The Ultimate Guide to moving averages !

A mega thread to understand the Use of 21 , 50 and 200 ema.

4 Effective uses of Exponential Moving Averages !

Retweet and Share 🔄

#stockmarkets #nifty

@kuttrapali26 @caniravkaria

A mega thread to understand the Use of 21 , 50 and 200 ema.

4 Effective uses of Exponential Moving Averages !

Retweet and Share 🔄

#stockmarkets #nifty

@kuttrapali26 @caniravkaria

Once Can refer the use of Moving Averages Throught this thread 🔖

https://twitter.com/JayneshKasliwal/status/1459757180735967233?s=20

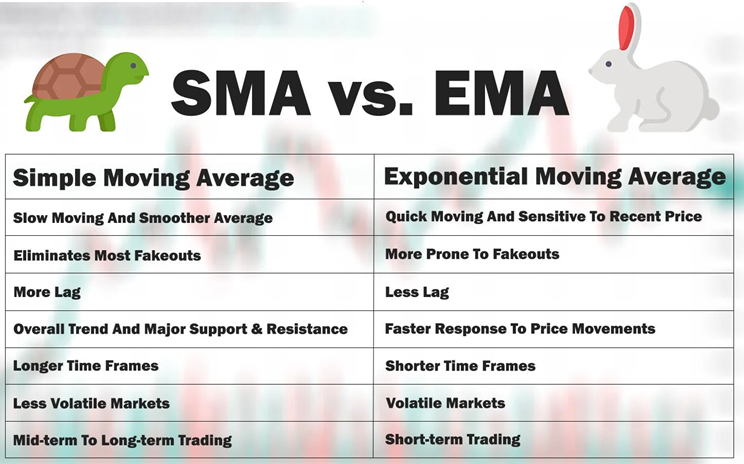

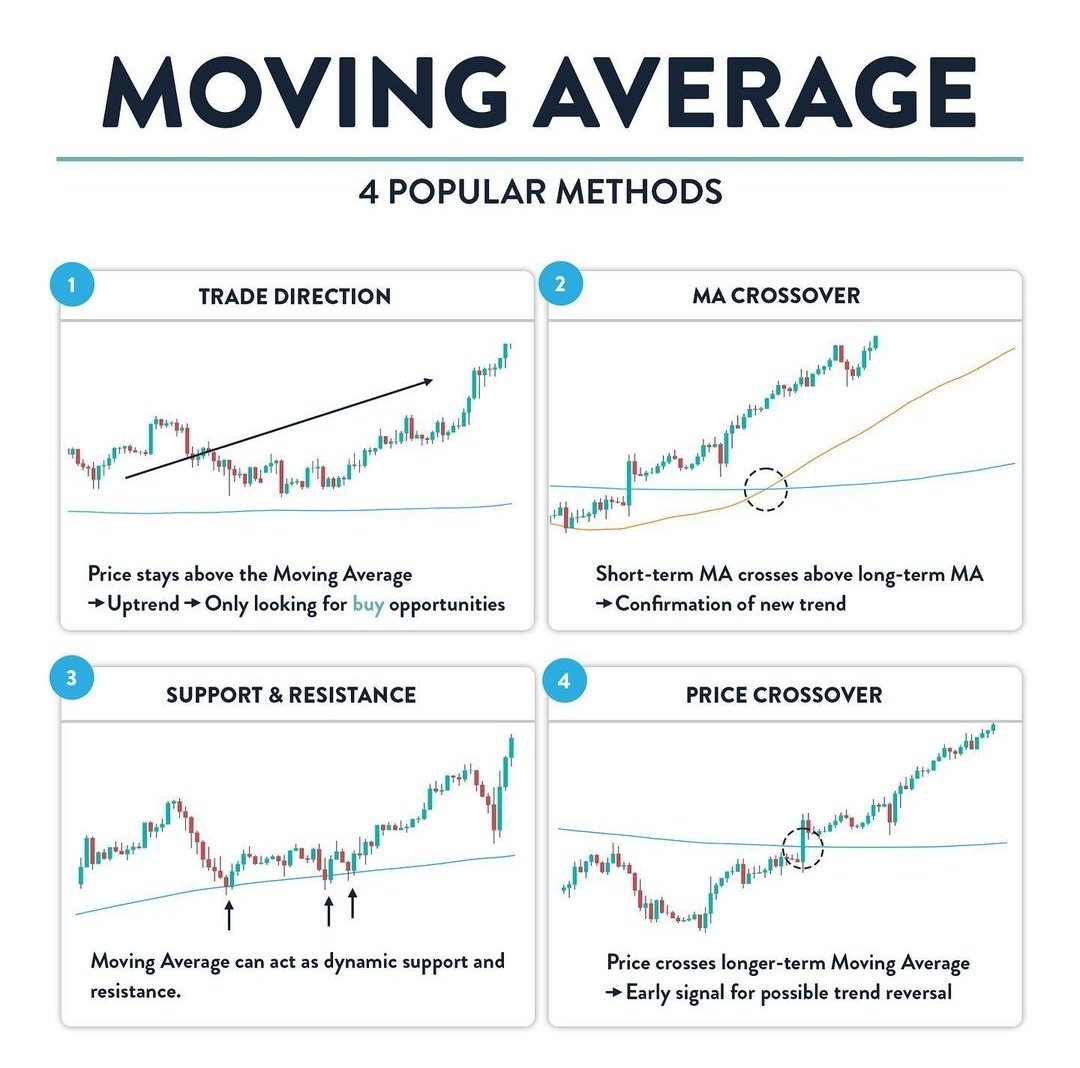

4 Popular uses of moving averages

1. Identifying the direction of trend

2. MA crossover

3. Dynamic Support and Resistance

4. Price Crossing above Key EMAs

Note : In chart 21 ema is red , 50 ema is green and 200 ema is black

2/n

1. Identifying the direction of trend

2. MA crossover

3. Dynamic Support and Resistance

4. Price Crossing above Key EMAs

Note : In chart 21 ema is red , 50 ema is green and 200 ema is black

2/n

Use 1 : Identifying the trend of stock on dtf

The 21 ema will tell us the Short term trend of a stock , while the 200 ema will tell us the long term trend of a stocks

Any EMA that is sloping

:upwards trend is BULLISH

:sideways trend is NEUTRAL

:downwards trend is BEARISH

4/n

The 21 ema will tell us the Short term trend of a stock , while the 200 ema will tell us the long term trend of a stocks

Any EMA that is sloping

:upwards trend is BULLISH

:sideways trend is NEUTRAL

:downwards trend is BEARISH

4/n

MOVING AVERAGES SIDEWAYS:

When Moving averages turn flat means the stock is in consolidation and is in sideways zone .

Generally this occurs after an uptrend or downtrend and may lead to continuation of previous trend .

This is generally no trading zone for swing traders

5/n

When Moving averages turn flat means the stock is in consolidation and is in sideways zone .

Generally this occurs after an uptrend or downtrend and may lead to continuation of previous trend .

This is generally no trading zone for swing traders

5/n

1. Whenever ema is sloping upwards its called uptrend

2. Whenever ema is sloping downwards its called dowtrend

3. Whenever ema is sideways its called consolidation

⏫Buy in uptrend

⏬Sell in downtrend

Whenever stocks move too away from ema it is extended and pullsback

6/n

2. Whenever ema is sloping downwards its called dowtrend

3. Whenever ema is sideways its called consolidation

⏫Buy in uptrend

⏬Sell in downtrend

Whenever stocks move too away from ema it is extended and pullsback

6/n

EMA CROSSOVER

1. Whenever the 21 ema crosses 50 ema from down to up short term trend changes from bearish to bullish and vice versa.

2. The 21 Should be above 50 ema for uptrend and below 50 ema for downtrend

Ex:

7/n

1. Whenever the 21 ema crosses 50 ema from down to up short term trend changes from bearish to bullish and vice versa.

2. The 21 Should be above 50 ema for uptrend and below 50 ema for downtrend

Ex:

7/n

Crossover rules:

Crossover shouldnt be traded solely as it can lead to multiple signals of buy and sell ,always use confirmation of volume , price etc to take trade .

During consolidation you will get many signals and hence its not advised to use during sideways trend

8/n

Crossover shouldnt be traded solely as it can lead to multiple signals of buy and sell ,always use confirmation of volume , price etc to take trade .

During consolidation you will get many signals and hence its not advised to use during sideways trend

8/n

50 and 200 ema crossovers

50 cutting 200 from down : Golden Cross

50 cuttinf 200 from up : Death Cross

The Long term trend changes when DEATH CROSS happens and its one of the most dangerous situations

Price falls raidly after the Death Cross

9/n

50 cutting 200 from down : Golden Cross

50 cuttinf 200 from up : Death Cross

The Long term trend changes when DEATH CROSS happens and its one of the most dangerous situations

Price falls raidly after the Death Cross

9/n

DYNAMIC SUPPORT AND RESISTANCE

1. 21 ema Dynamic support for trending stocks in short term

2. 50 ema dynamic support for mid term

3. 200 ema dynamic support for long term

Examples Explained !

10/n

1. 21 ema Dynamic support for trending stocks in short term

2. 50 ema dynamic support for mid term

3. 200 ema dynamic support for long term

Examples Explained !

10/n

PRICE CROSSING AVOVE 200 EMA

200 EMA : THE LONG TERM TREND

1. When a stock price crosses its 200-day moving average, it is a technical signal that a reversal has occurred.

11/n

200 EMA : THE LONG TERM TREND

1. When a stock price crosses its 200-day moving average, it is a technical signal that a reversal has occurred.

11/n

3. A simple rule of not buying stocks below 200 ema for short term trading could save a lot of money

4. One may consider investing in stocks if the stock is below 200 ema only if he is confirmed about the fundamentals of the stock

5. Some may not agree with this and its ok!

12/n

4. One may consider investing in stocks if the stock is below 200 ema only if he is confirmed about the fundamentals of the stock

5. Some may not agree with this and its ok!

12/n

WEEKLY 200 EMA : VERY LONG TERM VIEW:

1. If you use 200 ema on weekly timeframe you can be in a trend for a very long time

2.The sell signs will be given late as we are using weekly timeframe

@rohanshah619 @Puretechnicals9

13/n

1. If you use 200 ema on weekly timeframe you can be in a trend for a very long time

2.The sell signs will be given late as we are using weekly timeframe

@rohanshah619 @Puretechnicals9

13/n

Consider Following my Private group :

app.cosmofeed.com/view_group/618…

My telegram Free Group

t.me/Techno_charts

app.cosmofeed.com/view_group/618…

My telegram Free Group

t.me/Techno_charts

• • •

Missing some Tweet in this thread? You can try to

force a refresh