Looking at $SDGR:

This company was one I use to bash a lot for its valuation when it was up over $70. Now, I am recommending it. It has strong fundamentals and a cheap valuation. Let us take a look.

This company was one I use to bash a lot for its valuation when it was up over $70. Now, I am recommending it. It has strong fundamentals and a cheap valuation. Let us take a look.

1/ This company is made of of 2 parts. The first is the software business which they developed. Its about physics based chemistry to predict how proteins will move and targeting them with therapies.

2/ They license their software to over 1,500 global companies and have over 25 partnerships for the use of their software in drug development.

3/ The amount of revenues they make from the actual software is nothing that big. They do about $100 million a year in sales with a slow 15% ish growth rate. The important part about the software sales is it helps pay for the clinical development of their pipeline.

4/ They also have a broad ability to collaborate with companies with programs that will yield them royalties or even equity stakes.

5/ The other half of their business is their own clinical pipeline which excites a biotech investor like me. They have some very big potential candidates if they pan out in the clinic.

6/ Their first program is for MALT1. This is a key pathway that links the B cell receptor activation to the NF kappa B pathway which controls inflammation cytokine release.

7/ This plays a key role in a subset of B cell cancers that are driven by MALT1 signaling. The first will be the 30% to 40% of DLBCL that is MALT1 related. This program should reach the clinic next year.

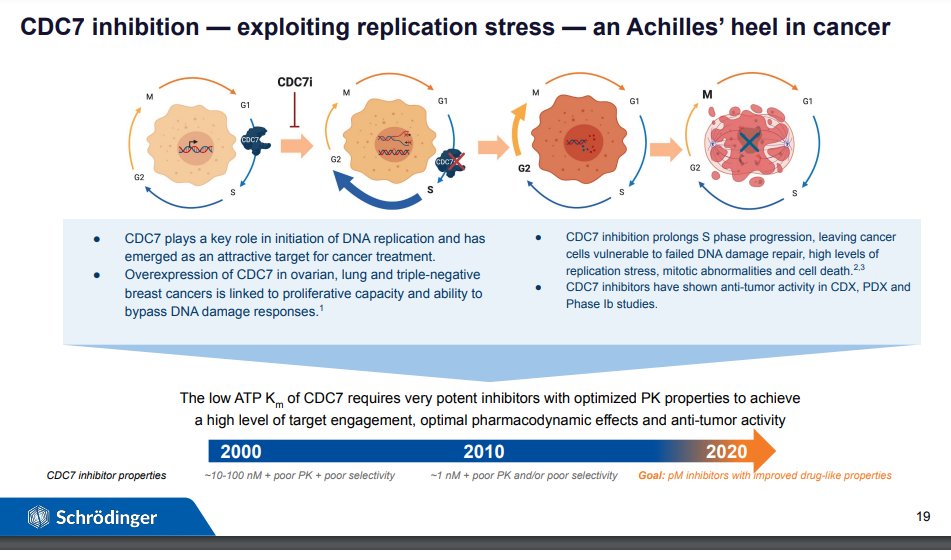

8/ The next program is CDC7. This is a key in initiating DNA synthesis during the cell cycle. Its believed it plays a key role in patients that become resistant to CDK4/6 inhibitors. This could be a very big drug in combo with those drugs.

9/ This is currently in IND enabling studies. It could be in the clinic later in 2022. The CDK4/6 inhibitor market reached about $7 billion in annual sales and about 10% of patients become resistant to those drugs.

10/ The last program is their WEE1 program. This is another pathway in the cell cycle. This one plays a role in checking the DNA quality before letting the cell advance from G2 to Mitosis.

11/ They are offering a potentially differentiated drug from the previous WEE1 inhibitors which had good data, but resulted in too much toxicity. This could offer a better alternative to the first generation drugs.

12/ The management team seems like a very good one for the limited time I have followed the company. I really like their CSO who is in charge of the clinical development. She sounds like a very sharp scientist.

13/ I think $SDGR offers a great value based on the software business and its many collaborators. It gives you a great and high potential pipeline and a revenue stream to fund the majority of it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh