Have you ever asked yourself ‘what is the role of #hydrogen in climate neutrality🐢?’ We’ve spent the last 11 months trying to piece together a picture from the wealth of research and analyses out there. Below highlights from our recent publication 12 Insights on Hydrogen?📺1/8

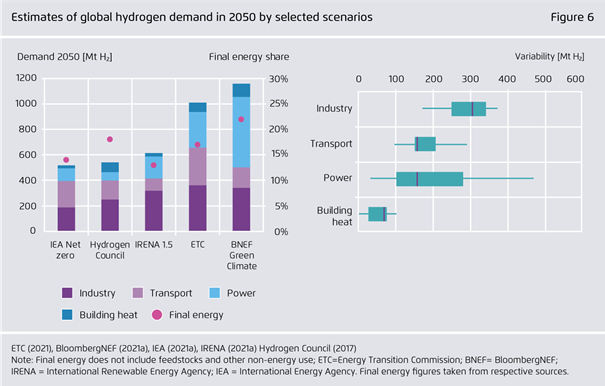

In European 1.5C scenarios, hydrogen and hydrogen-based products are most useful in industry🧑🏭and transport ✈️🚢, with a potentially large role in the power sector⚡️. Building heat🏘️sees minimal hydrogen. 2/7

More recent global scenarios confirm industrial importance but see less H2 in transport than EU studies due to lower FCEV 🚗expectations. Power sector is again a wildcard and depends on alternative LDES pathways or nuclear revival. Still minimal role for H2 in building heat. 3/7

The selected scenarios see H2 as cross-sectoral decarbonisation tool, but not all use cases are sensible 💡. We identify a number of ‘no-regret’ applications where future H2 demand will be inescapable on the journey to a decarbonised energy system. 4/7

Focus on no-regret applications is useful in anchoring early #H2 infrastructure ⚓️. We agree with @GasforClimate on two West European hydrogen superclusters by 2030, and additionally see further opportunities connecting Poland & the Baltics, as well as the Balkans. 5/7

Long duration storage will be a crucial part of future hydrogen infrastructure, and is critical for scaling #renewable H2. A number of different options exist, but geological storage 🪨, particularly salt caverns, offer the best attributes for European purposes. 6/7

There is a lot of geological storage potential in 🇪🇺 through new developments, or by repurposing existing storage. However, given the lead times (~10 yrs) it's important to start planning today. By 2050, a lot more greenfield capacity will also need to come online. 7/7

If you made it this far but still have questions check our recent publication!📜

agora-energiewende.de/en/publication…

agora-energiewende.de/en/publication…

• • •

Missing some Tweet in this thread? You can try to

force a refresh