Every incremental person @YouTubeGaming takes increases the value of the remaining big twitch streamers. The pillars of twitch.

The negotiating leverage @REALMizkif , @Sykkuno @xQc @hasanthehun wield just increased, its like a high stakes game of creator musical chairs.

The negotiating leverage @REALMizkif , @Sykkuno @xQc @hasanthehun wield just increased, its like a high stakes game of creator musical chairs.

Twitch internally prob has a different perspective. They probably think the platform is where the lion share or value resides, to continue with the musical chairs analogy, the value accrues to the seats rather than the person sitting in it.

Netflix is an analog. Netflix shows

Netflix is an analog. Netflix shows

That they can license super popular content (friends, the office, etc), distribute it to their viewers then drop that content when it comes time to negotiate. Reed Hastings at Netflix uses view time as a kpi (quipping that netflix competes with video games and sleep) and it’s

likely that many twitch insiders feel emboldened by the the relative die-hardness (bleeding purple) of its user base. It could be argued that twitch viewers are on balance MORE hardcore than Netflix profiles given the 2hr/day avg Netflix watch time can be due to account sharing

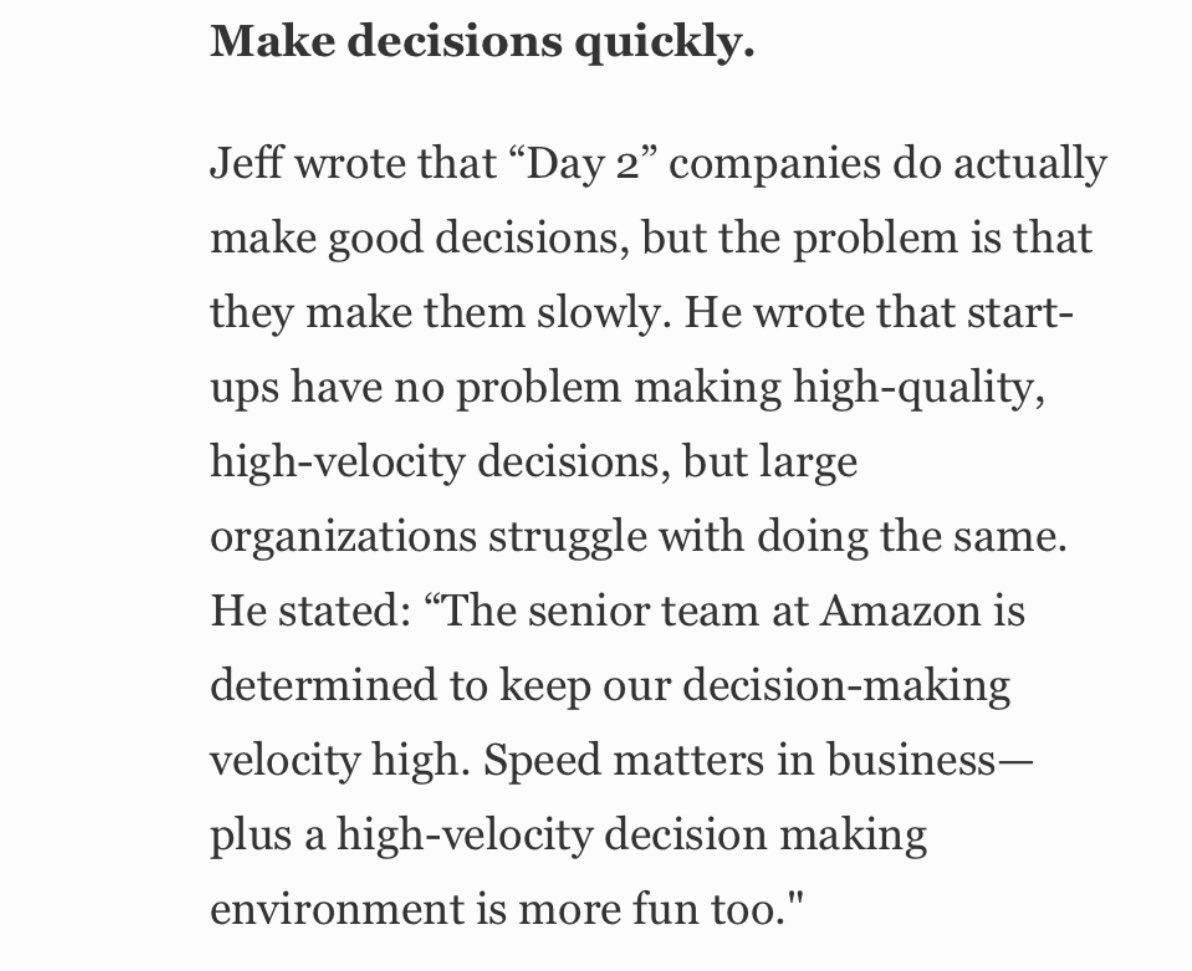

I’m not so sure, but regardless this is interesting to see play out. YouTube feels like thanos here, inevitable. It’s strange to see twitch not paying up for biggest creators and slow pace of feature innovation given twitch’s parent company Amazon is no Stranger to

enduring “accounting losses” while they invest in new adjacencies.

Listening to the @TheStanzShow it really sounds like given Ludwig’s telling of the negotiations that twitch has failed to adhere to @JeffBezos’s “day 1” Philosophy.

It’s day 2 for twitch 🙁

Listening to the @TheStanzShow it really sounds like given Ludwig’s telling of the negotiations that twitch has failed to adhere to @JeffBezos’s “day 1” Philosophy.

It’s day 2 for twitch 🙁

If you squint Twitch sort of makes sense in $Amzn corporate strategy. Ads is one of the fastest growing “other” segment at amazon after AWS, and there seems to be a push for gaming.

Prime video is spending top dollar to lock in unique IP, but prime video adds value to the

Prime video is spending top dollar to lock in unique IP, but prime video adds value to the

amazon prime subscription bundle in a mental accounting sense. Twitch does not. Is The free prime sub, one of the biggest incentives for large creators going to be enough? Is the platform/seat really where

the value and thus loyalty accrues to in terms of viewers having to choose between fidelity to their favorite creator or to the platform (ui, features, community familiarity)? We’re all gonna find out 😐

Congrats to @LudwigAhgren , the feeling of a new adventure must be so liberating and exciting. Kudos for embarking upon something outside your comfort zone.

And to the rest of us,

And to the rest of us,

• • •

Missing some Tweet in this thread? You can try to

force a refresh