1/n A bunch in this thread needs modification:

1) OER has huge hedonic adjustments and has ZERO direct link to home prices. @DiMartinoBooth has written well about this, but OER is drawn from a panel of rental properties not home prices.

1) OER has huge hedonic adjustments and has ZERO direct link to home prices. @DiMartinoBooth has written well about this, but OER is drawn from a panel of rental properties not home prices.

https://twitter.com/dm3531/status/1469299571713056781

2/n 2) If rental prices jump in outlier fashion, they are discarded. They are also hedonically adjusted for age, amenities, geography, etc. Current environment, with lots of new single family rentals coming online thanks to PE investors is ripe for data errors

3/n 3) We are still digesting the implications of eviction moratorium on rents. Properties that would historically have become available have not. This constraint in supply is building towards mass evictions in Q1-22 and the appetite for further support/stimulus is low

4/n As a result, rental landlords are both salivating (about ability to upgrade units and re-rent at higher prices) and a bit concerned about risks to big supply increase as build-to-rent explodes at same time

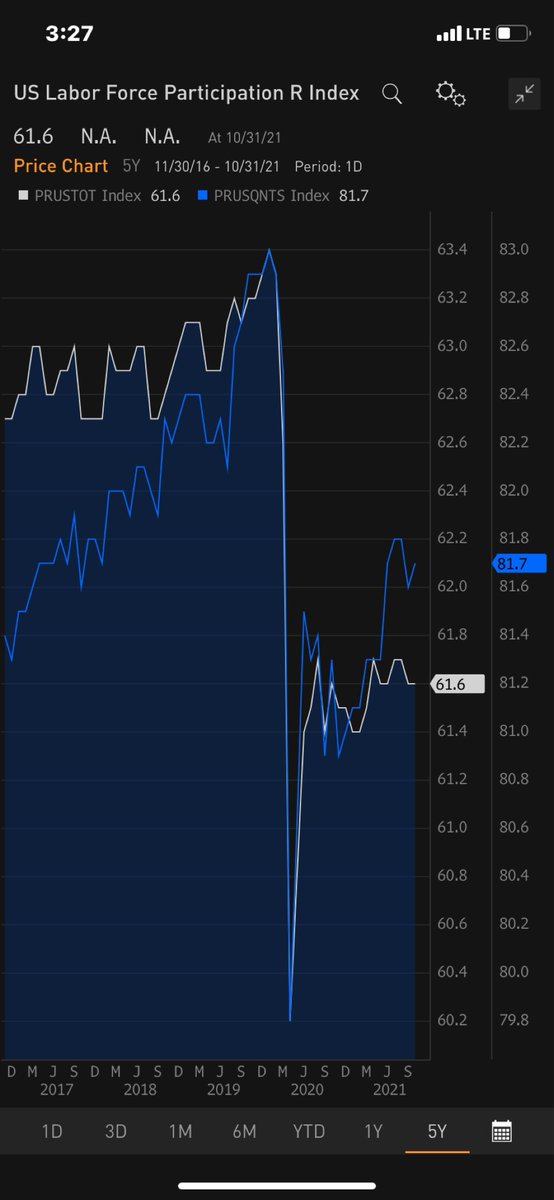

5/n 4) The below chart is a reasonable graph of two correlated, but far from directly linked, series. It is also mislabeled, with series switched. Will rents increase? “Yes, but…” As always in economics, it’s complicated. The introduction of giant corporate SFH landlords will

6/n likely increase pricing power for landlords vs historical. On flip side, it has also reduced reliance on traditional appraisal process for home purchases. I’m hearing many stories of properties for refinancing appraising well below current market pricing as PE giants use

7/n lines of credit rather than one-off mortgage apps. Zillow’s experience in this area illustrative and inflating Case-Shiller series. So C-S higher and possibly rents end up lower. We really don’t know.

8/8 Finally, the accumulated debt of households not paying rent or mortgage is significant. Estimate $9K for median renter not paying and $24K for homeowners. This data doesn’t factor into overstated hhld savings rates. Stop paying rent and buy toys… when that reverses… oi vey

• • •

Missing some Tweet in this thread? You can try to

force a refresh