One of the most common questions I get is "I feel like they're coming for my stops".

Sounds like a conspiracy theory, but fun fact, it's not.

The market is DESIGNED to stop people out. You will always struggle with entries, exits and risk management until u understand this.

Sounds like a conspiracy theory, but fun fact, it's not.

The market is DESIGNED to stop people out. You will always struggle with entries, exits and risk management until u understand this.

That's why everything can look good in hindsight & on ur backtested charts, but when shit gets real & the cameras start rolling, it quickly becomes a different ball game. Just b/c it looks perfect on ur stats & saved charts, doesn't mean it will always be perfect in real time

U can think "ok, i've seen this happen over & over again. I practiced. I studied. I'm ready", then soon as u get on the field and put ur football 🏈helmet on, u realize the field just switched to a fucking skating rink. The market says " u're playing hockey now, motherf*cker"

why? The market is not out for YOU specifically. It is simply out for liquidity.

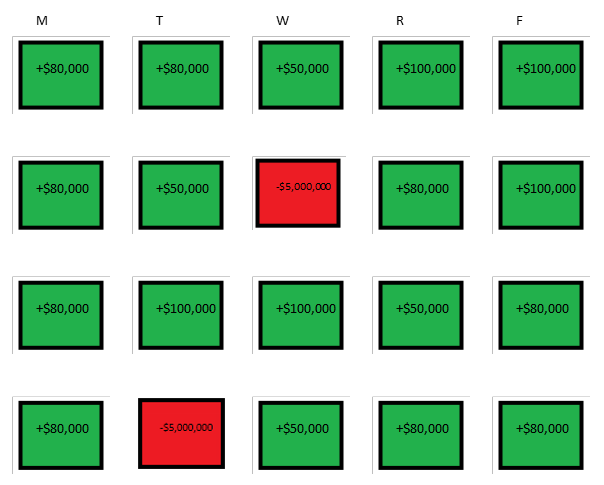

ur setup will only work as long as there is no significant liquidity on the opposite of YOUR trade. If everyone is LONG, then ALL of ur cunty stops will also be concentrated in the same area.

ur setup will only work as long as there is no significant liquidity on the opposite of YOUR trade. If everyone is LONG, then ALL of ur cunty stops will also be concentrated in the same area.

if everyone is short around the same area, then all of ur stops (even mental) will tend to be around the same area. u call them stops, marketmakers & big funds call them liquidity. And they'll sniff those orders out like blood in the water🦈. It's nothing personal, just business.

Instead of complaining, USE this to your advantage. that's why my best setups are always "failed setups". The best moves happen when everyone thinks the same thing, expect the same thing, load up long (or short), and get creampied as the stock goes the complete opposite direction

That's why my best long setup (#youGonLearnToday) is simply a failed breakdown

Thats why my best short setup (2-3pm #bloodBath) is simply a failed breakout

Find out where the crowd (dumb💵) is

Find out where their stops are likely to be

Then choose violence

#BearTipOfTheDay

Thats why my best short setup (2-3pm #bloodBath) is simply a failed breakout

Find out where the crowd (dumb💵) is

Find out where their stops are likely to be

Then choose violence

#BearTipOfTheDay

• • •

Missing some Tweet in this thread? You can try to

force a refresh