🕙 24/7 Options🕙

Restricting trading between 9:30-4pm M-F is pure stupidity. It's market discrimination.

24/7 is the future

And our fastest way to get there is via crypto derivatives: on-chain markets for tokenized US equities and options.

🧵on OPTIONS MARKET-MAKING ON-CHAIN

Restricting trading between 9:30-4pm M-F is pure stupidity. It's market discrimination.

24/7 is the future

And our fastest way to get there is via crypto derivatives: on-chain markets for tokenized US equities and options.

🧵on OPTIONS MARKET-MAKING ON-CHAIN

Note: this thread is a collection of all the operational challenges and structural considerations required to bring a fully functional system of tokenized options on-chain.

Expect more questions than answers.

Because such a fully functional system doesn't yet exist.

Expect more questions than answers.

Because such a fully functional system doesn't yet exist.

PART 1: How "normal" options MM works

As traders we take a lot for granted. Options markets somehow "just work" in TradFi.

But how does price discovery actually work?

How do local updates propagate to rest of the options chain?

What happens to longs when shorts get liquidated?

As traders we take a lot for granted. Options markets somehow "just work" in TradFi.

But how does price discovery actually work?

How do local updates propagate to rest of the options chain?

What happens to longs when shorts get liquidated?

Let's start with the MM's biggest problem: price discovery

e.g. TSLA Dec $1400 calls are initially quoted $35-38. A large whale buys. Quote moves to $36-39.

How much should the $1450-strike contracts move up by?

What about Jan $1400 calls?

Does the whole vol surface reshape?

e.g. TSLA Dec $1400 calls are initially quoted $35-38. A large whale buys. Quote moves to $36-39.

How much should the $1450-strike contracts move up by?

What about Jan $1400 calls?

Does the whole vol surface reshape?

Mechanically, prices move when market makers adjust their quote. Every adjustment is the result of either:

- a mean reversion hypothesis

or

- a momentum hypothesis.

Biggest inputs affecting which view the MM takes:

- real-time order flow

- breaking news (earnings, merger, etc.)

- a mean reversion hypothesis

or

- a momentum hypothesis.

Biggest inputs affecting which view the MM takes:

- real-time order flow

- breaking news (earnings, merger, etc.)

Absent breaking news (no reason to justify price shift) MMs tend to:

- Treat anomalous hits+lifts as flukes

or

- Take the other side of anomalous trades

After events (high volatility), MMs tend to:

- Widen quotes

- Stop quoting

or

- Quote asymmetrically, i.e. move the (mid)price

- Treat anomalous hits+lifts as flukes

or

- Take the other side of anomalous trades

After events (high volatility), MMs tend to:

- Widen quotes

- Stop quoting

or

- Quote asymmetrically, i.e. move the (mid)price

Next up: Margining

Each clearing firm has its own margin requirements & different ways of handling each of these key questions.

- How should collateral be denominated?

- What is the forced liquidation threshold?

- Who eats losses when the market blows past liquidation threshold?

Each clearing firm has its own margin requirements & different ways of handling each of these key questions.

- How should collateral be denominated?

- What is the forced liquidation threshold?

- Who eats losses when the market blows past liquidation threshold?

Robinhood requires all short options positions to be collateralized by underlying stock. This forces shorts to instead sell covered calls (a different risk payout).

But if margin is posted in dollars, how much is enough?

And what happens to shorts when longs decide to exercise?

But if margin is posted in dollars, how much is enough?

And what happens to shorts when longs decide to exercise?

Apparently every options writer holds a hidden "call risk" that NOBODY talks about!

Namely, when TraderA decides to exercise a long call option, the OCC then calls up a random writer (TraderB) and forces them to unwind their short position equivalent to what TraderA exercised.

Namely, when TraderA decides to exercise a long call option, the OCC then calls up a random writer (TraderB) and forces them to unwind their short position equivalent to what TraderA exercised.

PART 2: Market-making for tokenized equity options (btw 9:30-4pm EST)

Good news: During market hours, price discovery on tokenized securities is a trivial problem.

No Black-Scholes.

No spline interpolation of vol surfaces.

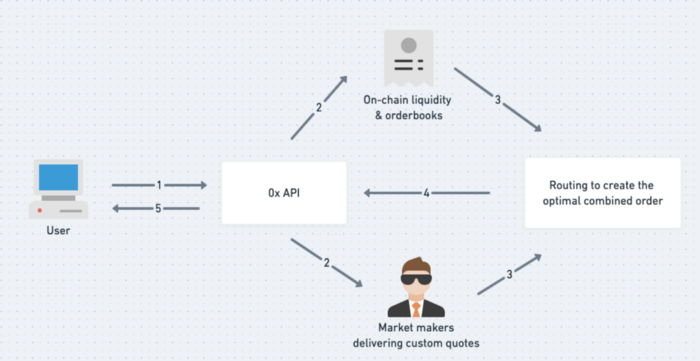

Just need a robust fast oracle like SOL's @PythNetwork

Good news: During market hours, price discovery on tokenized securities is a trivial problem.

No Black-Scholes.

No spline interpolation of vol surfaces.

Just need a robust fast oracle like SOL's @PythNetwork

What is @PythNetwork & why is it a groundbreaking step forward for tokenized options on chain?

Pyth bridges TradFi data into @solana every 400ms (vs 15s on ETH), i.e. on-chain MMs can simply call an API & get near-simultaneous quote updates across the entire options chain.

Pyth bridges TradFi data into @solana every 400ms (vs 15s on ETH), i.e. on-chain MMs can simply call an API & get near-simultaneous quote updates across the entire options chain.

In other words, on-chain MMs would not need to do double-duty price discovery on a new isolated system, and arbitrageurs would not need to constantly arb between the two systems to lock in price consistency.

On-chain prices would simply "mirror" traditional exchanges' bid-asks.

On-chain prices would simply "mirror" traditional exchanges' bid-asks.

Lots of problems can arise, however, if a slow oracle were in use:

- rapid price divergence between tradfi & defi market quotes

- tradfi front-running opportunities

- outdated margin thresholds based on a previous iteration's stale quote, leading to rampant on-chain liquidations

- rapid price divergence between tradfi & defi market quotes

- tradfi front-running opportunities

- outdated margin thresholds based on a previous iteration's stale quote, leading to rampant on-chain liquidations

While price discovery is trivial, liquidity is not.

In fact illiquidity is the #1 problem tokenized equity platforms face today.

Takers don't want to trade b/c spreads are too wide; spreads are wide b/c makers don't want to make given low taker demand.

How to solve this 🐤🔄🥚?

In fact illiquidity is the #1 problem tokenized equity platforms face today.

Takers don't want to trade b/c spreads are too wide; spreads are wide b/c makers don't want to make given low taker demand.

How to solve this 🐤🔄🥚?

To bootstrap liquidity, one method is to incentivize LPs/makers first.

Highly liquid derivatives markets exhibit these qualities:

- Constant uptime

- 2-sided liquidity provision

- Depth

- Tight spreads

- Ability to support LP delta neutral hedging strategies

Highly liquid derivatives markets exhibit these qualities:

- Constant uptime

- 2-sided liquidity provision

- Depth

- Tight spreads

- Ability to support LP delta neutral hedging strategies

. @dydxprotocol's LP Rewards program is a great model of successful liquidity boosting.

Below is the equation they use to assess how many reward tokens to give each LP.

Below is the equation they use to assess how many reward tokens to give each LP.

- Constant uptime is rewarded by summing up binary counts of an LP's availability at each minute.

- 2 sided liquidity is emphasized by considering the MIN of liquidity provided btw bid- & ask-side

- depth & spread tightness is rewarded via min/max reward eligibility thresholds

- 2 sided liquidity is emphasized by considering the MIN of liquidity provided btw bid- & ask-side

- depth & spread tightness is rewarded via min/max reward eligibility thresholds

Let's say we solve the liquidity problem.

"Odd-lots"/fractional options will be the next biggest hurdle.

Explanation: In TradFi, options trade in minimum lot sizes of 100x (representing 100 shares). In DeFi, the tokenized options would trade in arbitrarily small order amounts.

"Odd-lots"/fractional options will be the next biggest hurdle.

Explanation: In TradFi, options trade in minimum lot sizes of 100x (representing 100 shares). In DeFi, the tokenized options would trade in arbitrarily small order amounts.

LPs running delta neutral strategies wouldn't be able to provide liquidity for a fractional "odd-lot" order on-chain (e.g. sell 25.3-lots of tokTSLA 1400) and subsequently hedge with the exactly matching inverse position on a TradFi exchange (e.g. buy 25.3 lots of $TSLA 1400).

PART 3: Market-making for tokenized equity options when markets close (aka the Wild West!)

Key Issues:

- Price discovery returns as a problem (no TradFi data source for the oracle to bridge)

- What happens at the next market open? Prices may diverge significantly overnight.

Key Issues:

- Price discovery returns as a problem (no TradFi data source for the oracle to bridge)

- What happens at the next market open? Prices may diverge significantly overnight.

Solutions to the price discovery problem will vary depending on:

a) if there's a sole tokenized options exchange

vs

b) multiple low-liquidity exchanges

And in case (b):

i) if MMs can see depth on all other exchanges

vs

ii) if MMs can only see NBBOs on non-LPed exchanged

a) if there's a sole tokenized options exchange

vs

b) multiple low-liquidity exchanges

And in case (b):

i) if MMs can see depth on all other exchanges

vs

ii) if MMs can only see NBBOs on non-LPed exchanged

The "what happens at market open" problem is equally tricky.

- TradFi markets can jump at the open because of DMMs & auction market structure

- On-chain LPs don't know which way they'll jump & might not want to take the "snapping back" risk, thus decide to sit out during the MO

- TradFi markets can jump at the open because of DMMs & auction market structure

- On-chain LPs don't know which way they'll jump & might not want to take the "snapping back" risk, thus decide to sit out during the MO

- Unfortunately if every LP decided to sit out, on-chain tokenized exchange(s) would have zero liquidity during each market open. What incentives make sense to prevent this?

- Should exchanges require extra collateral on overnight trades in case of a steep jump at next open?

- Should exchanges require extra collateral on overnight trades in case of a steep jump at next open?

End/

If you've ever wanted to trade US equities or options outside of market hours, OR if you want to get involved to make this a reality for every trader in every time zone of the world, then I want to talk to you!

My DMs are waiting for you with open arms!

If you've ever wanted to trade US equities or options outside of market hours, OR if you want to get involved to make this a reality for every trader in every time zone of the world, then I want to talk to you!

My DMs are waiting for you with open arms!

• • •

Missing some Tweet in this thread? You can try to

force a refresh