1. Weekend Reading: Continuing with my research on USDA reports. Up today is my 1994 JEBO article with Phil Garcia, Ray Leuthold, and Li Yang. So many interesting back stories on this article. sciencedirect.com/science/articl… (pretty sure behind Elsevier pay wall)

2. Paper had its beginnings in an early 90s working paper by Phil and Ray. Ray had a former student who worked at Sparks Commodities, which became Informa, which became IHS Markit. This person gave Ray the history of Sparks and Conrad Leslie corn/soy production forecasts.

3. Conrad Leslie was a real pioneer in this regard. Started in the 60s doing a famous "postcard" survey of yield expectations from elevator managers and others (e.g., Darrel Good) before USDA crop reports. I was fortunate enough to talk to him a few times. A real character.

4. We averaged Leslie/Sparks over 1971-1992 to get a measure of pre-report expectations for USDA corn and soybean crop reports. I've kept the series up ever since and used in a number of studies. Applied economists love data!

5. Here is a chart of the complete series I now have of corn "market surprises" for USDA August crop reports from 1965-2020. Not much evidence that market is any better at anticipating USDA crop production forecasts now than 50 years ago. Fascinating.

6. Now back to 1993. I was on sabbatical leave at Illinois for a year and needed a new research project to justify to Ohio State why they were still paying me. Ray and Phil were kinda stalled on their paper and I said lets update it and get a good publication out of it. Bingo

7. Paper was eventually published in 1997 at JEBO, which is not the normal place for this stuff but the editor at the time, Richard Day, was receptive to ag econ work. We looked at value of USDA reports based on three different types of tests found in the literature.

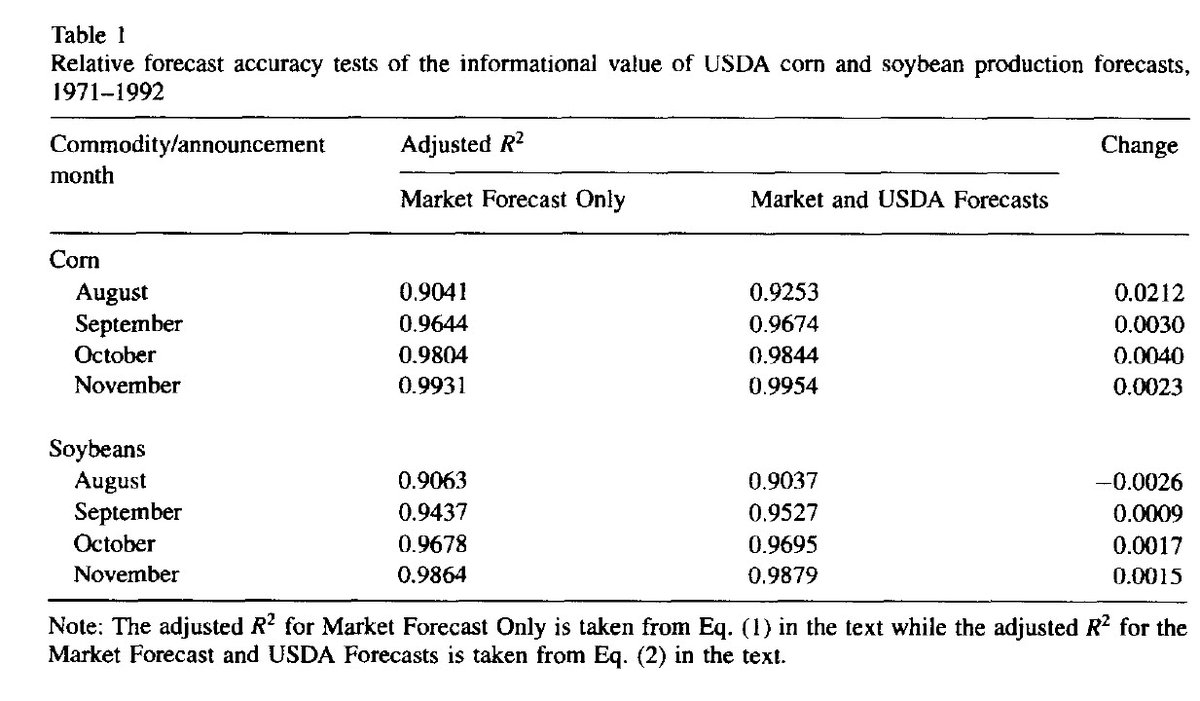

8. I liked the first test best, which looked at forecast accuracy of private firms compared to USDA. We were surprised at how close the two were in terms of accuracy. And privates had been gaining on USDA, especially since the mid 1980s.

9. There was a major debate in the 1990s about the need for USDA crop and livestock reports and whether they were redundant give available private forecasts. Our research showed that even small USDA accuracy advantages led to large price impacts. Win for the USDA.

10. Final point. 97 JEBO paper was important personally for two reasons. First, foundation for lots of work that came later. Second, the experience of working with Phil, Ray, and Li was a key factor in my interest in returning to Illinois permanently. The rest is history.

11. Typo in first tweet in thread. JEBO paper published in 1997 if anyone was confused.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh