I'm not writing any more economic threads until after Thanksgiving. I hope you're not reading any until after Thanksgiving either. But in case you're weird enough to want to use the break to catch up here is a thread of some recent threads. Enjoy--or even better don't!

I put my thoughts on inflation and the Fed together in a thread and many other formats. Short version: economy getting better, inflation is high and likely to be at least partly persistent, Fed should recalibrate towards less expansionary policy.

https://twitter.com/jasonfurman/status/1462880674566737920

Underlying this is the argument that: (1) monetary policy is a continuum, (2) it is constantly changing and has become looser recently, and (3) there really is a risk of doing too much.

https://twitter.com/jasonfurman/status/1460360192382554113?s=20

Labor markets are sending conflicting signals with quits indicating super tight, openings somewhat tight, UR more normal, and EPOP is falling short. Which too look at? All of them but probably especially quits, openings and unemployment rate.

https://twitter.com/jasonfurman/status/1463244842939523073?s=20

One thing some commentators appear to be getting wrong is the idea that delta is raising inflation. I think it is more likely lowering it but I'm not completely sure. I tried to grapple with that in this thread.

https://twitter.com/jasonfurman/status/1463518560068648962?s=20

Another ting that many are missing is the fact that job growth is roughly what was expected after the passage of the American Rescue Plan (although the pattern/underlying data has offsetting errors). What has been weaker is productivity.

https://twitter.com/jasonfurman/status/1462890132558651392?s=20

There was a long of hand wringing over the weak GDP growth numbers for Q3. But what if those numbers were wrong? Initial estimates always based on incomplete data, in this case other measures show much more strength.

https://twitter.com/jasonfurman/status/1463507544320708610?s=20

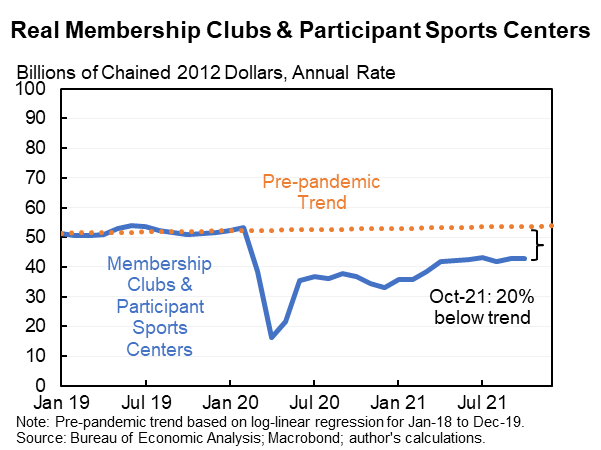

On Wednesday we got comprehensive data on consumer spending through October. It tells a fascinating story of goods continuing to rise (even in the face of very high prices) while services are recovering. A demand shift but also a demand increase.

https://twitter.com/jasonfurman/status/1463540781189324812

The Wednesday data also includes inflation and personal income/compensation/etc.

https://twitter.com/jasonfurman/status/1463533211716403203?s=20

https://twitter.com/jasonfurman/status/1463531410535464965?s=20

No more economic posting until next week! But I might come here to share some book reviews.

Happy Thanksgiving everyone!

Happy Thanksgiving everyone!

P.S. Me again. Forgot to include my thread on the macro vs. micro perspective on inflation. Why you should not just think of price increases as a set of micro stories but also or even especially the overall macro context.

https://twitter.com/jasonfurman/status/1458886062890270720

And then my favorite, a little long and tortured and imperfect for Twitter, but struggled with the best way to think about whether work is a plus or not in a range of policy contexts like monetary policy, child tax credit, EITC and tax reform.

https://twitter.com/jasonfurman/status/1461432811651534848

OK, now back to your Thanksgiving!

• • •

Missing some Tweet in this thread? You can try to

force a refresh