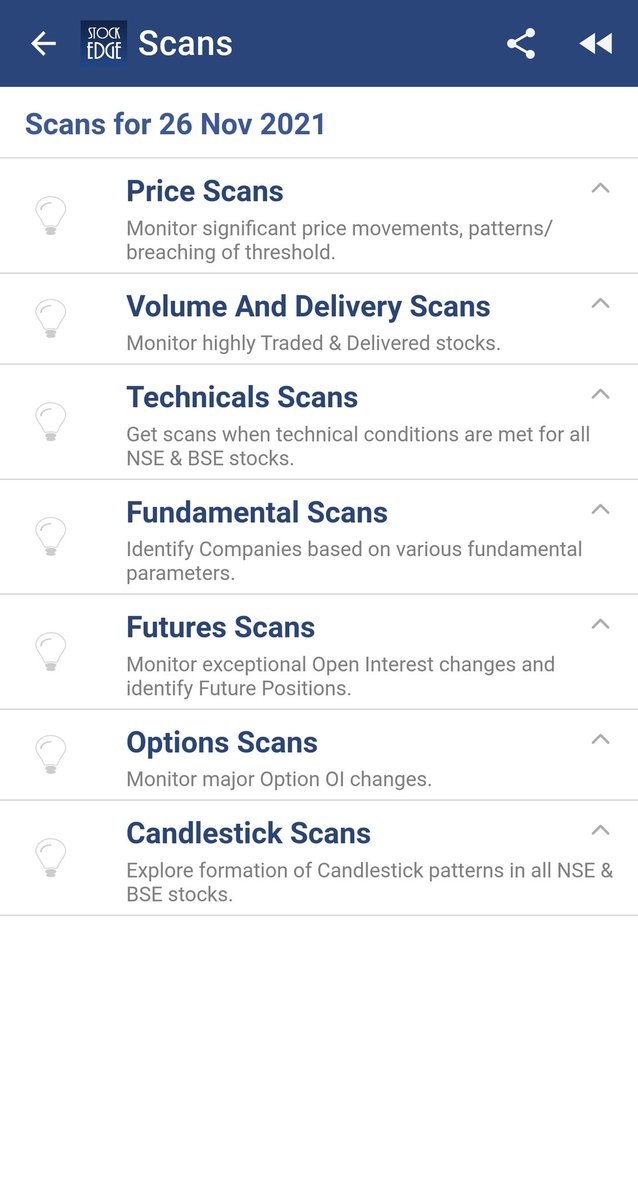

Simple and effective scans for stock identifications. No fancy engine to keep you confused. I strongly believe simple things work the best in market.

Also combo scans with multiple scan combos can identify stocks like butter.

Also combo scans with multiple scan combos can identify stocks like butter.

Investment themes for your potential long term investing journey.

30 plus effective ideas covering 100 stocks.

This makes your life simple, again.

30 plus effective ideas covering 100 stocks.

This makes your life simple, again.

Swing Strategies for regular market participants who want active stock ideas for their regular trading need.

Again simple.

Again simple.

Cutting edge reports

Case studies on stocks

Concal analysis

Important infograohics

Ipo notes with ratings

Keeping it simple.

Case studies on stocks

Concal analysis

Important infograohics

Ipo notes with ratings

Keeping it simple.

And moreeeeeeeee

If you are not into it, you are not there.

Subscribe to premium today. Use BLACK33 to get this lack Friday offer.

stockedge.com/Plans/stockedg…

If you are not into it, you are not there.

Subscribe to premium today. Use BLACK33 to get this lack Friday offer.

stockedge.com/Plans/stockedg…

• • •

Missing some Tweet in this thread? You can try to

force a refresh