IT'S TIME WE HAD A BIG, SURVEY OF WORKERS

In today's newsletter, I wrote about something that's bothered me for a long time -- we don't have a big, monthly survey that asks workers and the non-employed about the job market. It's a great time to fix this.

bloomberg.com/account/newsle…

In today's newsletter, I wrote about something that's bothered me for a long time -- we don't have a big, monthly survey that asks workers and the non-employed about the job market. It's a great time to fix this.

bloomberg.com/account/newsle…

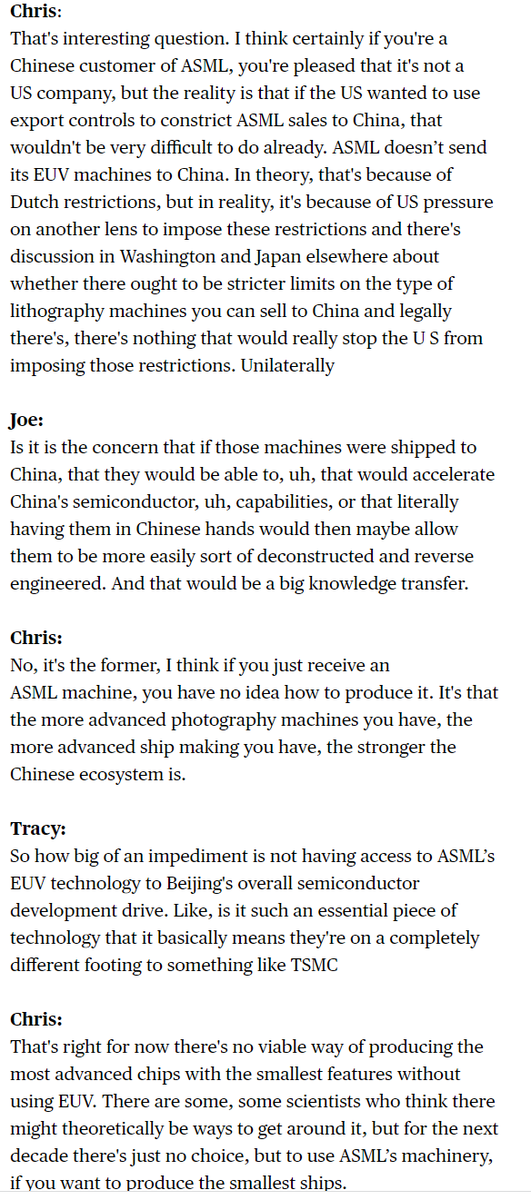

We have all these questions about the labor market, and various vague theories for why people aren't taking up job openings faster.

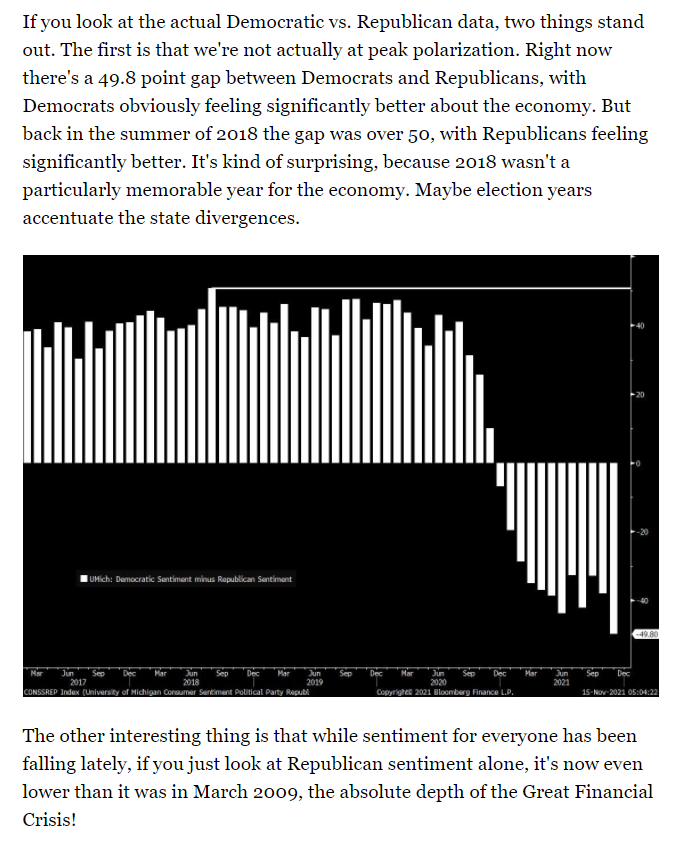

And yet instead of asking the public about this, we ask the public whether now is a good time to buy a vacuum cleaner or a dishwasher.

And yet instead of asking the public about this, we ask the public whether now is a good time to buy a vacuum cleaner or a dishwasher.

Meanwhile, we have these business surveys, which can be interesting and useful. But the respondents have been complaining about tight labor markets and labor shortages for almost a decade now, which shows that we need to take these with a grain of salt.

Anyway, here is our episode with Thomas Lubik of the Richmond Fed on the unusually high number of job openings, and what that tells us. podcasts.apple.com/us/podcast/why…

Yiiikes, there it is folks, new low in the number of people who say the plan to buy a vacuum cleaner in the next 6 months.

• • •

Missing some Tweet in this thread? You can try to

force a refresh