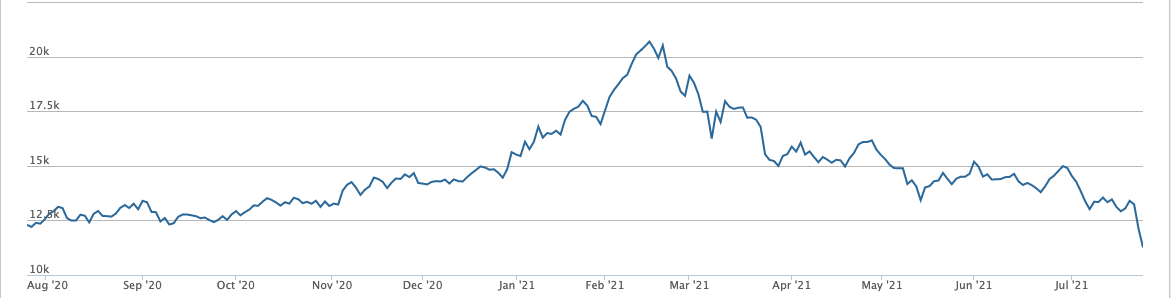

I remember at UBS we used to write in 2000s how and why China’s property market was the most important in the world. Fast fwd to 2021, it still is. At over 16% GDP, its more than 2 x US real estate in 2008. Evergrande et al are key to real estate, & metaphor for the economy /1

https://twitter.com/jkynge/status/1439755688914284545

It surely cannot be allowed to end up in a messy default with collapsing property prices a) anyway b) so close to nov 22 Party Congress, but govt restructuring plan can’t wait too long as fin distress mounts /2

That said, extend and pretend, and other restructuring solutions will only defer a denouement for real estate, which is cyclically and structurally weak and having regulatory headwinds, incl from Common Prosperity. /3

So, even if the govt managed to manage the current crisis for a year or so the allocation of costs among creditors and households is unavoidable, now sooner than later. Losses will occur, prices will fall at least in real terms and growth will be pegged back. Ends.

• • •

Missing some Tweet in this thread? You can try to

force a refresh