1. In the IFES webinar on Monday I projected 96 million planted acres for corn in 2022 for the US. A number of people have asked how in the world I get to such a high number. The key is not found in corn acreage but total planted acreage for all crops. Let me explain.

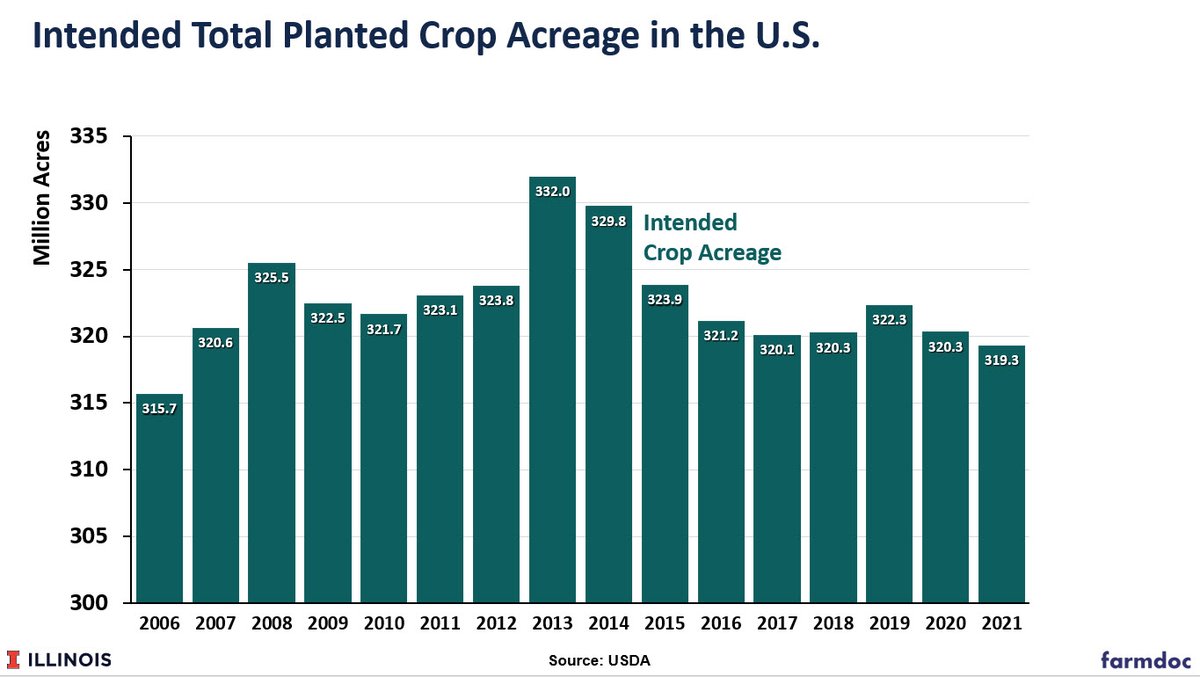

2. History of US total planted crop acreage starting in 2006. Start of the ethanol boom. Total acreage = principal crop acreage + prevented plant acreage. This is what US farmers planted or intended to plant for 22 crops. Big 3 of corn/soy/wheat about 70%.

3. I like to add actual PC + PP to get total intended planted crop acreage each year. This is the topline number we want to focus on as the starting point for 2022. Note that total dropped almost 13 million acres from 2013-2021.

4. 2021 total of 319.3 was a surprise to many analysts, including myself. I thought we would at least recover back to the 2019 level. Think the problem was not enough appreciation of lags involved in bringing acres back into crop production.

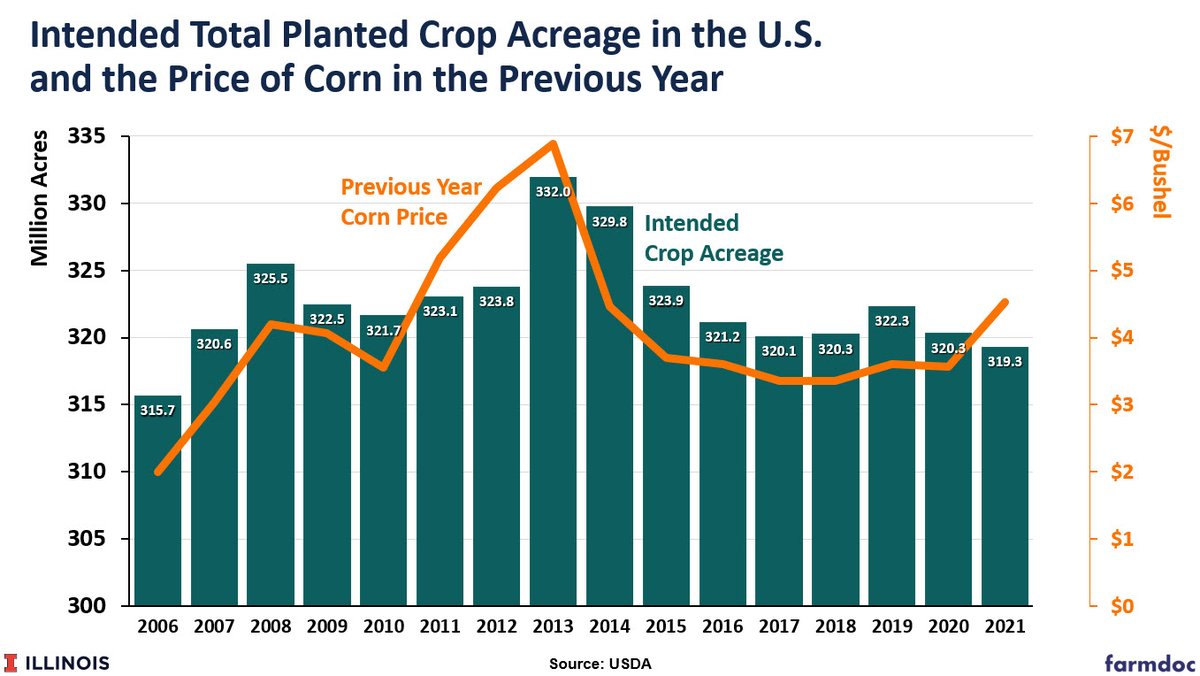

5. So now lets look at acreage response to economic incentives. Here I plot total intended acreage vs. price of corn in the previous marketing year. Certainly not a perfect fit but clearly total expanded as corn price increased and then reversed as price fell.

6. Plotted this way you can see why many analysts thought total acreage would expand in 2021. But the lags are more than one year and complicated. Look at 2011 and 2012 vs. 2013.

7. Now turn to 2022. The price for 2022 is $5.45, Nov WASDE estimate for 2021/22 marketing year. Matching that price increase is my projection of an increase of 7.2 million acres in total crop acreage in 2022. While a big jump, it still does not get back to 2013/14 peak.

8. This is a key assumption underlying my corn/soybean acreage projections for 2022. Expansion of total allows room for all profitable crops to expand planted acreage, particularly for corn, wheat, and cotton.

9. If I am wrong about total acreage, which can certainly happen, then I don't see how we can get to 96 million on corn. Finally, note this is a very simple analysis. For one, only using corn price as the indicator of overall crop profitability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh