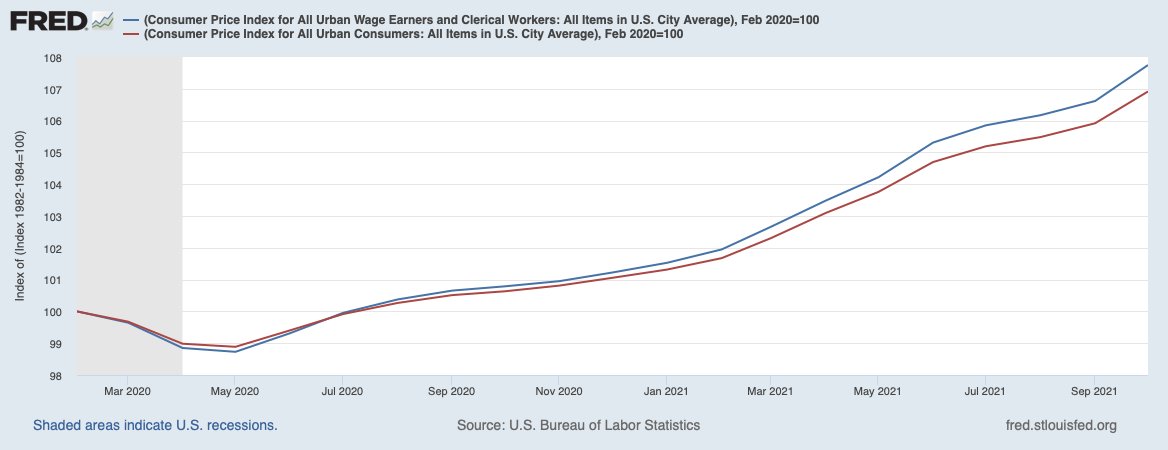

Part of the reason people might be upset is that this is not true. Real wages are down ~1% since the pandemic.

Your data suffer from composition bias: about 5m generally lower-wage workers are no longer employed and not having them in the data spuriously raises wages.

Your data suffer from composition bias: about 5m generally lower-wage workers are no longer employed and not having them in the data spuriously raises wages.

https://twitter.com/paulkrugman/status/1468552448424005634

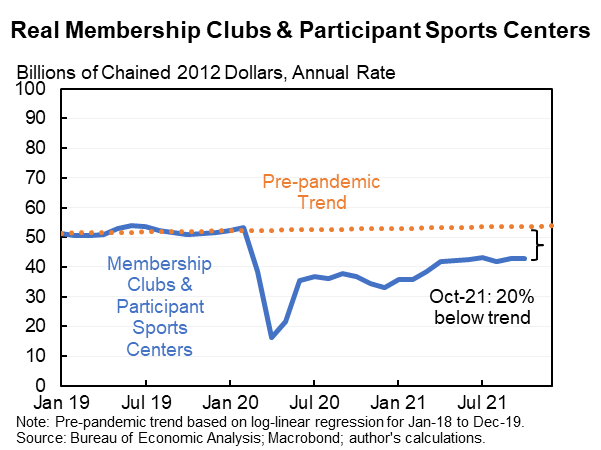

Moreover, the important issue is not are real wages up but by how much. They rose ~1% annually pre-COVID. They're now 2.5%-3% below where they "should" have been. See my piece with with Willie Powell that tells the broad story.

piie.com/blogs/realtime…

piie.com/blogs/realtime…

There are important distributional issues: real wages do appear to be up for lower wage workers, although not quite as quickly as they were rising pre-COVID.

The rest of this thread is a technical appendix--I don't recommend anyone read it.

The rest of this thread is a technical appendix--I don't recommend anyone read it.

The Employment Cost Index (ECI) does not suffer from severe composition bias. It only has data for every 3 months and shows shows real wages +0.4% for Dec-2019 to Sep-2021 using CPI-U.

If we had data for Feb-2020 to Nov-2021 it likely would show -1.0% real wage growth.

If we had data for Feb-2020 to Nov-2021 it likely would show -1.0% real wage growth.

1. Add Oct + Nov 2021: Avg hourly earnings were up 0.6% in the last 2 months. CPI was 0.9% in Oct & expected 0.7% in Nov. So real wages down 1% in last two months.

2. Remove Jan + Feb 2020: Avg hourly earnings up 0.4% in these two months.

(Note: above not composition adjusted.)

2. Remove Jan + Feb 2020: Avg hourly earnings up 0.4% in these two months.

(Note: above not composition adjusted.)

Also, @paulkrugman used CPI-U to deflate wages for production & non-supervisory workers. The BLS uses the CPI-W for this because it captures what these workers actually spend money on. It has grown 0.8% more than the CPI-U over this period. bls.gov/news.release/r…

Note, I also used CPI-U because the ECI is all private workers, not just the prodn & non-supervisory workers (i.e., non-managers) in @paulkrugman's original tweet. If we had ECI for PNS & used CPI-W is plausible real wages would be down even more than 1% since pre-COVID.

FIN

FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh