1. Yesterday I had a thread on my projection of total planted crop area in the US for 2022. Crucial part of my projection for corn and soybean planted acreage. Oh. I need to also apologize for missing my interview with @MikeAdamsAg. Got my booster and it did not go well :(

@MikeAdamsAg 2. To recap, I projected total planted acreage in 2022 to rebound to 326.5 million acres based on the lagged impact of high grain prices. This would allow all major crops to expand acreage at least somewhat, e.g., corn would not have to steal acres from wheat.

@MikeAdamsAg 3. With that background I can walk through how I go to 96 million for corn. I start by projecting the total combined corn/soybean planted acreage. Pretty steady in recent years around 181-182 million. I jump it to 183 million based on high prices. Note only +1.5 mil over 2021.

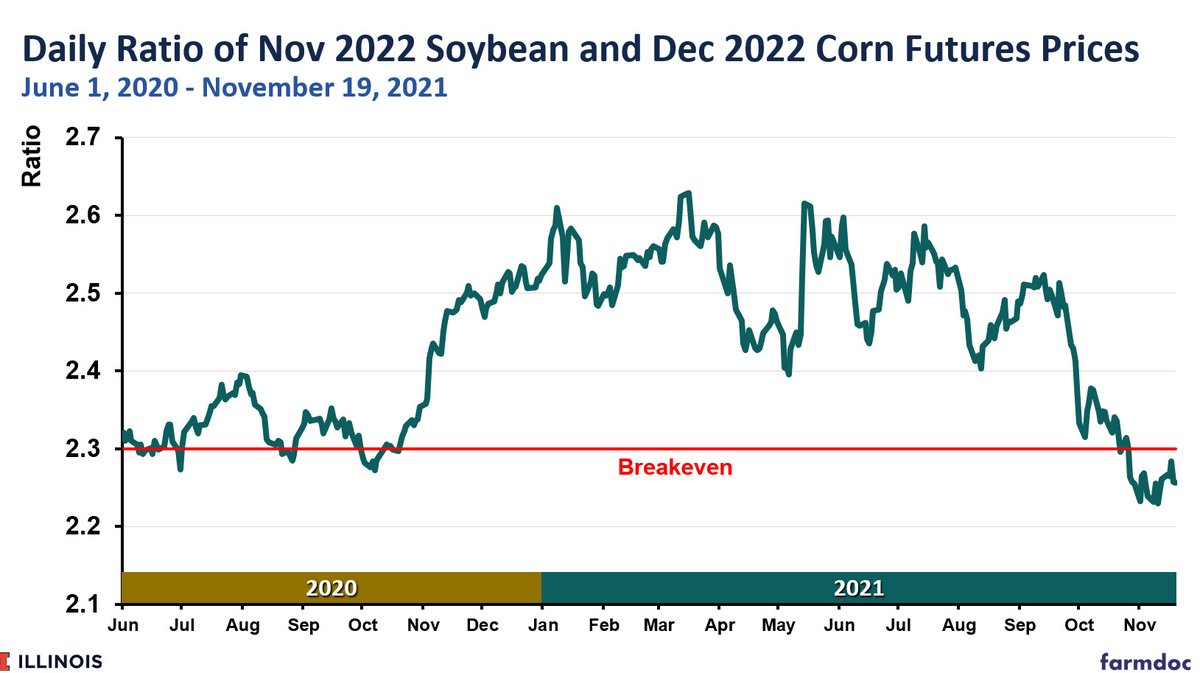

@MikeAdamsAg 4. Now of the intended total of 183 million, what will be the split between corn and soybeans? Classic indicator is the new crop 22 soybean/corn futures ratio. Very interesting pattern for 22 contracts. Clearly favored soybeans for the last year until mid Oct.

@MikeAdamsAg 5. Basically what I think happened is that market drop up corn price relative to soybeans following the spike in nitrogen (and other fertilizer prices). But the increase in corn prices was large enough to fully offset increase in nitrogen costs.

@MikeAdamsAg 6. Now one can argue that my 2.3 breakeven is too low given jump in input costs for corn. Possibly. But UI budget projections for 2022 show that corn and soybeans are breakeven at worst right now. Realize that this may not hold for areas outside of heart of Corn Belt.

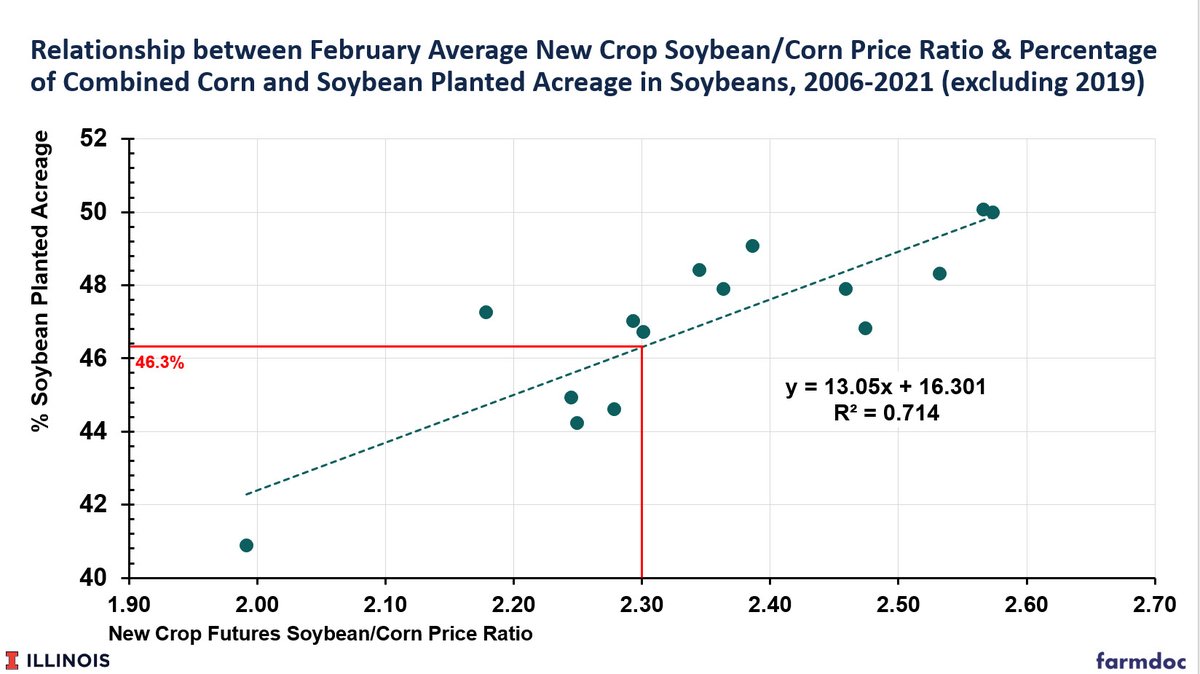

@MikeAdamsAg 7. I find this relationship to be super helpful in projecting corn and soybean planted acreage. Given a projection for the combined corn/soy acreage, if you project % soy acreage then by definition you project corn acreage.

@MikeAdamsAg 8. At present ratio of 2.25, this model predicts soybeans about 45% of total, slightly below 46% for 2.3 breakeven. With a nod to higher input costs for corn, I settled on 47% for soybean split of the total. Wanted to be a little conservative.

@MikeAdamsAg 9. 0.47 X 183 = 86 mil intended planted acres for soybeans. 183 - 86 = 97 million intended planted acres for corn. Then subtract projected prevented plant acres and you get 96 mil for corn and 85.5 for soybeans. That's how I got the numbers.

@MikeAdamsAg 10. A final comment. I like to think of this as a pure data exercise to project corn and soybean planted acreage for 2022 in the US. This is what the data tell me. Lots of room for this to still evolve before next spring!

• • •

Missing some Tweet in this thread? You can try to

force a refresh