Conventional narrative keeps telling us it’s only a q of time until China is the worlds largest economy, maybe 5 or 10 years. But there’s nothing inevitable about that at all. In fact it’s being stressed right now. Read on /1

US and China nominal GDP are about 23 and 14.7 trillion usd. Over the last couple of decades and to now, US gdp growth has trended at 5%, but now running at close to 10%. China’s the opposite, trend 10%, now closer to 5%. Get the picture? /2

Let’s say for the next decade, US is 6.5% - higher inflation but lower than now, and China is 5.5 % lower real gdp trend and little inflation. In a decade, the tyranny of compounding has China falling further behind not overtaking. This isn’t just a numbers game /3

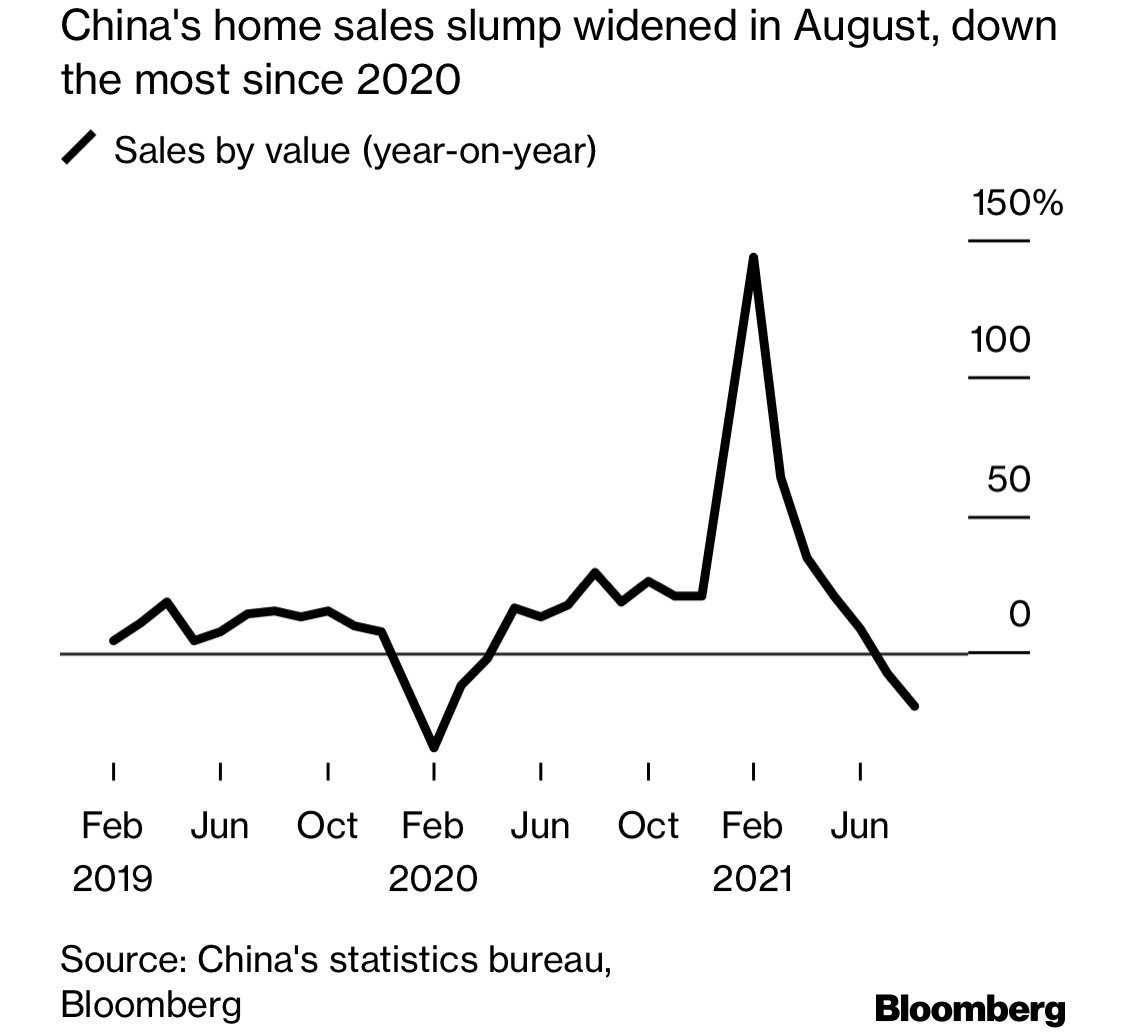

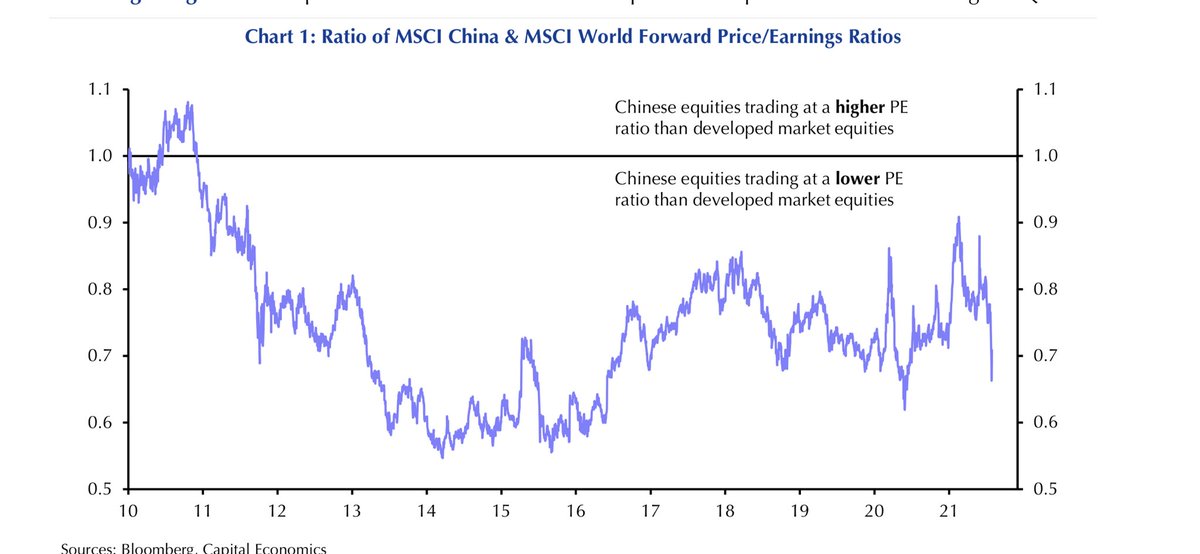

US growth really could surprise on the upside as much as China well might on the downside. And I’ve made no allowance for property price deflation in China or any sort of Chinese characteristics recession post 20th party Congress, both of which seem quite likely. And so … /4

…. the oft cited China destined to be the worlds largest economy still seems to me to be a narrative based on spreadsheet extrapolations without context or deference to what’s actually going on. If China confounds, the accompanying narrative hasn’t been written yet. Ends

• • •

Missing some Tweet in this thread? You can try to

force a refresh