💱CROSS MARGINING is the next big thing in crypto💱

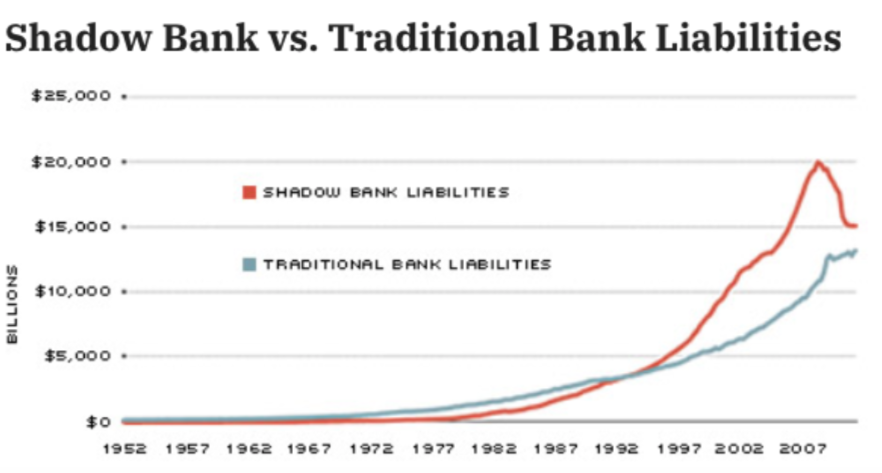

Today it's the most overlooked & misunderstood opportunity in all of DeFi, with TAM >$20B ARR.

If u don't *really* know what it is, chances are you're getting massively screwed on capital efficiency & don't even know it.

🧵/

Today it's the most overlooked & misunderstood opportunity in all of DeFi, with TAM >$20B ARR.

If u don't *really* know what it is, chances are you're getting massively screwed on capital efficiency & don't even know it.

🧵/

1/ What is cross margining?

Googling this term returns only half the story.

The full picture has 2 parts:

1. cross-asset margining

(what most blogs talk about & a solved problem on most Cexs)

2. cross-exchange margining

(terribly overlooked & a problem for both Cexs & Dexs)

Googling this term returns only half the story.

The full picture has 2 parts:

1. cross-asset margining

(what most blogs talk about & a solved problem on most Cexs)

2. cross-exchange margining

(terribly overlooked & a problem for both Cexs & Dexs)

2/ Cross-asset margining is where an exchange lets u re-use the same aggregate account collateral to post margin on multiple trades, regardless of the composition of underlying margin assets:

e.g. whether Bob has

2x $BTC+ 8x $ETH + 100x $USDC = 128,762x $USDC

OR

128,762x $USDC

e.g. whether Bob has

2x $BTC+ 8x $ETH + 100x $USDC = 128,762x $USDC

OR

128,762x $USDC

What happens when an exchange DOESN'T do cross-asset margining?

e.g. Bob wants to short 25x $BTC front-month futures from a 10x margin account

i-suck-Dex: "ok plz post 2.5x $BTC collateral"

Bob: "but i don't have 2.5x"

i-suck-Dex: "then go swap some of ur $USDC or $ETH, mf*er!"

e.g. Bob wants to short 25x $BTC front-month futures from a 10x margin account

i-suck-Dex: "ok plz post 2.5x $BTC collateral"

Bob: "but i don't have 2.5x"

i-suck-Dex: "then go swap some of ur $USDC or $ETH, mf*er!"

This is extremely annoying. Cuz:

i. Fees

now Bob needs to pay 1 liver + 2 kidneys in gas for the unnecessary transaction

ii. Capital efficiency

even after he comes back with 2.5x BTC, that original 8x $ETH and 100x $USDC are now just lying around IDLE in his portfolio

Sucks.

i. Fees

now Bob needs to pay 1 liver + 2 kidneys in gas for the unnecessary transaction

ii. Capital efficiency

even after he comes back with 2.5x BTC, that original 8x $ETH and 100x $USDC are now just lying around IDLE in his portfolio

Sucks.

3/ Luckily, cross-asset margining is a solved problem on most Cexes! Hooray!

You can read how @FTX_Official handles ur margin here:

bit.ly/3DqQ0GN

And @binance here:

bit.ly/3lBbiLF

And all tradfi OCC member exchanges here:

bit.ly/3olk2HJ

You can read how @FTX_Official handles ur margin here:

bit.ly/3DqQ0GN

And @binance here:

bit.ly/3lBbiLF

And all tradfi OCC member exchanges here:

bit.ly/3olk2HJ

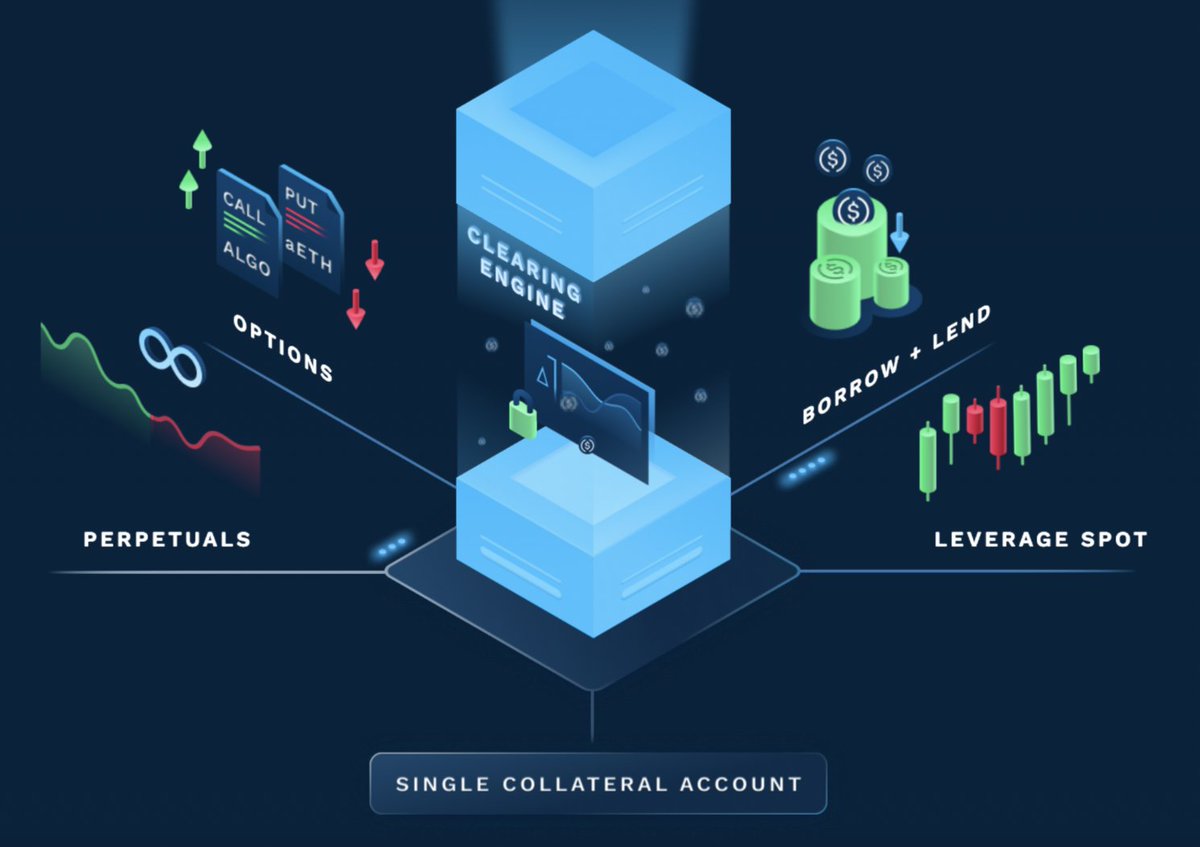

4/ Now what about DeFi?

Sadly i don't know if there are any fully-functional cross-asset margin solutions in defi today. (If u know, please prove me wrong & drop a note for everyone here!)

Some projects working on this problem:

@Oxygen_protocol

@LemmaFinance

@C3protocol

Sadly i don't know if there are any fully-functional cross-asset margin solutions in defi today. (If u know, please prove me wrong & drop a note for everyone here!)

Some projects working on this problem:

@Oxygen_protocol

@LemmaFinance

@C3protocol

5/ Cross-exchange margining solves the same collateral efficiency problem as x-asset.

Just on a higher dimension.

This is when u can re-use collateral across multiple accounts on multiple Cexs & Dexs for a trade on any exchange.

Tradfi has this👏.

Crypto does not😢 ... yet 🤔.

Just on a higher dimension.

This is when u can re-use collateral across multiple accounts on multiple Cexs & Dexs for a trade on any exchange.

Tradfi has this👏.

Crypto does not😢 ... yet 🤔.

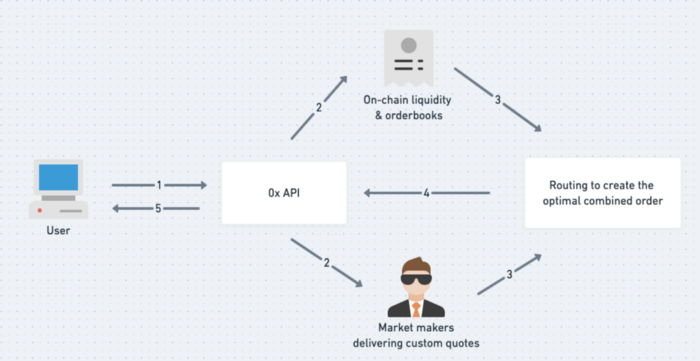

6/ What do we need to solve to add fully functional x-margining to today's crypto markets?

1. An "all seeing" entity that can read all ur positions in all accounts

2. A real-time data feed on all asset correlations

3. An entity to run & report Monte Carlo simulation stress tests

1. An "all seeing" entity that can read all ur positions in all accounts

2. A real-time data feed on all asset correlations

3. An entity to run & report Monte Carlo simulation stress tests

7/ The OCC achieves this using STANS: theocc.com/Risk-Managemen…

First it pools together EOD positions across all accounts in a CM (clearing member). Using historical vol data it then computes min margin required to cover 99% expected shortfall (i.e. 1% probability of liquidation).

First it pools together EOD positions across all accounts in a CM (clearing member). Using historical vol data it then computes min margin required to cover 99% expected shortfall (i.e. 1% probability of liquidation).

End/

I'm not usually one to go around declaring giant overlooked market opportunities but this problem is so prevalent among all my trader friends that SOMEONE NEEDS TO SOLVE IT! 🦾

Happy weekend! ✌️

I'm not usually one to go around declaring giant overlooked market opportunities but this problem is so prevalent among all my trader friends that SOMEONE NEEDS TO SOLVE IT! 🦾

Happy weekend! ✌️

• • •

Missing some Tweet in this thread? You can try to

force a refresh