My Long term equity investment setup

1. Identifying quality stock in watchlist

2. Selections amongst those for final watchlist

3. Final trigger to buy the stock in portfolio

4. Adding or pyramiding

(will explain this in detail step-by-step in this thread , so keep glued)

1. Identifying quality stock in watchlist

2. Selections amongst those for final watchlist

3. Final trigger to buy the stock in portfolio

4. Adding or pyramiding

(will explain this in detail step-by-step in this thread , so keep glued)

Some consideration kept in mind before following this setup

- this is a regular sip investment plan

- for 10-20 years of wealth creation

- cannot be used for trading or speculation

- not useful for those who want to allocate all the money at once

- this is a regular sip investment plan

- for 10-20 years of wealth creation

- cannot be used for trading or speculation

- not useful for those who want to allocate all the money at once

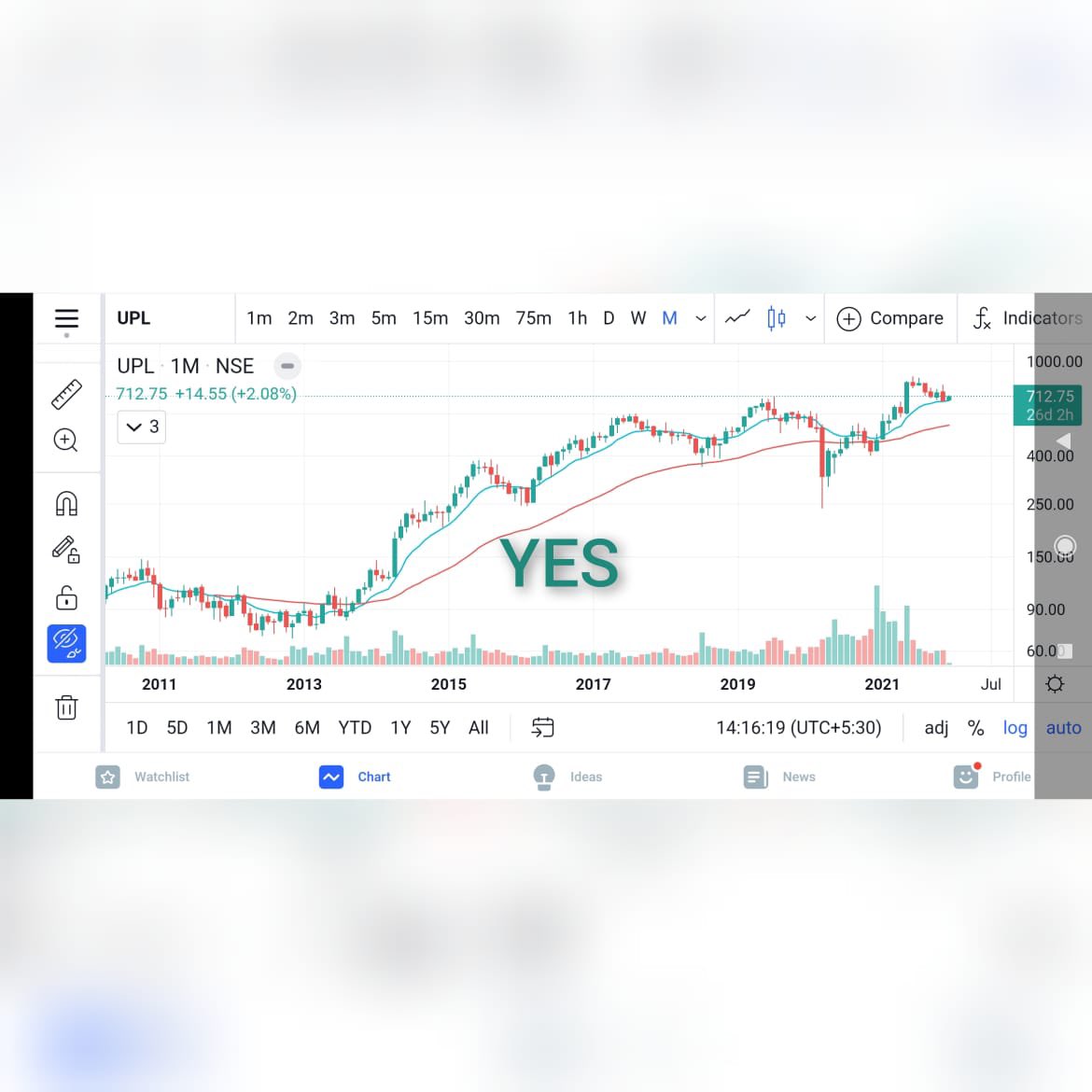

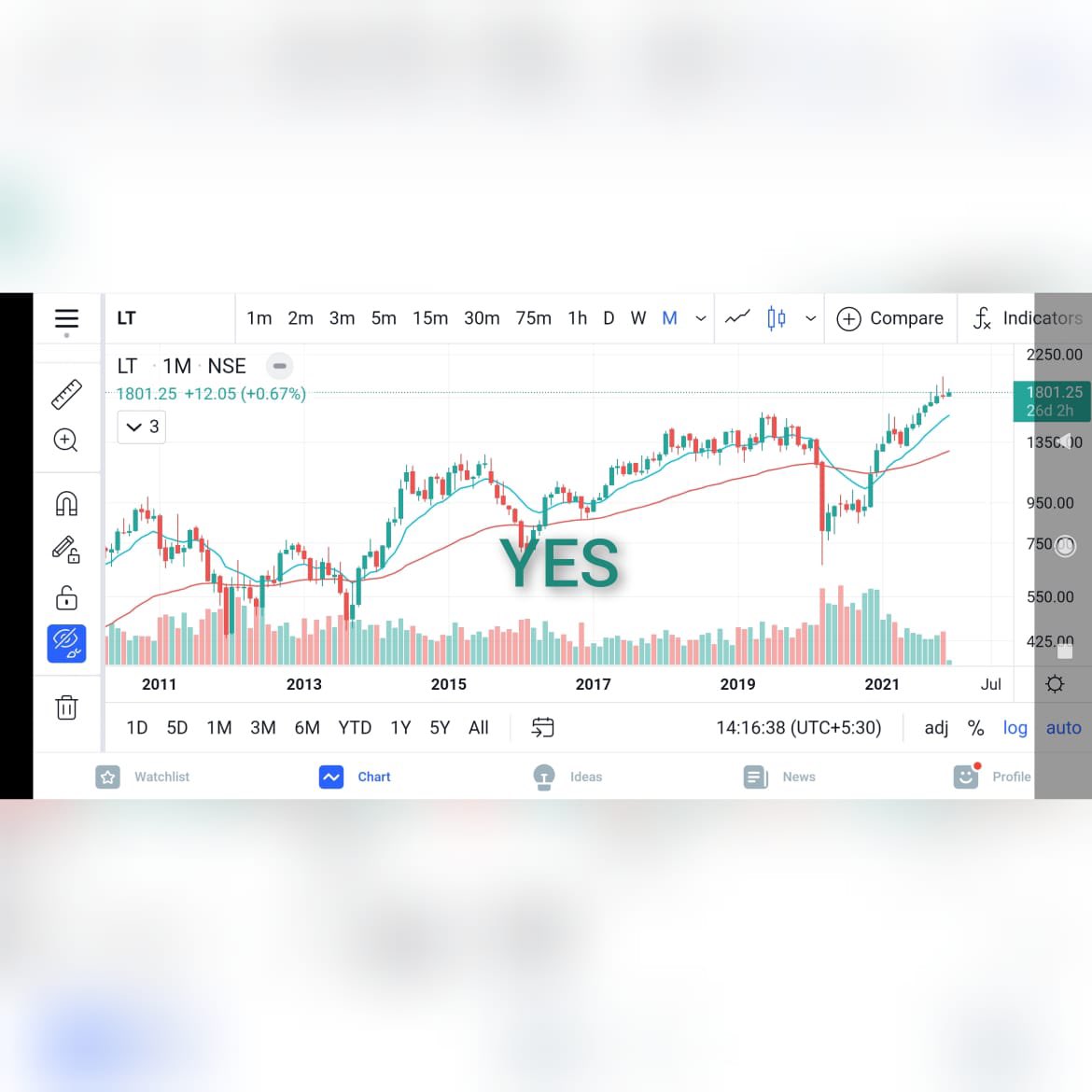

1. Identifying good quality #stocks

Use #monthly #charts

60ema should be below 12 ema, for a considerable period.. and 60ema sloping upwards

Logic is average price of last year is about the average price of last five years..

Examples 👇🏻

Use #monthly #charts

60ema should be below 12 ema, for a considerable period.. and 60ema sloping upwards

Logic is average price of last year is about the average price of last five years..

Examples 👇🏻

U can use above framework to Identify good quality of stocks in #NSE 500

Make a preliminary #watchlist of 100-150 such #stocks

Try to identify stocks from different sectors

Make a preliminary #watchlist of 100-150 such #stocks

Try to identify stocks from different sectors

Now you have identified these stocks which are in long term have proven their track record..

Also there is very low chance of corporate governance or fundamental issues with them..

Go through some of these qualified stocks

#3mindia #TorrentPower #LT #torrentpharma #escorts #upl

Also there is very low chance of corporate governance or fundamental issues with them..

Go through some of these qualified stocks

#3mindia #TorrentPower #LT #torrentpharma #escorts #upl

2. Selecting stocks for final watchlist

Weekly charts to be used, with 8ema crossing 52ema repeatedly up and down.. sideways market.

Logic is sideways correction in a long term up trending stocks gives a fair entry price

#upl #LT #torrentpower #torrentpharma #3mindia #escorts

Weekly charts to be used, with 8ema crossing 52ema repeatedly up and down.. sideways market.

Logic is sideways correction in a long term up trending stocks gives a fair entry price

#upl #LT #torrentpower #torrentpharma #3mindia #escorts

Strongly correcting stocks in weekly TF to be avoided..

Repeated crossovers signifies fight between bears and bulls with range creation..

Make a final watchlist from this weekly TF setup and keep a close watch on it..

(All the charts are log charts)

Repeated crossovers signifies fight between bears and bulls with range creation..

Make a final watchlist from this weekly TF setup and keep a close watch on it..

(All the charts are log charts)

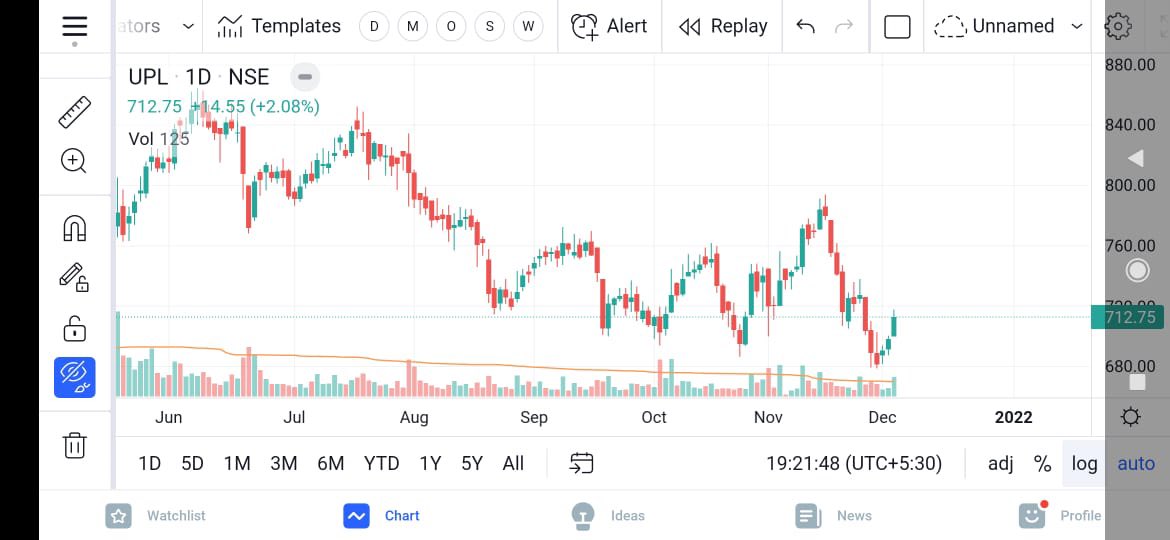

3. Final trigger to buy the stock in #portfolio

#Daily time frame

watch for the #price action with #support and #resistance..

Buy the stock, whenever a good bullish candle is formed near the support or trend line..

#Daily time frame

watch for the #price action with #support and #resistance..

Buy the stock, whenever a good bullish candle is formed near the support or trend line..

Till now we have understood the system for stock selection to entry..

next comes the most important step that is money management, risk management and pyramiding..

Which decides ultimately the wealth creation by the entire investment portfolio..

next comes the most important step that is money management, risk management and pyramiding..

Which decides ultimately the wealth creation by the entire investment portfolio..

4. Adding position or pyramiding

If u are planning an amount 100 to be invested every month divide it in five..

Now buy 5 stocks with the above amount 20 invested in each every month..

Slowly build up a jumbo portfolio of 50-60 stocks from different sectors..

If u are planning an amount 100 to be invested every month divide it in five..

Now buy 5 stocks with the above amount 20 invested in each every month..

Slowly build up a jumbo portfolio of 50-60 stocks from different sectors..

Only principle to keep in mind is

Further addition to the same stock is to be done only when it moves above the previous bought price by 20-25%

This way we have first taken care while selecting stocks, and then addition is done only on upside.. still there will be some loosers

Further addition to the same stock is to be done only when it moves above the previous bought price by 20-25%

This way we have first taken care while selecting stocks, and then addition is done only on upside.. still there will be some loosers

Over period of time allocation of money in stock going up will be higher and higher. while losers will get very small allocation.

Few examples from my portfolio

#LT - winner - total allocation 4 sip

#heromoto - looser - allocation only 1 sip

Green lines are entry points 👇🏻

Few examples from my portfolio

#LT - winner - total allocation 4 sip

#heromoto - looser - allocation only 1 sip

Green lines are entry points 👇🏻

Few more examples from my portfolio

#Infy - winner - 4 sip

#mgl - neutral - 2 sip

#sbin - winner - 4 sip

#cub - looser - 1 sip

#Infy - winner - 4 sip

#mgl - neutral - 2 sip

#sbin - winner - 4 sip

#cub - looser - 1 sip

Where to EXIT?

1. Winners are never to be exited unless u are in need. or can be partially exited if surge is steep on monthly charts

2. Losers can be exited temporarily when monthly chart becomes bearish

If u like the thread, do retweet the first tweet..

1. Winners are never to be exited unless u are in need. or can be partially exited if surge is steep on monthly charts

2. Losers can be exited temporarily when monthly chart becomes bearish

If u like the thread, do retweet the first tweet..

Do go through the thread and give ur opinion

@PRSundar64 @Investor_Mohit @SubhadipNandy16 @Abhishekkar_ @Mitesh_Engr @sunilminglani @Abhishekkar_ @Traderknight007 @FI_InvestIndia @PAVLeader @InvesysCapital

@PRSundar64 @Investor_Mohit @SubhadipNandy16 @Abhishekkar_ @Mitesh_Engr @sunilminglani @Abhishekkar_ @Traderknight007 @FI_InvestIndia @PAVLeader @InvesysCapital

Now what to do when markets are going down and none of the stock qualifies for a repeat SIP or a fresh buy?

Ans - Just keep your SIP money in your saving bank account till you get a stock which qualifies for buy

Ans - Just keep your SIP money in your saving bank account till you get a stock which qualifies for buy

• • •

Missing some Tweet in this thread? You can try to

force a refresh