🚨 NEW POST 🚨

🇺🇸🛢️😬 My latest Commodity Context looks the lackluster US shale patch recovery and explains why it's a BIG problem for the post-COVID oil market unless US producers start drilling more real soon. #oott #eft

Read, subscribe, & share here:

commoditycontext.substack.com/p/shale-lacklu…

🇺🇸🛢️😬 My latest Commodity Context looks the lackluster US shale patch recovery and explains why it's a BIG problem for the post-COVID oil market unless US producers start drilling more real soon. #oott #eft

Read, subscribe, & share here:

commoditycontext.substack.com/p/shale-lacklu…

I'm a big fan of maps & this is my way of understanding the relative importance of the different major shale regions.

Permian is most of the oil, Appalachia is most of the gas.

Oil dominant regions = 45% of gas output, while gas-dominant regions = only 2% of oil. #oott #eft

Permian is most of the oil, Appalachia is most of the gas.

Oil dominant regions = 45% of gas output, while gas-dominant regions = only 2% of oil. #oott #eft

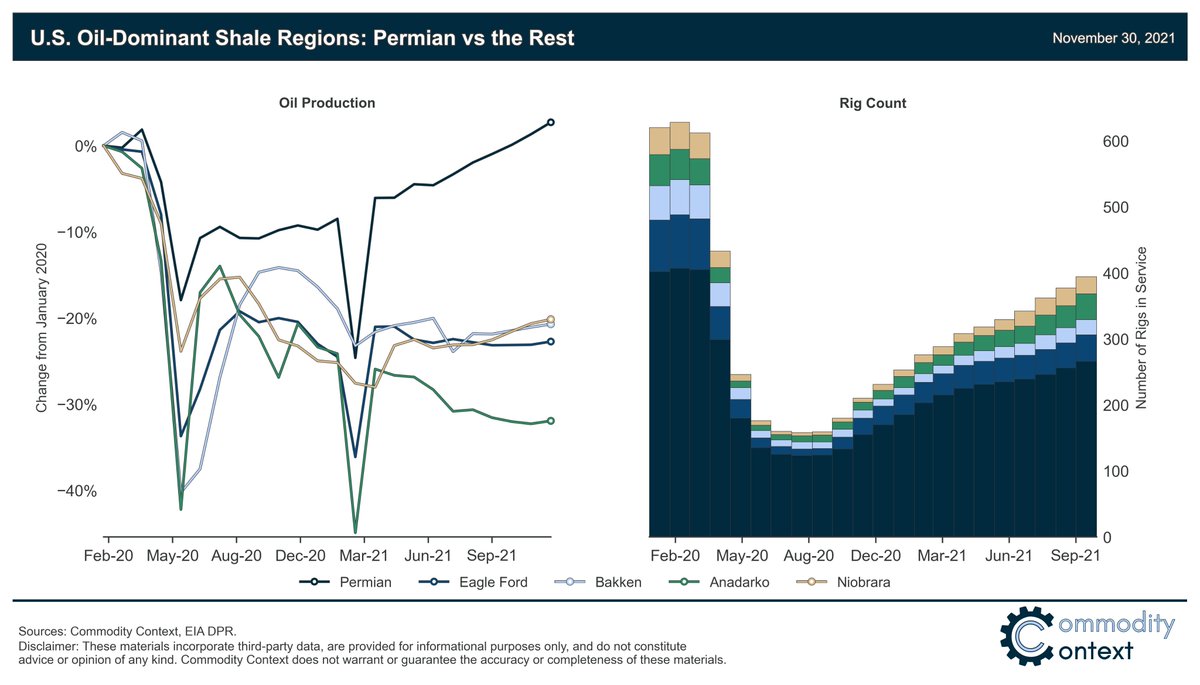

The Permian Basin's relative outperformance vs the rest of the shale patch is well known but it's even more stark than I imagined going into this piece.

Permian setting new production highs while the rest of the oil-dominant regions are still down 20-30%. #oott #eft

Permian setting new production highs while the rest of the oil-dominant regions are still down 20-30%. #oott #eft

If you looked closely at the chart in the prior tweet you'll notice that Permian production is setting all-time highs but rigs are still down by 1/3.

So what gives?

🦆🦆🦆 DUCs!

Completions have VASTLY outpaced drilling activity & DUCs are down 43% from summer 2020. #oott #eft

So what gives?

🦆🦆🦆 DUCs!

Completions have VASTLY outpaced drilling activity & DUCs are down 43% from summer 2020. #oott #eft

There's no problem with that DUC inventory depletion, per se—gotta work through that fracklog eventually.

But it's definitely giving the perception of much higher rig efficiency than is deserved and giving a false sense of security concerning the current rig count. #oott #eft

But it's definitely giving the perception of much higher rig efficiency than is deserved and giving a false sense of security concerning the current rig count. #oott #eft

Endless bad eulogies have been written for US shale & we're still a far way off that.

But whether it's due to cashflow discipline, reg burden, or supply chain issues we're just not seeing the investment we need to satisfy a post-COVID world.

But there's still time! #oott #eft

But whether it's due to cashflow discipline, reg burden, or supply chain issues we're just not seeing the investment we need to satisfy a post-COVID world.

But there's still time! #oott #eft

• • •

Missing some Tweet in this thread? You can try to

force a refresh